GOLD Is STILL a BUY, These Charts Say It All

Commodities / Gold and Silver 2011 Dec 16, 2011 - 03:29 AM GMTBy: Lorimer_Wilson

With what is happening with the price of gold these past few days it is imperative to take a look at the long and short of it all (the trends, that is). In doing so it shows that we are still very much in a long-term bull market but in a short-term (yes, short-term) bear market. Let's take a look at some charts that clearly outline where we are at and where we could well be going.

With what is happening with the price of gold these past few days it is imperative to take a look at the long and short of it all (the trends, that is). In doing so it shows that we are still very much in a long-term bull market but in a short-term (yes, short-term) bear market. Let's take a look at some charts that clearly outline where we are at and where we could well be going.

Physical Gold

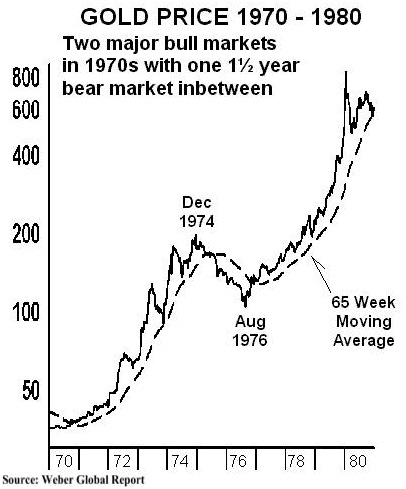

As can be seen in the graph below the 70s experienced 2 major bull markets and an 18 month bear market in between while continuing to trend upwards.

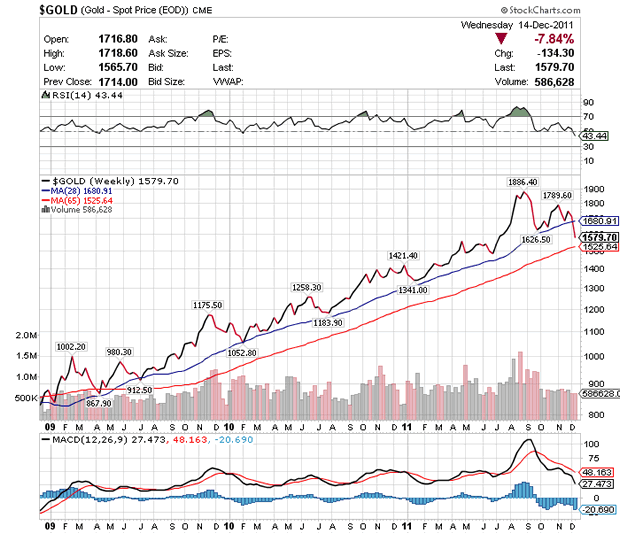

Right now, I believe we're at a period not unlike early 1975. Then, as it is now, the uptrend is still intact. True, gold has dropped below the 28 week (200 day) simple moving average but is still above the 65 week moving average as can be seen in the weekly graph for gold as of December 14th, 2011:

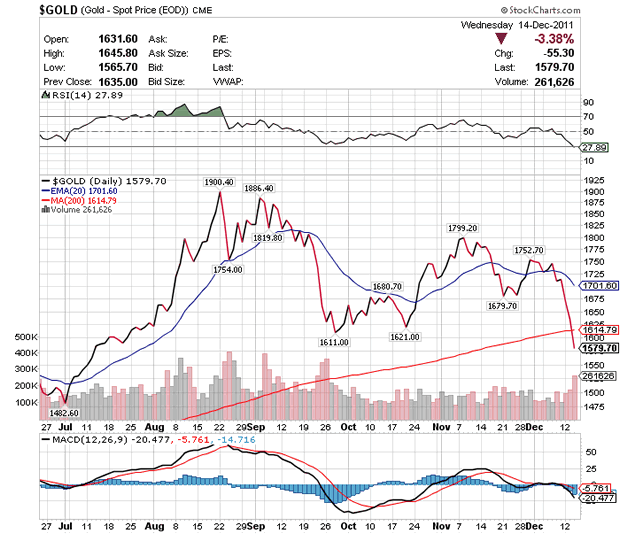

A look at the chart below of the daily close of the price of gold over the past 3 months clearly shows that an excellent way to trade gold is to buy and sell on the basis of the 20 day Exponential Moving Average. EMA is a moving average that gives greater weight to more recent data (in this case the past 20 days) in an attempt to reduce the lag of (or "smooth") the moving average.

