Gold Oversold and “Buying Opportunity” as “Protection Against Currency Debasement”

Commodities / Gold and Silver 2011 Dec 16, 2011 - 09:09 AM GMTBy: GoldCore

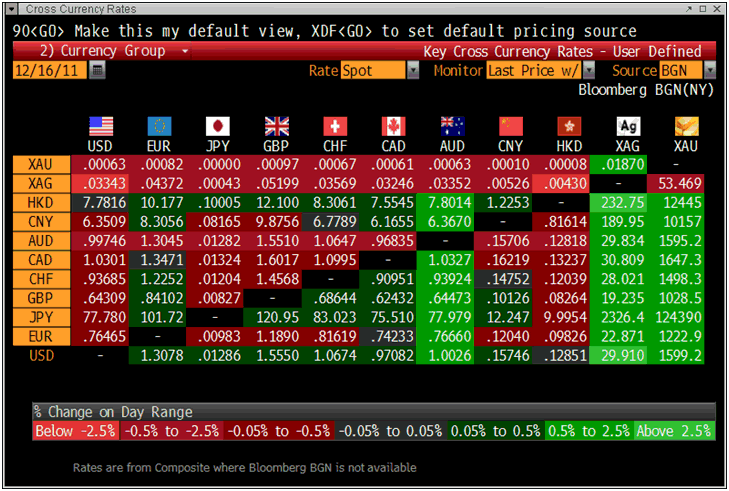

Gold is trading at USD 1,599.20, EUR 1,222.20, GBP 1,028.30, CHF 1,498.40, JPY 124,340 and AUD 1,595.0 per ounce.

Gold is trading at USD 1,599.20, EUR 1,222.20, GBP 1,028.30, CHF 1,498.40, JPY 124,340 and AUD 1,595.0 per ounce.

Gold’s London AM fix this morning was 1,589.50, GBP 1,022.84, and EUR 1,218.94 per ounce.

Yesterday's AM fix was USD 1,590.00, GBP 1,026.54 and EUR 1,223.64 per ounce.

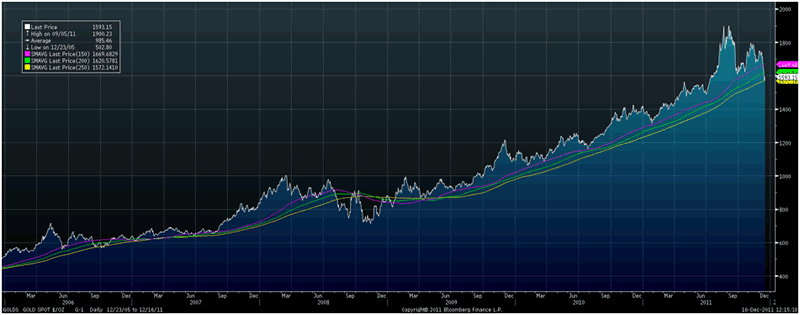

Gold in USD – 5 Yr (150, 200, 250 DMA)

