Mike Shedlock Tells Nouriel Roubini, Fundamental Case for Gold Has Not Changed

Commodities / Gold and Silver 2011 Dec 15, 2011 - 05:29 AM GMTBy: Mike_Shedlock

In response to Dollar Soars vs. All Major Currencies Following FOMC No Hint of QE3; Looking Ahead, What's Next? I received the following email question from a reader.

In response to Dollar Soars vs. All Major Currencies Following FOMC No Hint of QE3; Looking Ahead, What's Next? I received the following email question from a reader.

Still standing by your position? The euro has tanked, US dollar has shot up, and lo-and-behold gold drops $150.

Sigh.

What does it take for people to realize movements in the US dollar have been irrelevant to the price of gold for nearly six years?

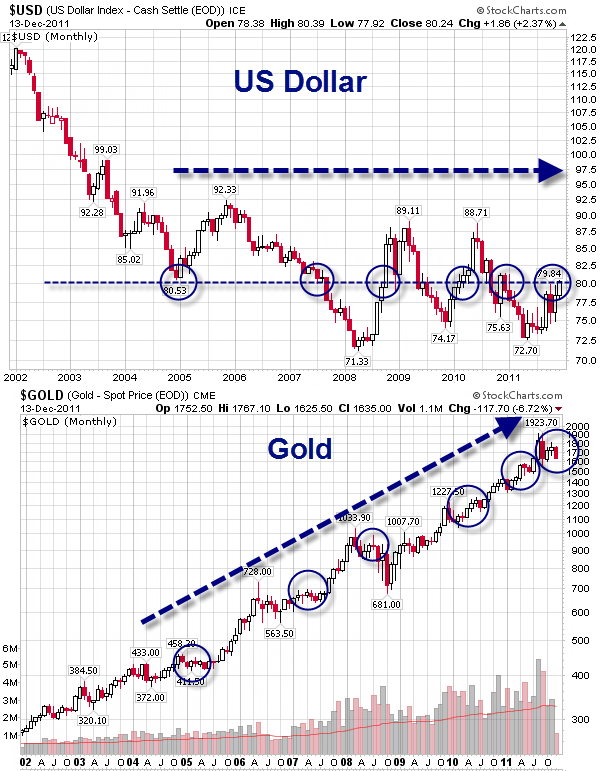

Don't believe me? Please consider the following chart.

Gold vs. the US Dollar

Day in and day out someone writes me concerned about strength in the US dollar and what it might mean for gold. Still others email that gold will soar because the US dollar is plunging and will continue to plunge.

However, the US dollar is about where it was at the start of 2005 (a bit higher actually).

The US dollar has seen or crossed this level six times. In effect there has been no net movement in the US dollar for six years. Meanwhile in every instance, with each cross of 80.50 level on the US dollar index, there has been an upward trend in the price of gold.

At the beginning of 2005 gold was at $435. The US dollar index was 80.5.

Now gold is $1640 with the US dollar index a half-point higher at 81.0

Is there any conceivable reason I should change my position on gold (or for that matter the US dollar).

Hyperinflation Theories Remain Laughable

Hyperinflation theories remain as silly as ever. Try as he might, Bernanke has not been able to stimulate lending or credit growth to any significant degree since 2007.

Consumers are stuck in their houses, unable to move, owing far more on them than they are worth. Students are mired in student loans. Demand for dollars from Europe as well as to pay US debts has soared.

It is preposterous to assume hyperinflation will result from these conditions, especially since Bernanke will not act to destroy banks.

I currently like the US dollar (as I have on and off since 2005). However, that statement in relation to fiat currencies, not vs. gold.

More importantly, I still like gold in spite of the fact I expect the US dollar to strengthen, and in spite of the fact the US has gone into deflation twice (based on credit, not consumer prices) since 2007.

For further discussion as to a realistic approach to what inflation and deflation are all about, please see

- Yes Virginia, U.S. Back in Deflation; Inflation Scare Ends; Hyperinflationists Wrong Twice Over

- Bizarro World Inflation; About that 2011 Hyperinflation Call ...