Gold Miner Stocks

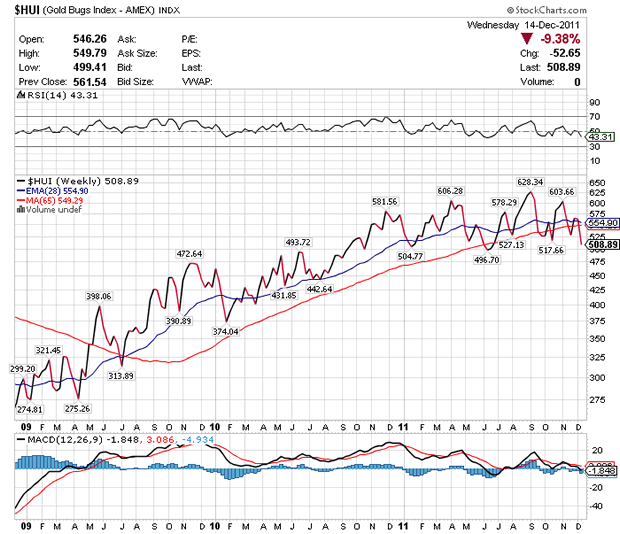

No discussion about gold would be complete without taking a look at the performance of the HUI index which consists primarily of large and mid-cap gold producers. As the graph shows below it is struggling terribly underperforming equities in general and gold by a wide margin. Be that as it may, most analysts believe it is just a matter of time (Goldrunner writes in Goldrunner: Gold, Silver and HUI Index to Bounce Back to Major Highs by May 2012 that the HUI could almost double in the next few months - see here for his rationale) before the precious metals mining (and royalty streamers) sector closes the gap as a result of much healthier bottom lines.

Gold Miner Warrants

If you agree that the gold and silver mining sector has nowhere to go but up in the next few months serious consideration should be given to investing in the long-term warrants that are offered by a few of the constituents of the HUI. Warrants generally enable an investor to take a similar position in a company for approximately 60% less dollars deployed and realize gains often double that of the associated stock. No warrant ETFs exist but a look at my proprietary Gold and Silver Warrants Index entitled Gold and Silver Warrants: An Insider's Insights (see here) will provide you with major insights into this extremely small and unknown investment option.

Conclusion

When I look at the charts above it is obvious that gold has just undergone a pre-Christmas sale of epic proportions which I think is probably the last opportunity to get in before it continues in trend upwards. The financial crisis in Europe has chased people out of gold and equities hitting gold stocks with a double whammy making for an ideal entry point at this time. The long-term gold and silver warrants have been hit hard making them the buy of the decade.

The above being said, who knows what nasty surprises the powers-to-be might throw our way in the months to come in 2012 but whatever they might be gold and silver, in all its investment forms, should do very well long-term, thank you very much.

Lorimer Wilson is editor of www.munKNEE.com (Your Key to Making Money!), publisher of a daily FREE Financial Intelligence Report which can be subscribed to here and a frequent guest contributor to www.PreciousMetalsWarrants.com which also offers a FREE newsletter (sign up here) and a subscription service (see details here).

Disclaimer: Please understand that the above is just the opinion of a small fish in a large sea. None of the above is intended as investment advice, but merely an opinion of the potential of what might be. Simply put:

The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Comments within the text should not be construed as specific recommendations to buy or sell securities. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities. Do your own due diligence regarding personal investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.