France Triple A Debt Rating Downgrade, G7 Government Debt Facts and Projections

Interest-Rates / Eurozone Debt Crisis Dec 16, 2011 - 05:37 AM GMTBy: Asha_Bangalore

The possibility of Standard &Poors downgrading France’s triple A debt rating is the latest source of market anxiety among several other factors. Standard &Poors put 14 eurozone countries on negative watch earlier in the month. Today, Christian Noyer, the head of the central bank of France, expressed strong reservations about ratings agencies. It is helpful in this context to look at recent trends of government debt as a percent of GDP of major advanced nations.

The possibility of Standard &Poors downgrading France’s triple A debt rating is the latest source of market anxiety among several other factors. Standard &Poors put 14 eurozone countries on negative watch earlier in the month. Today, Christian Noyer, the head of the central bank of France, expressed strong reservations about ratings agencies. It is helpful in this context to look at recent trends of government debt as a percent of GDP of major advanced nations.

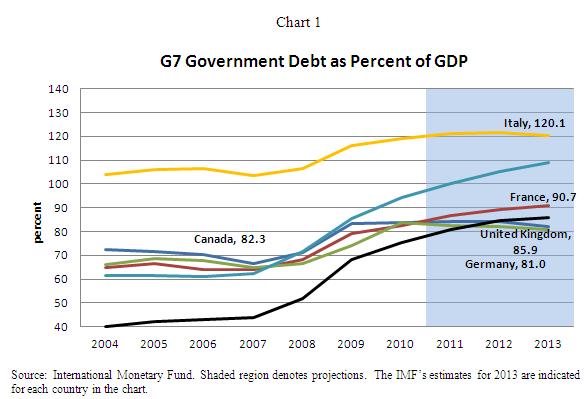

Facts and projections of government debt as a percent of GDP are made available by the International Monetary Fund. Chart 1 depicts the recent history of G7 government debt as percent of GDP 2004-2013; the International Monetary Fund’s projections are used for 2011-2013. Japan is excluded from Chart 1 to make the chart reader friendly. Public debt of Japan in 2010 stood at 220% of GDP and is projected to touch 242% in 2013.

The bottom line is that the G7 is projected to face severe budgetary pressures in the next two years, with Italy at the top of the list and Germany at the bottom of the list according to the International Monetary Fund. Although each of the G7 shares this problematic status, the important difference is that the likely growth path of the each nation is different. That is the discussion for another day, just the facts today.

http://www.imf.org/external/pubs/ft/weo/2011/02/weodata/weoselco.aspx?g=110&sg=All+countries+%2f+Advanced+economies

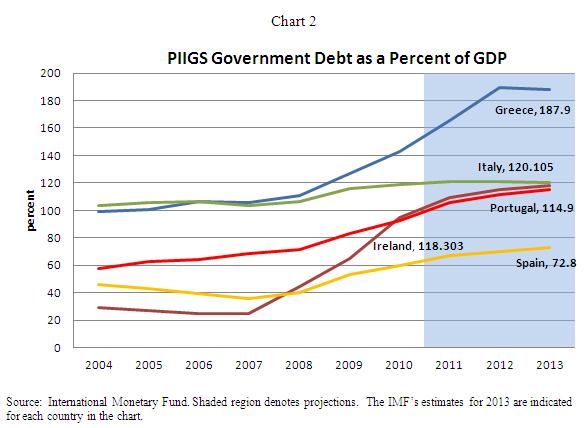

The status of Portugal, Ireland, and Greece is significantly more worrisome (see Chart 2), while Italy and Spain are also grouped with these folks. The IMF’s projections are used for the period 2011-2013 in Chart 2.

http://www.imf.org/external/pubs/ft/weo/2011/02/weodata/weoselco.aspx?g=110&sg=All+countries+%2f+Advanced+economies

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.