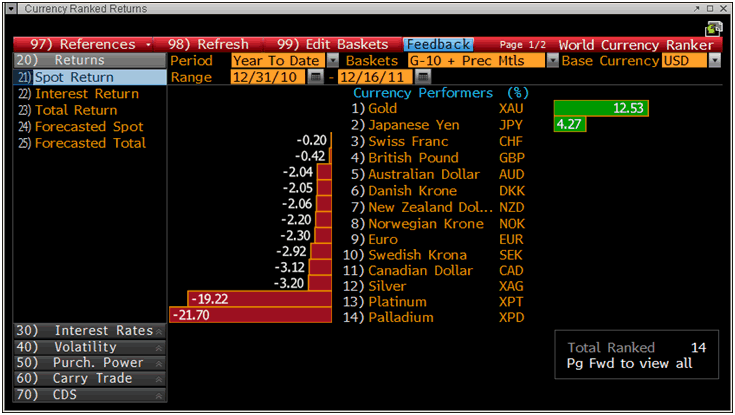

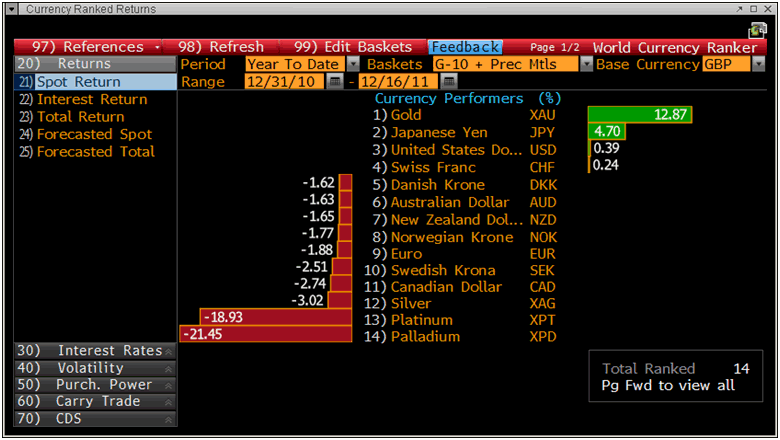

Gold is 1.6% higher in dollars and higher in most major currencies after four sessions of heavy losses and a 7% loss this week – the biggest weekly loss since September. Liquidity squeezed speculators and banks have been closing long positions and selling gold this week but global physical demand remains robust.

The Relative Strength Index (RSI) on spot gold returned to above 30, after spending 2 days below that mark in oversold territory two days ago. It is the first time that this has happened since September 2008 in the aftermath of the Lehman Brothers sell off.

Demand for physical gold from investors, store of wealth buyers and central banks accelerated this quarter at the fastest pace in more than a year as Europe’s debt crisis deepened and contagion loomed. We have experienced record demand in recent weeks and this week demand has been particularly strong in the European Union according to fellow bullion dealers in the UK and on the continent.

European demand is increasing, although from still very low levels, due to real concerns about the euro and currency devaluations and concerns about the solvency of banks and nations.

Bullion buying in much of Asia has picked up also. Reuters reports that there has been a jump in buying in most Asian countries and that demand for gold in India, still the world's top buyer, rose slightly for the first time in almost a week on Friday.

Bullion dealers in India told Reuters that the price drop “enthused buyers.”

"We saw huge physical demand from Thailand and Indonesia," a Singapore based dealer told Reuters. Gold bar premiums were steady at $1.00 an ounce over spot prices in Singapore. Prices may edge up next week as supply reduces around Christmas holidays according to a dealer.

Opinion has been divided about the outlook for gold. Most analysts of the gold market remain positive about the outlook for gold in the medium and long term. Some are cautiously suggesting that the worst of the sell off may be over as gold looks very oversold technically and the fundamentals remain sound.

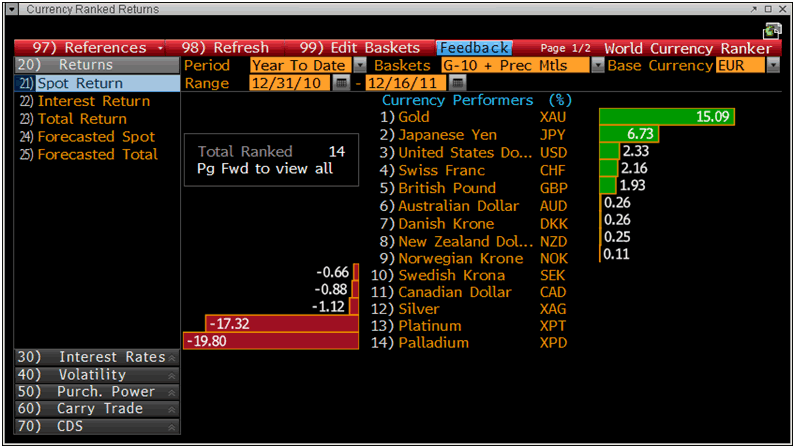

Cross Currency Table

Bearish sentiment in the gold market is very high which may be indicative of a market bottom.

Some economists continue to confuse gold’s frequent short term correlation with risk assets with its proven hedging and safe haven properties in the long term.

Nouriel Roubini has declined to elaborate and clarify regarding his suggestions that gold is a bubble. Roubini Global Economics has said that the breach of gold’s 200 day moving average is “signaling that prices may drop to US $1400/oz.”

