Stock Market Increasing Volatility Signaling a Powerful Move

Stock-Markets / Volatility Dec 29, 2007 - 11:55 AM GMTBy: Marty_Chenard

A big market decision is approaching: Expect increasing market Volatility in the coming days ... and then a powerful move afterwards.

A big market decision is approaching: Expect increasing market Volatility in the coming days ... and then a powerful move afterwards.

The reason : Everyday, we track the Long Term Inflowing Liquidity going into the markets. This is a liquidity driven market, so this is an important underlying element to what the stock market does.

(This study is posted daily on the paid subscriber website.)

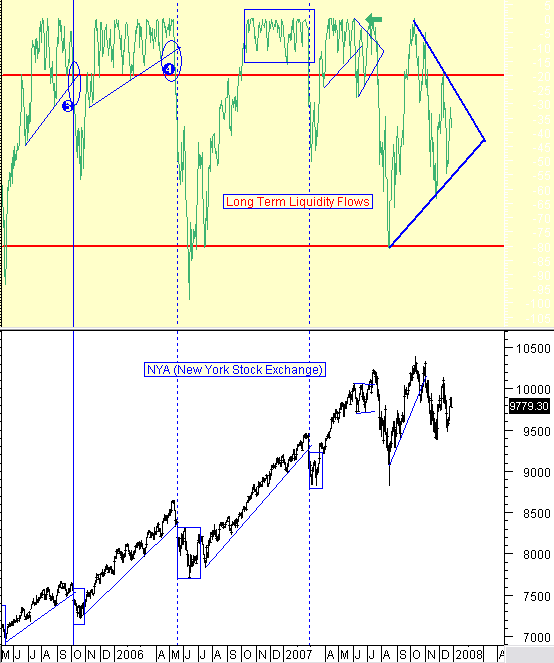

What's happening : If you look at the Liquidity Flows in the chart below, you will see that we have a converging triangular pattern. What that means, is that the up and down inflows have lower tops and higher bottoms setting in. As we approach the apex of the triangle, Volatility will increase and occur within shorter time frames until a break out occurs.

What happens after the breakout : The breakout will be followed with a sharp movement of the stock market in the same direction. If it is to the upside, large amounts of money will flow into the market sending it higher.

If the breakout is to the downside, large amounts of amounts of money will flow out of the market sending the market lower.

Which direction will it breakout? We cannot determine that at this point, as many underlying market technical-fundamental indicators are close to a Neutral condition. Who ever is on the wrong side of the equation when it happens will feel some pain. This is an important formation that will have an key impact on the market.

By Marty Chenard

http://www.stocktiming.com/

Please Note: We do not issue Buy or Sell timing recommendations on these Free daily update pages . I hope you understand, that in fairness, our Buy/Sell recommendations and advanced market Models are only available to our paid subscribers on a password required basis. Membership information

Marty Chenard is the Author and Teacher of two Seminar Courses on "Advanced Technical Analysis Investing", Mr. Chenard has been investing for over 30 years. In 2001 when the NASDAQ dropped 24.5%, his personal investment performance for the year was a gain of 57.428%. He is an Advanced Stock Market Technical Analyst that has developed his own proprietary analytical tools. As a result, he was out of the market two weeks before the 1987 Crash in the most recent Bear Market he faxed his Members in March 2000 telling them all to SELL. He is an advanced technical analyst and not an investment advisor, nor a securities broker.

Marty Chenard Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.