Credit Crisis part 2 or another reprieve?

Stock-Markets / Credit Crisis 2011 Dec 15, 2011 - 08:01 AM GMTBy: Clif_Droke

Recent investor disappointment is being blamed on the Federal Reserve and the fact that it didn’t announce another round of stimulus at its latest meeting. Recent market action can also be chalked up to a continuation of the lingering disappointment from last week’s EU summit meeting. Participants are upset that the European Central Bank (ECB) refuses to engage in a major bond buying program to provide liquidity and bolster investor confidence.

Recent investor disappointment is being blamed on the Federal Reserve and the fact that it didn’t announce another round of stimulus at its latest meeting. Recent market action can also be chalked up to a continuation of the lingering disappointment from last week’s EU summit meeting. Participants are upset that the European Central Bank (ECB) refuses to engage in a major bond buying program to provide liquidity and bolster investor confidence.

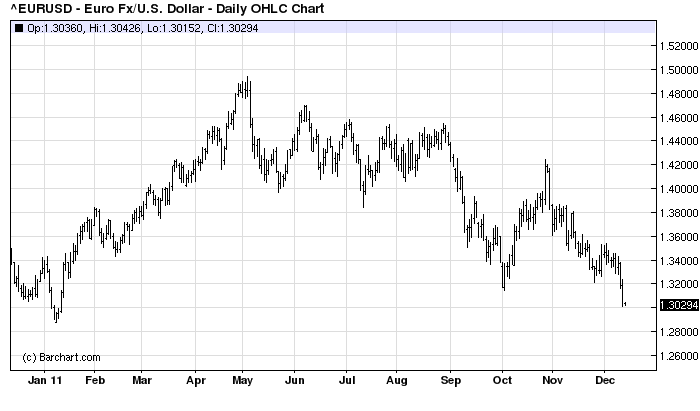

Investors lately have also been reacting to the warning by major ratings agencies that European leaders hadn’t done enough at last week’s EU summit to tackle the debt crisis. The euro currency, which is the primary barometer of the debt crisis, plunged to its lowest level in almost a year on Tuesday.

Around the world markets are concerned about the same thing: while the major central banks have pledged to tackle the eurozone debt problem, neither the ECB nor the Fed appear willing to aim the proverbial bazooka at the financial crisis. I’m referring to a coordinated monetary stimulus, a global QE3 if you will. This is the narrative that we’ve been discussing for the last couple of months and one that will set the tone for 2012.

The wait-and-see approach of European and American political leaders and central bankers is reminiscent of the reticence these same leaders displayed in 2007 on the eve of the 2008 credit collapse. In December 2007, Fed Chairman Bernanke looked the brewing credit storm in the eye and gave a shrug when he announced the Fed lowered its target for the Fed funds interest rate by a (at the time) miniscule 25 basis points. The Dow plunged over 300 points for the day in response to the news and this proved to be a major turning point in the crisis. Within a month the Dow had fallen over 1,000 points and the credit crisis was well on its way to becoming a major conflagration threatening the very survival of the U.S. banking system.

The lesson that policy makers should have learned by heart during the 2007-2008 experience is that the financial market is a merciless judge that waits for no one. Policy makers dragged their feet throughout the year 2007 until the U.S. was the edge of the abyss and only when the economy began its headlong plunge into the abyss did the Fed and the Treasury Dept. take serious action. By then of course it was too late, although a case could be made that without the Fed’s aggressive intervention the banking system may not have survived.

Now Europe finds itself staring into the face of a fiscal crisis not unlike the one the U.S. faced four years ago. The crisis began in Greece last year before spreading to Ireland and Portugal. Now it has spread to the European mainland and threatens to spread even further overseas. Yields on Italian bonds have approaching 7 percent recently, which is widely considered to be the tipping point for sustainability given Italy’s massive debts. Meanwhile ratings agency Standard & Poor’s is expected to strip France of its AAA rating after a review that found the country has large outstanding loans to Italy, Spain, Greece and Ireland.

