Robust Demand for Gold Bullion in Europe, Middle East and China Again - Very Little Selling

Commodities / Gold and Silver 2011 Dec 20, 2011 - 09:22 AM GMTBy: GoldCore

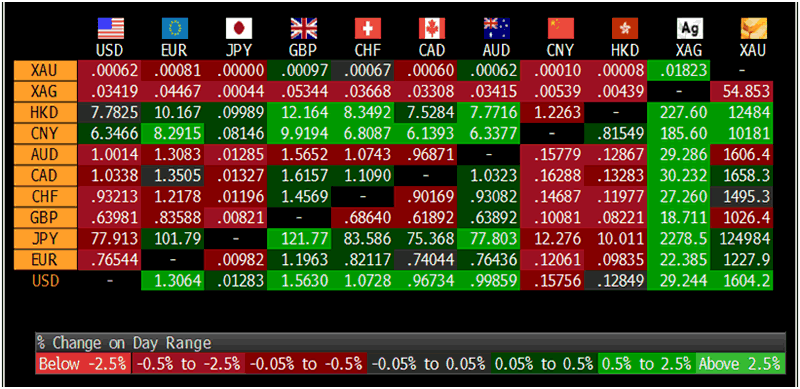

Gold is trading at USD 1,604.2, EUR 1,227.90, GBP 1,026.40, CHF 1,495.0, JPY 124,984 and AUD 1,606.40 per ounce.

Gold is trading at USD 1,604.2, EUR 1,227.90, GBP 1,026.40, CHF 1,495.0, JPY 124,984 and AUD 1,606.40 per ounce.

Gold’s London AM fix this morning was USD 1,593.00, GBP 1,028.34, and EUR 1,222.94 per ounce.

Yesterday's AM fix was USD 1,605.00, GBP 1,027.003 and EUR 1,227.91 per ounce.

Cross Currency Table

Gold is mixed and marginally higher in dollars and euros today despite European finance ministers pledging extra funding to the IMF. Concerns linger that politicians efforts to address the euro zone debt crisis are failing.

Last week's price drop has stimulated demand from Europe and the Middle East and Asia with GoldCore and other dealers confirming still robust demand and little or no selling of bullion.

Gold bar premiums in Singapore and Hong Kong rose from last week, as demand is expected to increase during the upcoming Chinese New Year holidays and buying interest has returned after last week’s price drop. Premiums in India have also increased.

Demand from China ahead of the Lunar New Year in late January should help support prices. While demand may not be on the massive scale seen last year – demand will likely be very high again which makes gold well supported at these levels.

Reuters report that Societe Generale points out in a note this morning that turnover on the Shanghai Gold Exchange was at record levels yesterday morning. "After an average daily turnover of 6.5 tonnes during November, volumes have averaged 11.5 tonnes daily since the 12 December, when gold had dropped below $1,700," Soc Gen said.

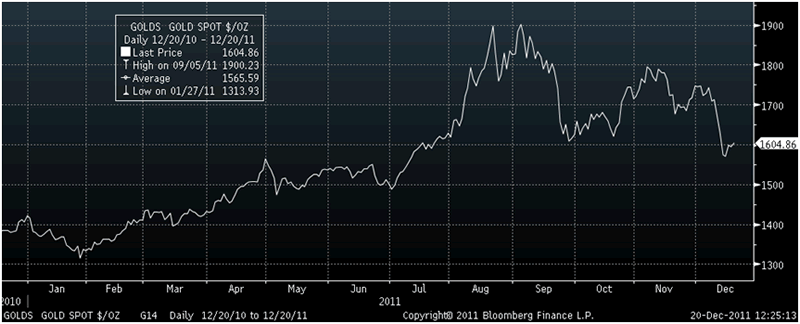

Gold Spot $/oz

This means that average daily turnover on the SGE is up a significant 77% from levels seen in November suggesting that China’s influence on the gold market may be reasserted in the coming days.

Goldman Sachs gave a three-month price view on gold of $1,785 an ounce in a note today, a six-month view of $1,840 and a 12-month view of $1,940.