- Shilling Sees Evidence of Deflation in 5 of 7 Key Areas; Bernanke Begs Congress for Fiscal Stimulus, Admits Fed is Out of Bullets

The fact of the matter is gold does well in deflation. It also does well in times of credit stress. There is immense credit stress right now in sovereign debt in Europe.

Moreover, central banks have on-and-off stepped on the monetary pedal in unison to combat recessions and deflation. Gold has reacted to that. Recently, gold has reacted to Fed statements regarding QE3 and bond buying by the ECB.

Gold may or may not track short-term fluctuations in the US dollar, but on a long-term basis it is clear that it doesn't.

History suggests central banks will step up the printing presses again. When that happens, I expect gold to make another all-time high, perhaps just as the US dollar index makes another plunge below the 80.5 mark from well above it.

I Don't Know, They Don't Either

I do not know what the price of gold will be tomorrow, or next week, or any point in the future. No one else does either. Moreover, even if someone were blessed with the knowledge of where the US dollar index would be three years from now, that person would still be clueless about the price of gold.

Yet, I have lots of people asking me where gold will be and others telling me where it will be (based on the US dollar).

All anyone can really say is the fundamentals for gold are strong because the fundamentals for credit stress and central bank printing are strong.

When I perceive those fundamentals have changed, my position will change. In the meantime, we have had a relatively trivial drop in the price of gold to which many gold bugs threw in the towel in disgust.

Clearly, gold is not the fantastic bargain it was six years ago, but it is still a relative bargain as long as the fundamentals hold, no matter how the US dollar meanders over time. Maybe this correction steepens, and maybe it doesn't, but the fundamental case for gold has not changed one bit.

Reflections on a Tweet

I wrote the above this morning at 5:00AM for posting sometime today (with a title simply on the fundamentals of gold). Well low-and-behold (to use my reader's phrase), I wake up to see this tweet posted by Nouriel Roubini on ZeroHedge

“Gold at a 7 weeks low down to 1635. Where is 2000 gold dear gold bugs?”

Dear Nouriel Roubini

As noted above, the fundamental case for gold has not changed. In a single sentence, the fundamental case for gold is that Monetartist clowns and Keynesian fools will eventually get their way.

When it comes to bailouts and printing money, it is nearly given central banks will try it, with more and more force, each time. The irony Nouriel, is you are begging them to do just that, every step of the way.

Gold has only fallen because central bankers ignored (for the time being), your foolish recommendations to print and spend more money.

If central banks do not resort to the printing press, if governments do not give in to more absurd Keynesian stimulus ideas, and if the US budget deficit is brought under control, then, yes, gold may have topped.

How likely is that?

Nouriel, if you want to better understand the fundamentals of gold, I advise you to look in the mirror and recite your "cure" for the economy.

How long have you been bearish on gold anyway? For something like forever or simply the last 1000 points? Regardless of your answer, the monetary policies you yourself espouse would have us at $2000 right now.

Instead, central banks have actually acted more rationally (for the time being) than many expected.

No one can predict short-term movements, but it would behoove you to understand long-term fundamentals or gold will make you look like a fool, yet again.

Addendum:

Flashback October 22, 2009: Nouriel Roubini: Big Crash Coming

Roubini: I don’t believe in gold. Gold can go up for only two reasons. [One is] inflation, and we are in a world where there are massive amounts of deflation because of a glut of capacity, and demand is weak, and there’s slack in the labor markets with unemployment peeking above 10 percent in all the advanced economies. So there’s no inflation, and there’s not going to be for the time being.

The only other case in which gold can go higher with deflation is if you have Armageddon, if you have another depression. But we’ve avoided that tail risk as well. So all the gold bugs who say gold is going to go to $1,500, $2,000, they’re just speaking nonsense. Without inflation, or without a depression, there’s nowhere for gold to go. Yeah, it can go above $1,000, but it can’t move up 20-30 percent unless we end up in a world of inflation or another depression. I don’t see either of those being likely for the time being. Maybe three or four years from now, yes. But not anytime soon.I do not care about wrong predictions. I do care about wrong thinking., especially consistently wrong thinking. Roubini's thinking has been and remains consistently wrong.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2011 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.