Stock Market Update: Work Ethic of an Unbiased Trader

Stock-Markets / Elliott Wave Theory Dec 30, 2007 - 02:00 AM GMTBy: Dominick

I hope you had an enjoyable, restful holiday week. But, if you're like me you've been looking forward to the end of these shortened weeks and can't wait to get back to some heavy volume trading! Friday's close left the immediate term outlook very muddled with many different patterns still viable, but as usual we're content to show up day after day to trade whatever the market offers. All the ambiguity of the current setup means is that anyone who now says they know exactly what will happen next is probably wrong!

I hope you had an enjoyable, restful holiday week. But, if you're like me you've been looking forward to the end of these shortened weeks and can't wait to get back to some heavy volume trading! Friday's close left the immediate term outlook very muddled with many different patterns still viable, but as usual we're content to show up day after day to trade whatever the market offers. All the ambiguity of the current setup means is that anyone who now says they know exactly what will happen next is probably wrong!

But that's not to say I'm shying away from my previous statements about a possible a new high in the S&P in early 2008, just that there was something suspicious about Friday's rebound that could indicate further work on the downside before resuming the rally. On Monday we'll pick up where we left off and do what we always do, but remember last week's update said to be patient – with just one more trading day before the new year officially starts, that sentiment remains appropriate. Between the light volume and tax-loss selling, counter currents in the market make sitting on the sidelines the best bet for many inexperienced traders.

As the calendar rolls over it's easy to get caught up in predictions for next year and other macro trends, but isn't this just being lazy? If we learned anything from 2007 it was that you can't just buy and hold in a volatile market that spends six months in a range. It's simply not profitable. There's no way around the fact that profitable trading is work and requires discipline, and I still prefer to trade each day as it comes without bias. Over and over, the strongest traders will be consistently taking 10 points here, 20 points there, making money every week and leaving everyone else to worry about a new year's list of predictions.

Obviously Elliott wave is a big part of what we do at TTC and I'm frequently asked by newer members how they can learn to spot patterns ahead of time when the market almost never provides the obvious textbook example. And my answer is always the same: there is no substitute for thousands of hours of screen time watching these patterns unfold over and over and over until you develop a “feel.” Again, discipline. But traders today have an advantage I never did, and that's a place like TTC where members can benefit from my experience and the experience of many others as they learn to refine their technique, make better and better trading decisions, and improve their own pattern recognition skills.

Many traders took some time off at least early in the week it seemed, preferring time with their families to rushing in those final year-end trades before Christmas. As we'll see, plenty of smart traders did get back to their desks by the end of the week and made Friday's action a perfect example of the market using the Elliott wave textbook to throw off inexperienced traders. But the setup really started in the sleepy post-holiday trading on Wednesday. The game plan at TTC had us looking for a rollover from the recent strength with a target of 1477 in the S&P cash index. The day started off lower but instead grinded upward all day and ultimately closed up a few points. But Thursday opened with a gap down, however, and we keyed off ES 1496 to signal the real start of the tradable move lower we'd been expecting. Thursday closed at the lows, and these happened to be exactly our 1477 cash target, just one day late as shown in the chart below.

Reaching our target into the end of the day on Thursday hinted at taking a long position overnight for an anticipated gap up Friday and it was nice to wake up and see exactly what we'd been looking for. But as for the rest of the day's trading, Friday became a typical example of a setup that would lead inexperienced Elliott wave traders to see one thing while the market set up another. In this case, most probably saw the gap up as an obvious wave 1, the start of a new impulse higher.

But as the chart below shows, TTC was taking a much more nuanced approach, counting the move up as the c wave of an expanded pattern. If you don't know, it's the hallmark of c waves to mimic an impulsive move, getting traders to chase, whether by covering short positions or entering new longs, only to reverse hard on them. Aware of this probability, I immediately posted before the open that I had taken profits in globex and gone flat at 1500. And while many were probably expecting another Santa Claus day, I was writing that losing 1496 again would make this rally a bull trap. The chart below was posted four minutes into the trading day and shows my expectations for what would become of Friday's gap up.

As I said, when it comes to real time analysis, there's no substitute for experience. With price action looking bullish and indicators turning upward it takes a certain instinct for the market to spot these patterns as they happen, and it takes discipline to trade accordingly. But nothing on the calendar or in the macro picture could have gotten you long for 10 points overnight and then short for 20 the next morning. What must've looked to many as the start of a new impulse higher, we saw as the last gasp of a corrective move up that would inevitably give way, and so it did. Just a short thirty minutes after posting the chart above, market looked like this:

Ultimately, our low target for Friday's selloff missed by three points. Perhaps we'll be heading back there to finish the job, perhaps not. We don't need to know so long as we know how to read what unfolds. But compounding the uncertainty for the short term is four possible outcomes to the crowded triangle pattern and a pattern that we have been watching closely, all of which are still valid. We firmly believe we know where the big picture is taking us, but unlike many who will be blindsided by the short term moves, we'll settle for waiting until the market tells us next week what direction the next trade will be. That, my friends, is the work ethic of an unbiased trader.

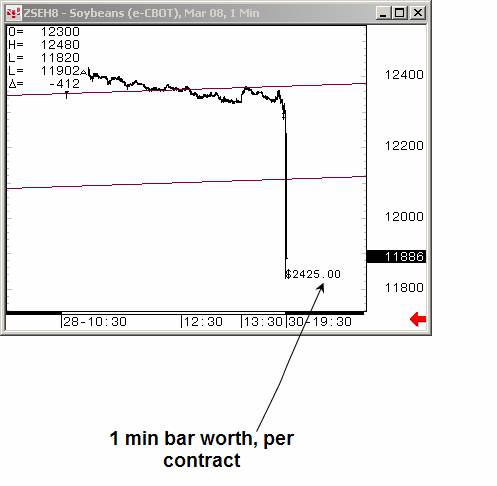

But don't forget we still have one more day of 2007 left! Remember that changing the calendar can also bring on big shifts in money and if you don't believe it, look at what happened in soybeans! I said on December 15 the next big move in beans would not be to the upside and to expect to see a lock limit down. The chart below shows a relatively boring day in beans on Friday until the final minute of the day when someone decided to dump a truck load right before the end of the week. That final bar on the 1-minute chart was worth $2425 per contract! So, you have to respect the powerful moves that can come in commodities, and respect the big movements of money that can happen at the end of the year!