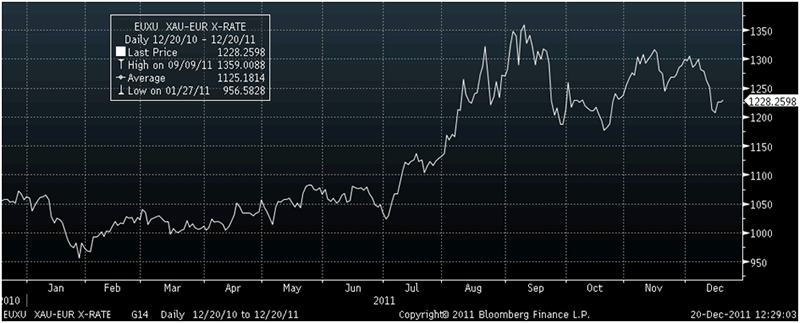

XAU-EUR Exchange Rate

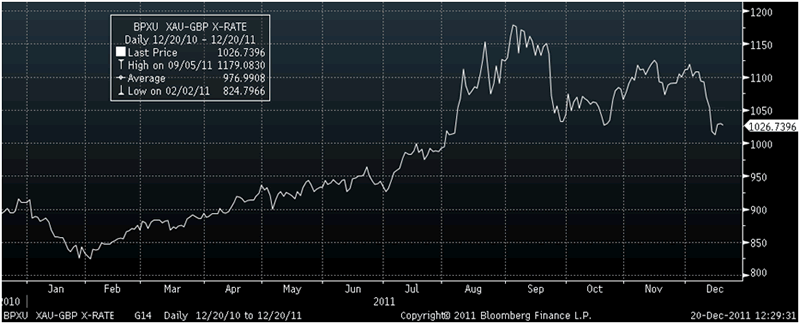

As long as cheap money and “bail outs” remain the misguided ‘grand solution’ implemented by politicians and bankers in Europe and internationally, gold’s bull market appears very sound.

As each solution fails, a bigger ‘bazooka’ is proposed and now comes the ‘nuclear bazooka’ of a multi trillion dollar bailout of Europe by the ECB, aided by the IMF and the Federal Reserve. Who will bail out Japan, the UK and the US from their coming debt crises?

An unsustainable mountain of debt will not be solved by creating more debt no matter how complex or what complicated structure is used.

Debt write downs, bankruptcy and a planned downsizing of our banking system and the gradual deleveraging of our financial system remains the real solution to this crisis.

Unfortunately, this remains taboo amongst many politicians and many of the so called experts that helped create the current financial and economic crisis.

XAU-GBP Exchange Rate

OTHER NEWS

(Bloomberg) -- Gold Decline a ‘Buying Opportunity,’ Societe Generale Says

The recent decline in gold is a “buying opportunity,” with lower prices spurring demand for physical bullion in India and futures trading in China, Societe Generale said in a report today. In India, “stockists have been buying again,” the bank said. Turnover on the Shanghai Gold Exchange has averaged 11.5 metric tons a day since Dec. 12, compared with 6.5 tons a day in November, a reached a record this morning, Societe Generale said.

(Bloomberg) -- Silver Puts Rise to Highest Ever After Dollar Rally: Options

Options traders are paying record prices to protect against losses in the iShares Silver Trust, concerned Europe’s debt crisis and the U.S. dollar’s advance will reduce demand for the metal.

Puts that pay should the biggest U.S. exchange-traded fund tracking silver futures fall 20 percent in six months traded 6.82 points higher than calls to buy on Dec. 16, according to data compiled by Bloomberg. That’s the widest gap ever for the price relationship known as skew and 19 times the 0.36-point average in the three-year history of options trading on the ETF, the data show.

Silver has dropped 41 percent since April as concern over Europe’s debt crisis prompted investors to seek relative safety in the dollar. After rising to a 31-year high of $49.845 an ounce, futures lost 27 percent in the five-day period that ended May 6, then fell 28 percent in September for the biggest monthly loss since 1980.

“Silver investors were given a rude awakening in early May and late September,” Nelson Saiers, who oversees $639 million at Alphabet Management LLC as chief investment officer of the New York-based hedge fund, said in a Dec. 16 telephone interview. “When skew gets to these levels, it points to their fear of a replay.”

After retreating 24 percent in 2008, silver surged more than fourfold through April this year as a hedge against the risk of inflation and the falling dollar, and amid speculation usage will rise because of industrial demand. The futures have risen in nine out of the last 10 years. The metal is used in everything from jewelry and coins to solar panels.

(Bloomberg) -- Venezuela Extends Time Period to Form Gold Mining Joint Ventures

Venezuela will give gold mining companies another 90 continuous days to negotiate joint ventures with the state, according to a partial reform of the gold nationalization law, published Dec. 15, and distributed today.

The revised decree extends a previous 90-day period that expired last week. Rusoro Mining Ltd., which operated two gold mines in Venezuela, said in a Dec. 16 statement that it hasn’t made progress in talks with the government.

(Bloomberg) -- Russia Boosted Gold Holdings to 28.1 Million Ounces

Russia’s central bank boosted its gold holdings to 28.1 million troy ounces last month, from 28 million at the end of October. The stockpile was valued at $48.2 billion as of Dec. 1, compared with $48.6 billion a month earlier, Bank Rossii said.

SILVER

Silver is trading at $29.21/oz, €22.34/oz and £18.69/oz

PLATINUM GROUP METALS

Platinum is trading at $1,420.50/oz, palladium at $613/oz and rhodium at $1,425oz

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.