European Union Agreement: Good or Bad for the Dow Industrials Stocks Index?

InvestorEducation / Stock Markets 2011 Dec 14, 2011 - 03:04 PM GMTBy: EWI

Did European Union leaders make the sovereign debt crisis "go away" last week?

Did European Union leaders make the sovereign debt crisis "go away" last week?

Not even close. What they did agree on is tougher budget rules:

"...17 countries of the euro zone...agreed to run only minimal budget deficits in the future and allowed the European Court of Justice the right to strike down national laws that don't enforce such discipline properly..." Wall Street Journal, (12/9)

Will the EU agreement prove bullish or bearish for world stock markets, including the Dow Industrials?

Let's put it this way: The evidence suggests that government intervention in the economy does not alter the dominant trend of financial markets.

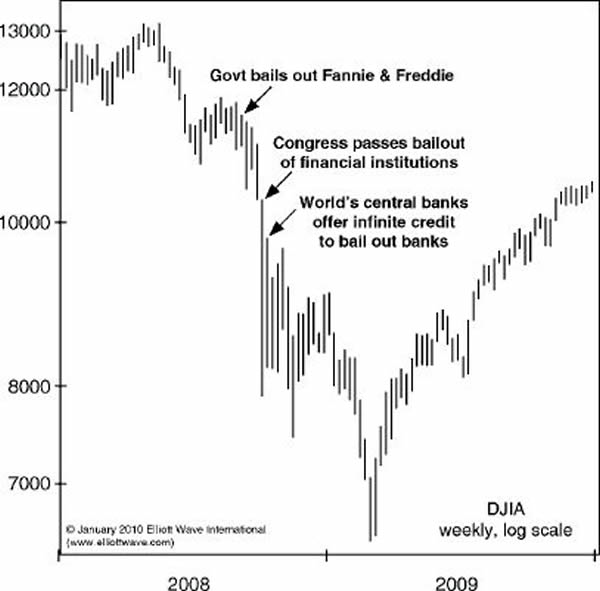

For example: Look at the DJIA chart and try to identify when the U.S. government bailed out Fannie Mae, Freddie Mac, and other financial institutions.

"[The chart below] shows that in fact these actions took place in the early portion of the biggest stock market decline in 76 years. These actions did not push stock prices back up. The market finally bottomed months later, at a time when nothing along these lines happened.

"It is no good to claim that these actions had results eventually. By that reasoning, any future turn in the stock market would prove the contention." Elliott Wave Theorist, March 2010

If anything, the face value of this chart argues that economic government intervention makes stocks go down. There is simply no "cause and effect" relationship between government actions and stock market trends.

If anything, the face value of this chart argues that economic government intervention makes stocks go down. There is simply no "cause and effect" relationship between government actions and stock market trends.

The stock market's price pattern is governed by the Wave Principle:

"Sometimes the market appears to reflect outside conditions and events, but at other times it is entirely detached from what most people assume are causal conditions. The reason is that the market has a law of its own. It is not propelled by the external causality to which one becomes accustomed in the everyday experiences of life.

"....The market's progression unfolds in waves. Waves are patterns of directional movement." Elliott Wave Principle, (p. 21)

If you found this insight into stock market behavior eye-opening, read the2011 Independent Investor eBook, an educational, powerful and FREE 50-page eBook to help you think independently about what really moves the markets. Thousands of investors have downloaded the Independent Investor eBook, and it has changed the way they think forever. Now YOU can get this important eBook, packed with insightful analysis from 2010 and 2011 Elliott Wave Theorist and Elliott Wave Financial Forecast, free. Download your free eBook now.

This article was syndicated by Elliott Wave International and was originally published under the headline European Union Agreement: Good or Bad for the Dow Industrials?. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.