Stock Market Year End Chaos

Stock-Markets / Stock Markets 2011 Dec 20, 2011 - 05:09 AM GMT The SPX has one more support level to break through, and that is the weekly mid-cycle support at 1194.37. Once that is accomplished, the next levels for is the cycle bottom support at 1014.11. The support also corresponds with the bottom trendline of a massive Orthodox Broadening Top formation.

The SPX has one more support level to break through, and that is the weekly mid-cycle support at 1194.37. Once that is accomplished, the next levels for is the cycle bottom support at 1014.11. The support also corresponds with the bottom trendline of a massive Orthodox Broadening Top formation.

If the SPX crosses that trendline in the next day or so, the average Broadening Top target is 780.00, corresponding. Nicely with the head and shoulders minimum target 778 that may be triggered when the SPX declines below 1074.77.

Believe it or not, the current declining cycle should not find a bottom until December 29. Suffice it to say that the SPX is entering a crash zone for the year end.

The analysts at Bank of America give the SPX a 50% chance of reaching 950-935 sometime next year. Let's see who is correct. I am not sure I want them on my side.

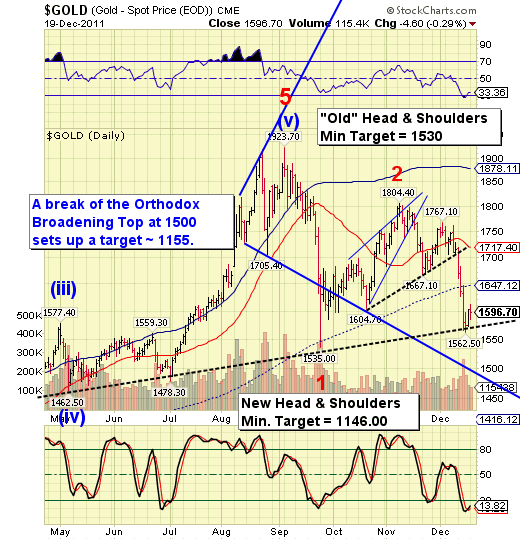

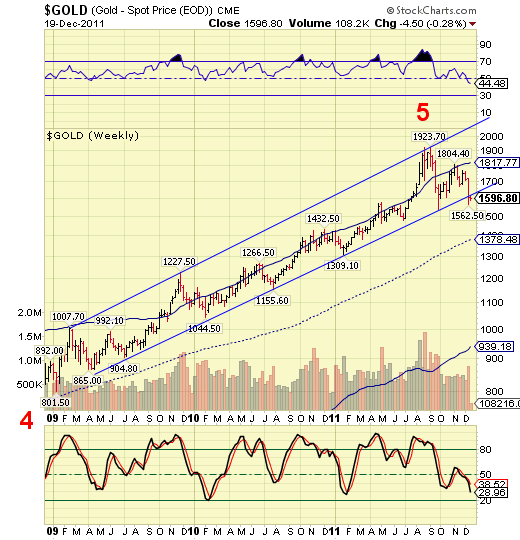

Many pundits are trying a line in the sand for gold around 1560.00, saying that gold is still in an uptrend which, technically, may be correct. However, the cycles model definition of the uptrend was to remain above 1647.12. Which is correct? It doesn't take a rocket scientist to figure out that this so-called trendline that most analysts are pointing to is also the massive head and shoulders neckline. Is broken, the “uptrend” is lost.

I always try to maintain multiple points of view and the weekly chart shows that the uptrend is already broken in gold. It has been retesting it trendline today. It is rare for an uptrend be broken on a weekly chart before daily chart. There are no tricks here, however. Long-term uptrend is now broken in gold.

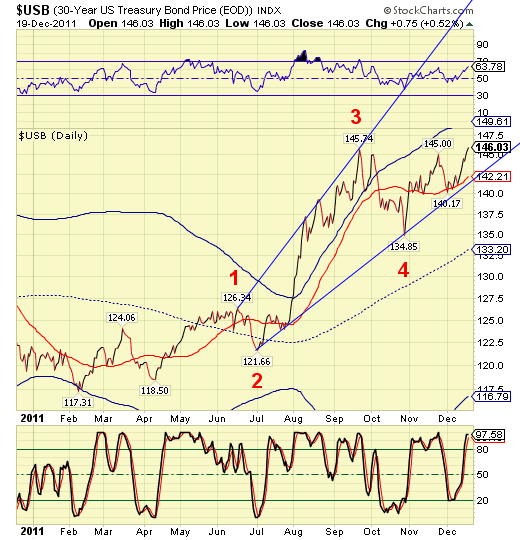

The USD just staged a breakout above its all-time high. The implication here is enormous. The broadening wedge formation implies that USB could go as high as 200.00. What we're looking at here is a potentially unprecedented buying panic in bonds. The trick now is to know when to get off this roller coaster.

Good luck and good trading!

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.