Why Buy that Parabolic Move in Gold

Commodities / Gold and Silver 2012 Dec 15, 2011 - 05:45 AM GMTBy: Aftab_Singh

It may be just me, but it seems like the majority of market participants are terrible at dealing with one of the rudiments of life as a human being; time. It is almost as if the herding man lives in constant contempt for his former self and dogmatic surety about his current convictions (whether they relate to past, present or even the future). If this hunch happens to be true, then it doesn’t take much to see the folly – for surprise surprise; as time passes the much-loved present conviction joins the realm of past regrets. So to thwart the arrogance of the gold bubble-top callers and the long-for-the-sake-of-being-long speculators here I outline why you, they and — hell — I might just buy that forthcoming parabolic move in gold.

It may be just me, but it seems like the majority of market participants are terrible at dealing with one of the rudiments of life as a human being; time. It is almost as if the herding man lives in constant contempt for his former self and dogmatic surety about his current convictions (whether they relate to past, present or even the future). If this hunch happens to be true, then it doesn’t take much to see the folly – for surprise surprise; as time passes the much-loved present conviction joins the realm of past regrets. So to thwart the arrogance of the gold bubble-top callers and the long-for-the-sake-of-being-long speculators here I outline why you, they and — hell — I might just buy that forthcoming parabolic move in gold.

Apologies if I sound like a broken record – but nothing about the future is obvious. However, given that the typical 21st century futurologist has a tendency to look at the past to guide his actions – gold may be regarded as particularly perplexing. For whereas equities have never (ever) met the widespread expectation that characterises its top (i.e. a ‘permanent plateau’ of abundant delight – a cornucopia), gold has frequently met the widespread expectation that envelopes its market top; hyperinflation. Gold, widely regarded as the objectification of worriment, has no precedent of not meeting the expectation held at its market top. Unlike most other assets on the radar of the speculator, the currency price of gold has often never returned to the levels traded on the eve of its bull run.

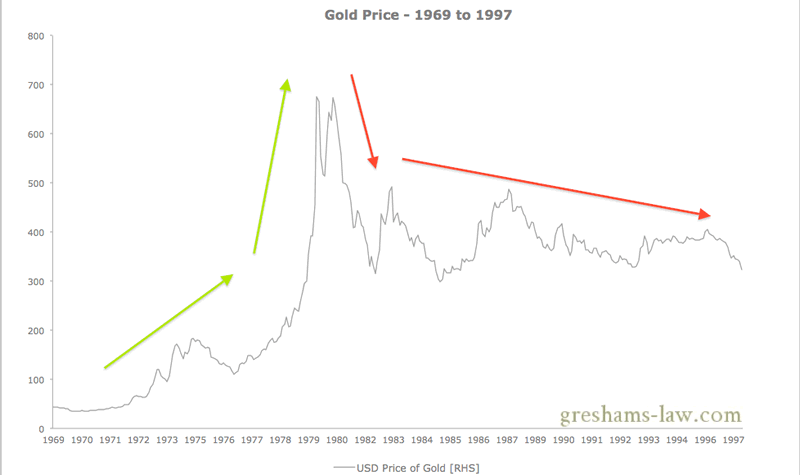

So regardless of your current convictions about your future self, I suspect that the great question that will haunt you will be this; what if this is one of those times? Pictorially speaking; will it be this:

The gold price's ascent and descent during the 70s & 80s.

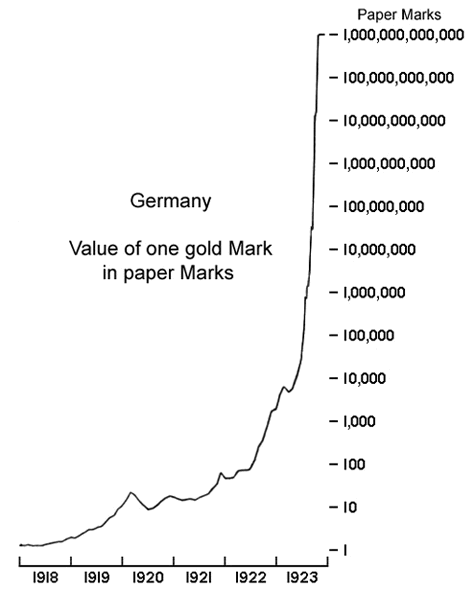

Or this:

The paper mark price of gold... still waiting for it to come back!

The man who takes the time to peruse the history books has the comfort of knowing that the expectation associated with stock market tops has never before come to pass. However with gold there is no such luxury!

The Point:

So why do I mention this? And why now?