Late longs to the soybean market got pounded on Friday's close and it's tough to say exactly

which way they'll open on Monday, but most traders probably weren't in that game. Most traders really don't get involved in multiple markets, either because they don't know the market or they don't see the setups. But TTC members make a concerted effort to shift their attention to where the power is, to trade in the markets that are trending. Why wait days for a triangle in the S&P to play out when you can catch a bottom in the Euro, for example?

The chart above was posted on December 20 not near the bottom, but AT the bottom. Eight days later, the bounce off the measured move yielded 3 points, a sizeable move in currencies. But, unfortunately, so many let this opportunity slip by.

I'll say it again: if nothing else, trading is work and it takes discipline. There's no substitute for the experience of watching the market unfold day after day after day. But, you don't have to go it alone. It's a big world out there and it's tough. Many institutional investors have found value in TTC's proprietary targets and indicators and in the wealth of knowledge shared in our community of traders. Don't you think you might, too?

With that in mind, let me remind everyone that TTC we be raising its monthly membership fee in February and look to close its doors to retail members sometime in the first half of the year. Institutional traders have become a major part of our membership and we're looking forward to making them our focus. If you're a retail trader/investor the only way to get in on TTC's proprietary targets, indicators, forums and real time chat is to join before the lockout starts, and if you join before February, you can still take advantage of the current low membership fee of $89. Once the doors close to retail members, the only way to get in will be a waiting list that we'll use to accept new members from time to time, perhaps as often as quarterly, but only as often as we're able to accommodate them.

To get you started I will run the refund offer again. . Subscribe by January 15th and stay for 7 days with full access to charts, chat and all TTC member privileges. At the end of your trial, if you're not satisfied, simply send me an email and I'll give you a full refund, no strings attached. It's that simple! There's no better value on the web than TTC and now there's no reason not to check it out for yourself. Click here to register for your free trial!

Our members continue to grow as a family of traders who easily get their money's worth month after month not only in terms of realized profits, but also in education and a sense of community. Bearish traders in particular have learned to overcome their previous losses, heal the psychological scars, and trade the huge upside potential of this market. The testimonial below that came in for the holidays shows exactly that.

“Dear Dominick;

I just wanted to wish you and your family a very merry Christmas and a Happy and prosperous New Year. I have been a subscriber to Trading The Charts for a little over a year now and I wanted to let you know that I think it is the greatest ever - there is nothing out there that can compare to it and I will be a subscriber forever. I had been a subscriber

to (left out intentionally) and had been one of his victims - I'm sure you've heard the story a thousand times. I wanted to thank you for sharing your knowledge and insight with us all each day. I am retired and you have made a big difference in the quality of my retirement. Just wanted to let you know that your work is appreciated and that I consider

myself lucky to have found your website and to have become a member. Thank You for all that you do and again I wish the best of everything to you and yours.”

“Hi Dom,

I told you earlier in the year my sub to TTC was a life changing event. I found with the kids and my health that I had less and less time to devote to trading the indexes, so I stopped it. Turned to currencies and I am happy to tell you that the first two months have been a roaring success. Have done especially well in the Euro and Aussie, and I know that being here has done it. I am an old seasoned trader but I learned a lot of new tricks here and especially I learned to be patient with my set ups.

I have you to thank for changing my whole attitude towards trading and am seeing the benefits of the training you have given me over the last twelve months. Thanks Dom for everything. Now, I don't need to use the word "hope" any more, because I know where my positions are going.

Now, 2008 is just around the corner and I am really looking forward pushing on in a really positive manner. Happy to say I am a member of TTC, and will continue to be (increase of subs was never a problem, I reckon you're still undervaluing TTC) and can only see good times ahead.

Cheers Dom for a great year, and look forward to many more with you. Happy New Year to you and your family, and may you have as much success as you richly deserve.”

Happy and safe New Year to all!

Have a profitable and safe week trading, and remember:“Unbiased Elliott Wave works!”

By Dominick

www.tradingthecharts.com

If you've enjoyed this article, signup for Market Updates , our monthly newsletter, and, for more immediate analysis and market reaction, view my work and the charts exchanged between our seasoned traders in TradingtheCharts forum . Continued success has inspired expansion of the “open access to non subscribers” forums, and our Market Advisory members and I have agreed to post our work in these forums periodically. Explore services from Wall Street's best, including Jim Curry, Tim Ords, Glen Neely, Richard Rhodes, Andre Gratian, Bob Carver, Eric Hadik, Chartsedge, Elliott today, Stock Barometer, Harry Boxer, Mike Paulenoff and others. Try them all, subscribe to the ones that suit your style, and accelerate your trading profits! These forums are on the top of the homepage at Trading the Charts. Market analysts are always welcome to contribute to the Forum or newsletter. Email me @ Dominick@tradingthecharts.com if you have any interest.

This update is provided as general information and is not an investment recommendation. TTC accepts no liability whatsoever for any losses resulting from action taken based on the contents of its charts, commentaries, or price data. Securities and commodities markets involve inherent risk and not all positions are suitable for each individual. Check with your licensed financial advisor or broker prior to taking any action.

Dominick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.