Curtains for the Silver Bull Market?

Commodities / Gold and Silver 2011 Dec 18, 2011 - 12:14 PM GMTBy: Clive_Maund

Some weeks ago in a Silver Market update we had noted that a large potential Head-and-Shoulders top area was completing in silver, but we got "thrown off the scent" by the positive Accum-Distrib line (now rapidly reversing) and the seemingly strongly bullish COT structure. In the light of the severe bearish breakdown by stocks indices last week this potential H&S top is now viewed as legitimate. Silver held up remarkably well last week considering what happened to gold, which is a straw that silver bulls are now clutching on to as evidence that silver is still in a bullmarket, but the reason that it held up so well is that it is close to a zone of strong support towards the lower boundary of the H&S top area. Once this support fails it's "curtains" for silver which can be expected to plunge into the high teens.

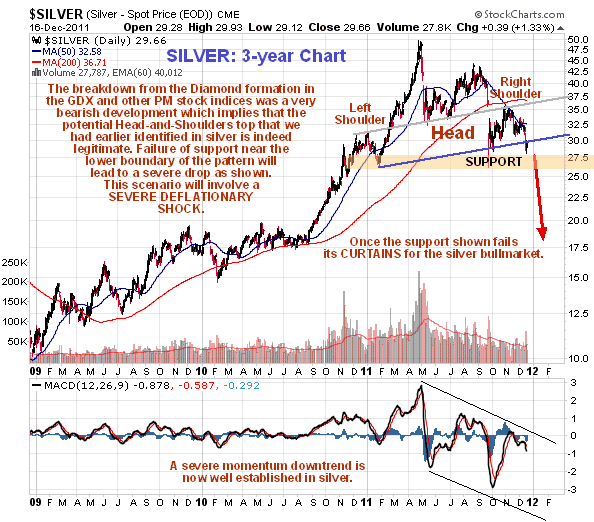

The Head-and-Shoulders top is shown on the 3-year chart for silver shown below. On this chart we can also observe various other bearish factors that are now coming into play. One is that silver has been trading way below its 200-day moving average since the September plunge, and this indicator is now rolling over and about to turn down, which will put the price and its moving averages in nerarish alignment for the first time since 2008. Another important bearish factor is that that the MACD momentum indicator shown at the bottom of the chart is now in an established downtrend, and with it now showing an only moderately oversold reading there is plenty of scope for further heavy losses going forward.

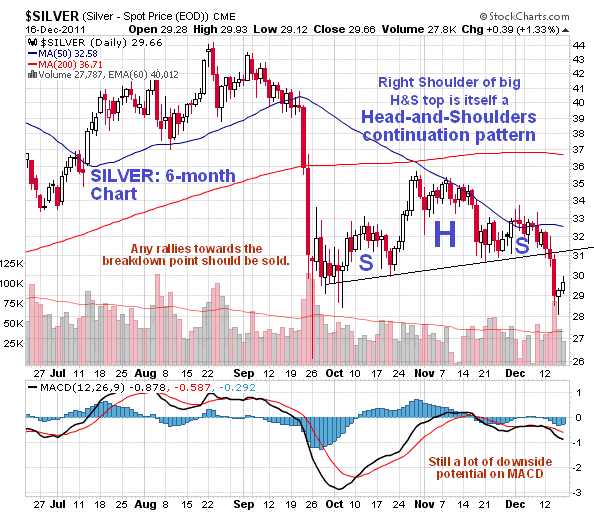

The 6-month chart for silver shows recent action in more detail, in particular last week's breakdown from what we can now see was a Head-and-Shoulders continuation pattern, which interestingly forms the Right Shoulder of the much larger Head-and-Shoulders top shown on the 3-year chart above. Some eagle-eyed subscribers pointed this out to me ahead of the breakdown, but fooled by the COT, I did not take it seriously enough. With regards to the COT, if it is not at historically bullish readings, how can silver drop? The answer to that is simple - the further it drops the more bullish the COTs are likely to become, and there is no law against the Commercials going net long one day - now that would be a sight to see.

By Clive Maund

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2011 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

JM

18 Dec 11, 16:33 |

Silver

I've been following hus articles for the last several months. One minute he's prediting silver will shoot up to the moon, the next it's going to collapse. The fact is, he has no idea, like most of us. if you don't believe me, have a look at he's previouse articles. Only a week or two ago he was predicting a major rally!! |

|

nathan Davis

19 Dec 11, 03:06 |

silver

I agree with JM and have been reading clives predictions for a few years and he is almost always wrong, might as well toss a dice. |

|

TBB

19 Dec 11, 11:05 |

Silver

It wasn't that long ago, maybe several months, that the majority of articles on silver were calling for new highs by the end of this year 2011. Last time I checked silver isn't anywhere near new highs and there is only 10 days or so left in the year. |

|

Nadeem_Walayat

19 Dec 11, 11:49 |

Silver

My last analysis of Silver - 15 May 2011 - Silver Crash 2011 Probably Not Over |

|

faith

19 Dec 11, 15:53 |

silver

there is nothing new for those commentators. Silver is a solid investment and it will not disappear nor bankrupt. There will be more paper notes and less silver in the future for sure regard the price they munipulated. |