Gold and Silver Bargain Time

Commodities / Gold and Silver 2011 Dec 16, 2011 - 03:36 AM GMTBy: Jeb_Handwerger

This is one of those times that we have inveighed about so often. It is a typical "COM" week where markets are designed to confuse, obfuscate and misdirect the players. All thirty DOW stocks and commodities were down as Europe and Bernanke disappointed the markets with what they did not do. The markets were looking for a morsel of guidance, what they got was further silence and ambiguity.

This is one of those times that we have inveighed about so often. It is a typical "COM" week where markets are designed to confuse, obfuscate and misdirect the players. All thirty DOW stocks and commodities were down as Europe and Bernanke disappointed the markets with what they did not do. The markets were looking for a morsel of guidance, what they got was further silence and ambiguity.

The screens have been awash with a sea of red, protestors are taking to the streets in both the U.S. and Europe waving flags representing defiance. Green is hardly to be seen as many indices are near their lows of the year except the U.S. dollar (UUP) and long term treasuries(TLT). There are few places to park money where they are safe. The only havens are those by default. Thus the U.S. dollar and U.S. debt appear to smell like roses in a field of weeds. Hoarding dollars and U.S. debt is no way to promote a recovery.

The Debt Tragedy of the West commands the market stage.

We are witnessing counter-trend rallies in the U.S. Dollar and precious metals. Gold (GLD) and silver (SLV) are getting ready to indicate points of reentry as it retreats. The U.S. Dollar and Long Term Treasuries are overbought, while gold and silver have registered their characteristic volatile selloffs and shakeouts.

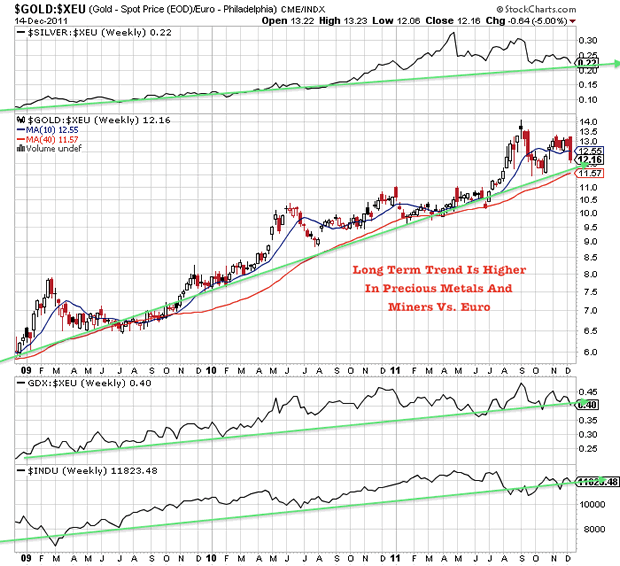

The long term trend higher has not been violated. Fear and panic are the twin refuges of short sellers and naysayers. They are having their week in the collateral damage spurred on by tax loss selling. It must be remembered that Greece is smaller than the state of Colorado and that Spain has a higher percentage of gold holdings vs. their GDP than the U.S. does. If there is a default in Europe it may be contained. If there is a government shutdown, or another credit downgrade in the U.S., where will capital turn from the overbought dollar and U.S. Debt? Perhaps the recent activities are being overdone of shorting the Euro (FXE) and going long the U.S. dollar and long term treasuries. The U.S. debt bubble is the real danger about to burst. Eventually, we believe the capital on the sidelines will seek precious metals, miners (GDX) and eventually gold and silver junior explorers (GDXJ) as they attempt to exit a sinking ship.

We acknowledge that precious metals and the miners are underperforming the U.S. dollar and long term treasuries and have made a bearish technical turn momentarily. However, our gold and silver selections are pulling back in a volatile correction and may soon be reaching support levels as silver and the miners test their 2011 low and gold pulls back to its July 2011 breakout after making record gains in both 2009 and 2010.

It is difficult to believe that the Central Bankers will opt for a deflationary scenario in a world which are taking to the streets. Do not forget that at any time the Central Banks can come together and print themselves out of trouble. Long term safe havens for investors should eventually include the mining stocks in gold and silver which may be hitting support at the 2011 low from which an upside reversal occurs.

No doubt the patterns tell us that we are testing support levels and that technical damage has been inflicted on most stocks including the precious metals. The weak hands inform that the golden bubble may have been broken and the warning inscription written on the entrance to hell "abandon all hope, yea who enter here" may be applicable. We do not agree and may be considering this recent move a fake out and that we may witness a reversal sooner rather than later.

We are witnessing irrational prices characteristic of the end of the year tax loss selling. This should be regarded as purchasing plums and holiday gifts. The red that is seen on the screens may be the color of the week. The current coloration in the past has been subject to volatile change. Stay tuned to my free newsletter for any up to the minute observations.

By Jeb Handwerger

© 2011 Copyright Jeb Handwerger- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.