Denis Gartman whose pronouncements of the death of the gold bull market were widely publicized this week has said that he may buy gold soon if it falls sharply again. Gartman said 3 days ago that gold was poised to enter a bear market and would hit $1,450/oz before it breached $1,800/oz.

A more nuanced view is that of UBS’ Chief Investment Officer who said that “as we enter 2012”, gold no longer retains “a safe haven status.”

However, “investment in bullion makes sense as a protection against currency debasement and as negative real interest rates reduce the opportunity cost of owning gold”, UBS CIO Alexander Friedman of UBS said.

“Investors should not, however, buy gold expecting it to act as a safe haven during severe, liquidity-driven market sell- offs,” Friedman said.

This week’s washout in gold is “overdone” according to respected UBS precious metals analyst Edel Tully. Edel said that “we think gold at these levels” presents a “buying opportunity.”

Buyers with a long term view might be prudent to dollar cost average into positions in the coming days and weeks.

The old adage to never “catch a falling knife” is worth remembering and it is still too early to say that this correction is over. A higher weekly close next week and weekly or monthly close above the 200 day moving average at $1,620.60/oz would likely see more speculative players come into the market again leading to gold regaining its footing and the technicals again aligning with the fundamentals.

OTHER NEWS

(Bloomberg) -- Credit Suisse Says Gold Drop May ‘Bottom Out’ Above $1,500

Gold may “bottom out” above $1,500 an ounce, Credit Suisse Group AG said in a report e-mailed today. Selling may stall as “buying of physical emerges in greater volume from both the Chinese market and emerging market central banks,” the bank said.

(Bloomberg) -- Gold No Longer a Safe Haven, UBS Says in CIO Monthly Letter

Gold is no longer a safe haven, UBS AG said in its monthly CIO letter. “Going into 2011, most investors believed that safe havens included gold, the Swiss franc, U.S. dollars, U.S. Treasuries, and Japanese government bonds,” the bank wrote in the letter. “As we enter 2012, neither gold nor the Swiss franc retains a safe haven status.”

(Bloomberg) -- Gartman May Buy Gold If Prices ‘Cascade’ Below Yesterday’s Lows

Economist Dennis Gartman said gold may “cascade” lower if prices drop below yesterday’s lows by early next week. If that were to happen, Gartman would “begin to look again at buying gold,” he said today in his daily Gartman Letter. He sold the last of his gold earlier this week.

(Bloomberg) -- China’s ICBC Says It Joins London Bullion Market Association

The Industrial and Commercial Bank of China Ltd., the world’s largest bank by market value, has joined the London Bullion Market Association as a full member, as the country’s imports of the precious metal gained to a record.

The Beijing-based bank will use the opportunity to forge itself into a global precious metal investment and management bank, according to an e-mailed statement from the lender. The LBMA is the London-based trade association that represents the wholesale over-the-counter market for gold and silver in London. China is the world’s largest gold producer.

China’s bullion demand may be more than 750 tons this year, as the country overtook India in the third quarter as the world’s largest gold jewelry market, Albert Cheng, managing director for the World Gold Council’s Far East region at the Council, said on Nov. 17. Gold imports from Hong Kong surged 51 percent to a record in October as investors sought to hedge against turmoil in the financial markets.

“ICBC’s becoming a member of LBMA will help the two markets -- China and overseas -- become more related in the long term,” Jin Shuguang, analyst at Nanhua Futures Co., said by phone from Hangzhou today.

By selling more than 40 tons of gold in the first 10 months, ICBC became the largest retailer in China by volume, Cheng Binghai, chairman of the Shanghai Gold & Jewelry Trade Association, said in Shanghai on Dec. 1.

Gold is rallying for an 11th year, gaining 12 percent, as investors seek to protect their wealth from declining equities, depreciating currencies and the threat of inflation. Bullion for immediate-delivery in London climbed for the first time in five days to $1,590.15 an ounce, down 17 percent from the record $1,921.15 on Sept. 6th.

SILVER

Silver is trading at $29.60/oz, €22.64/oz and £19.03/oz

PLATINUM GROUP METALS

Platinum is trading at $1,422.75/oz, palladium at $620.50/oz and rhodium at $1,425oz

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.