Germany’s Chancellor Angela Merkel is at the center of the growing euro crisis. She has steadfastly refused to issue euro bonds to quell the crisis, calling them “not needed and not appropriate.” Instead she has persistently called for greater austerity measures to force debtor nations to reduce their debts. Debt reduction is an admirable goal but is something that nations can only pursue during times of economic normalcy. Desperate times call for desperate measures and a debt reduction program during a deflationary cycle is tantamount to widespread deflation.

Unless Merkel and other European leaders want a global financial crisis on their hands they would do well to consider that the U.S. Great Depression was the result of the Federal Reserve’s failure to fulfill its role as a lender of last resort. Instead of pursuing a monetary easing policy by cutting interest rates and buying bonds, the Fed tightened and thereby fed the fires of deflation. The result of this was a catastrophic chain reaction of bank failures, which in turn caused the money supply to shrink and economic output to collapse.

It’s clear that the debt storm currently brewing in Europe will turn into a full fledged hurricane next year if aggressive monetary action isn’t taken soon. Europe has received several reprieves in recent months but hasn’t been granted an actual pardon. The financial market will judge the debt-plagued eurozone just as harshly in 2012 as the U.S. was judged in 2008 if aggressive policy action isn’t quickly forthcoming. The European debt crisis is the narrative we’ll be following from here on out until the problem is resolved and how it plays out will profoundly impact U.S. markets.

In late 2007 and early 2008 when the U.S. credit crisis was approaching the tipping point, gold rallied while the stock market declined. Investors in those days were treating gold as the preferred safe haven in the early stages of the crisis. It wasn’t until the credit collapse was in full swing during the summer of 2008 that gold was liquidated along with everything else in a desperate frenzy by investors to raise cash. This time around it appears that investors are circumventing gold and heading straight for cash whenever euro-related fear increases. It’s my belief that unless Europe’s leaders agree to an all-out monetary policy attack by early 2012, the problem will establish downside momentum in the euro and, conversely, more upward pressure in the dollar which will prove very difficult to reverse – as U.S. policy makers discovered in 2008.

A dollar rally which is gaining traction is a dangerous development for the global economy since it has been largely predicated on a weak dollar for the past decade. A sustained rise in the value of the dollar underscores the developing undercurrents of deflation, especially as we draw closer to the 60-year/120-year cycle bottom scheduled to bottom in late 2014. An important tool for monitoring deflationary pressures in the U.S. and world economy is the dollar index in relation to its 120-day moving average. A good proxy for the dollar is the PowerShares U.S. Index Bullish Fund (UUP). The 120-day moving average has been an excellent intermediate-term trend indicator as well as acting as a support/resistance at critical turning points along the way. Whenever the 120-day MA develops an upward bias for three months or more and the UUP price line is above it, investors can assume that deflation risks are increasing.

Accordingly it will be of paramount importance for us to monitor the ongoing situation in the eurozone and the market’s response to it. Until Europe’s leaders commit to a serious solution to the crisis investors should consider maintaining a conservative approach to the markets due to the heightened volatility risk.

Cycles

Over the years I’ve been asked by many readers what I consider to be the best books on stock market cycles that I can recommend. While there are many excellent works out there on the subject of technical and fundamental analysis, chart reading, etc., precious few have addressed the subject of market cycles. Of the relatively few books on cycles that are available, most don’t even merit mentioning. I’ve read only one book in the genre that I can recommend – The K Wave by David Knox Barker – but even that one doesn’t deal directly with stock market cycles but instead with the economic long wave. I’m pleased to announce, however, that after nearly 10 years of research and one year of writing, I’ve completed a book on the subject that I believe will meet the critical demands of most cycle students. It’s entitled, The Stock Market Cycles, and is available for sale at: http://clifdroke.com/books/Stock_Market.html

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.