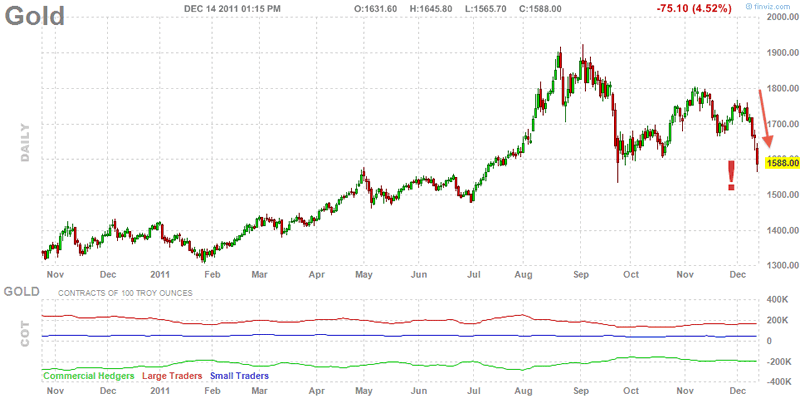

You may have guessed the reason but nevertheless I’ll spell it out – recent price action in gold may invite premature I-told-you-so’s from the gold-skeptics:

Daily Gold Futures Chart as of 14 December 2011 - Click to enlarge. Source: FINVIZ.com

Consider the musings of the gold top callers — after a decade of popping bubbles they’ve made a note to themselves and said ‘ Aha! I know how this works now! All I have to do is call a bubble whenever the price of a financial asset rises!’. I would argue that they have no idea about the environment that characterises a bubble-like top in an asset like gold. With the usual irony that is witnessed in the speculative arenas of life; they seek signals that do not correspond to the reality that they deal with (or so I presume). As I mentioned above – the future is not obvious. One implication of this is that it is never ’easy’ as such to accurately call the top of a bubble! To call a bubble top right now really has few consequences – prices today aren’t wildly different from yesterday and all you might miss out on is opportunity. This kind of thinking may make a little sense when you’re shuffling paper titles to assets – but I would argue that it doesn’t apply so strongly to gold. Try calling a bubble when the implication could be that you lose virtually everything just by owning the ‘risk free’ asset; cash!

The arguments of the gold bubble callers aren’t the only ones that are contemptous towards gold – another set of peculiarities comes from the ‘long-for-the-sake-of-being long’ speculators. Some bizarre communities of investors (MMTers ahem!) really don’t believe that central bank balance sheet expansions debase currencies. But that’s not all – they nevertheless are friends (or perhaps ‘frenemies’) with the long gold trade. The reasoning goes that others foolishly believe in the fairytale that fiat currencies can be debased, so therefore its good to buy gold just to front-run them. While I admit that the degree to which the market discounts the debasement of fiat currencies (via the bidding up gold) can be extreme – I scarcely acknowledge the premise! Anyhow, leaving this strange mode of thinking aside for a second, the implication is that these people think that they’ll just ride the bull market to the top and then get out. As I said above: – try doing that when you would really (really!) pay for that decision.

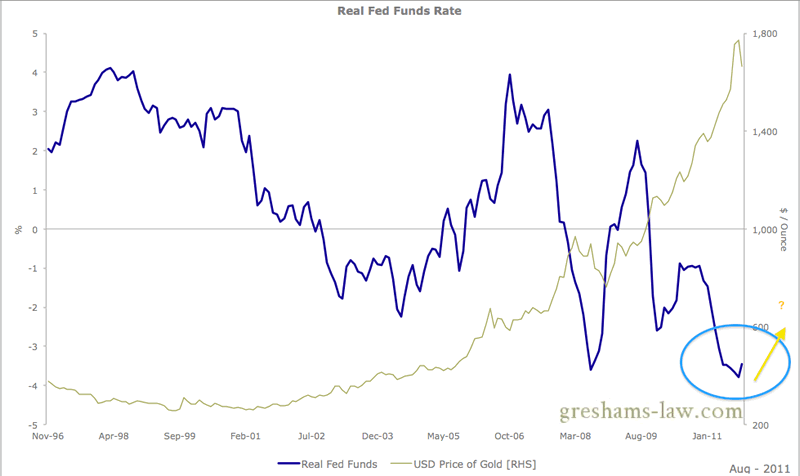

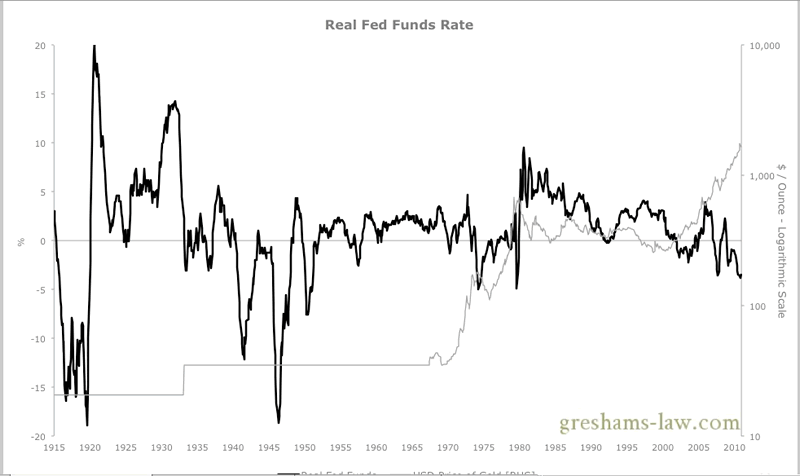

And now let me mention the final reason why I’m posting these thoughts right now: these attitudes may have the platform to gain ground over the coming months. We may have reached an inflection point in one of the indicators that people consider to be very important when dealing with gold (note: we don’t necessarily agree 100%) — the real interest rate:

An upward move in the real fed funds rate? - Click to enlarge. Source: St Louis Fed

Of course the longer-term picture remains unconvincing for positive real rates on the short-end of the curve

Aftab Singh is an independent analyst. He writes about markets & political economy at http://greshams-law.com .

© 2011 Copyright Aftab Singh - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.