Roubini Asks of ‘Goldbugs’ on Twitter “Where is 2,000?” - Ignores Academic Research

Commodities / Gold and Silver 2011 Dec 14, 2011 - 02:50 PM GMTBy: GoldCore

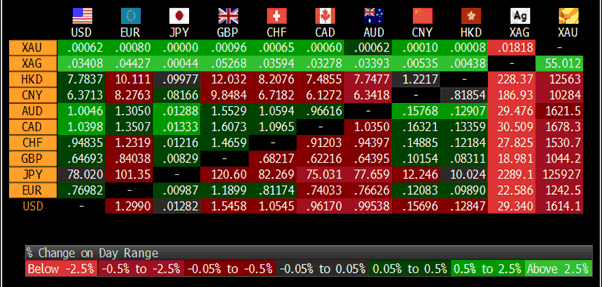

Gold is trading at USD 1,614.10, EUR 1,242.20, GBP 1,045.30, CHF 1,533.40, JPY 126,100 and AUD 1,623.0 per ounce.

Gold is trading at USD 1,614.10, EUR 1,242.20, GBP 1,045.30, CHF 1,533.40, JPY 126,100 and AUD 1,623.0 per ounce.

Gold’s London AM fix this morning was USD 1,635.00, GBP 1,055.32, and EUR 1,255.18 per ounce.

Yesterday's AM fix was USD 1,665.00, GBP 1,068.75, and EUR 1,262.22 per ounce.

Gold is marginally higher in most currencies today and bargain hunters are beginning to buy after the recent price falls. The falls were due to recent dollar strength, liquidity issues in the financial system and weak technicals.

We warned in August that gold could trade as low as $1,500/oz or $1,600/oz as it had become over extended and overbought in the late summer.

How much further might gold fall? Market momentum is a powerful force and therefore further weakness is quite possible.

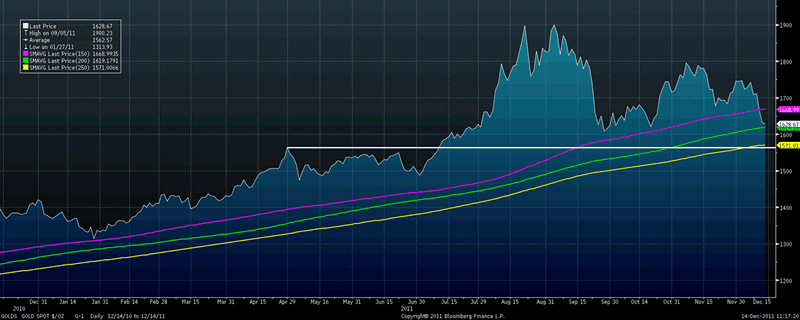

Support is at the 200 day moving average at $1,619/oz. Below that is the psychological level of $1,600 per ounce and the 250 day moving average of $1,571/oz.

Price resistance was seen at the $1,570/oz level between late April and July 2011 (see chart) and this level could become support as is often the case in bull markets.

Gold in USD – 1 Yr (150, 200, 250 DMA)

It is important to note that gold’s falls have been primarily dollar related and gold has fallen by a lot less in pound and in euro terms.

Most analysts of the gold market remain of the view that this is another correction and that the medium and long term uptrend will continue due to significant investment, store of wealth and central bank demand due to geopolitical, macroeconomic, systemic and monetary risk.

One analyst who appears to have a very different view regarding gold is world renowned economist Nouriel Roubini.

The Chairman of Roubini Global Economics has again taken to Twitter to engage in some name calling and to appear to question gold’s recent price action and whether gold may reach $2,000/oz.

Nouriel Roubini

@Nouriel New York

Professor at Stern School, NYU, Chairman of Roubini Global Economics (www.roubini.com), blog at www.economonitor.com/nouriel/ , co-author of Crisis Economics

Roubini or @Nouriel tweeted yesterday evening:

“Gold at a 7 weeks low down to 1635. Where is 2000 gold dear gold bugs?”

The tweet continues his frequent somewhat intemperate and aggressively dismissive tone with regard to gold itself and people who own it. He has also been intolerant of people and experts who believe that a form of gold standard might be beneficial to the global monetary and financial system.

It is interesting that the tweet did not have dollar symbol or mention USD or dollars.

Our expertise is not monetary economics so we will leave that debate to others (see commentary). However, we would note that experts on monetary policy such as the President of the World Bank, Robert Zoellick, and former Federal Reserve Chairman, Alan Greenspan, have proposed considering a return to some form of gold standard.

With regard to gold’s price and whether it is a bubble as has been suggested by Nouriel frequently, we do have an opinion.

Our opinion has been consistent - it is that markets are very unpredictable and it is extremely difficult to predict the future price movement of any asset class. It impossible to predict the future price movement of all asset classes over different time frames and over a long period of time.

This is the reason that we advise clients to have a genuinely globally diversified portfolio with allocations to global equities, global bonds (high credit, low duration), cash and gold.

Diversification is the closest thing there is to a free lunch.

The majority of investors, both institutional and individual, will find that the best way to invest is through an institutional index fund that charges minimal fees. Those following this path are sure to beat the net results (after fees and expenses) delivered by the great majority of investment professionals.

Nouriel and many other experts continue to focus on the nominal price of gold in dollar terms. They fail to adjust for inflation and they fail to look at gold in euro, pound or other fiat currency terms.

By continually focusing on the dollar price, they completely fail to see and understand gold’s value.

Gold’s value has proven itself a safe haven both historically, in recent years and academically. There is now a large body of academic and independent research showing gold is a safe haven asset.

Numerous academic studies have proved gold’s importance in investment and pension portfolios – for both enhancing returns but more importantly reducing risk.

The importance of owning gold in a properly diversified portfolio has been shown in studies and academic papers by Mercer Consulting, Bruno and Chincarini, Scherer, Baur and McDermott and the asset allocation specialist, Ibbotson.

An academic paper, ‘Hedges and Safe Havens – An Examination of Stocks, Bonds, Oil, Gold and the Dollar' by Dr Constantin Gurdgiev and Dr Brian Lucey and was presented in November at a conference hosted by the Bank for International Settlements, the ECB and the World Bank.

This excellent research paper clearly shows gold's importance to a diversified portfolio due to gold's "unique properties as simultaneously a hedge instrument and a safe haven."

Oxford Economics research on gold in July 201, showed how gold is a good hedge against inflation as well as deflation.

Only last week, more excellent independent research was released confirming gold's unique role as a diversifier and foundation asset in the portfolios of investors, especially at a time of heightened currency, investment and systemic risk.

The independent research from highly respected New Frontier Advisors (NFA) confirms the importance of gold as a portfolio diversifier to investors in Europe and to investors exposed to the euro.

As an academic and an economist, it is incumbent on Dr Roubini to do some research on this and thoughtfully reply. Engaging in name calling by calling people ‘gold bugs’ who advocate investing in gold is not professional.

It is the economics of the playground and akin to someone calling Dr Roubini a ‘paper bug’, an ‘equity bug’, a ‘bond bug’, a ‘dollar bug’ or God forbid a ‘spam bug’.

We have some respect for Dr Roubini as a macroeconomist and have indeed shared many of his concerns in many years and shared them with our clients and the wider public as long ago as 2005 and 2006 when we and he warned that the US would soon follow in Iceland’s footsteps: (‘Today Iceland: Tomorrow Turkey, Hungary, Australia, New Zealand, US’ 30/03/06)

However, giving financial advice is not his expertise and he may be better suited focusing on his strengths.

Roubini is regarded as a guru by many experts and opinion makers internationally and there is a real risk that his opinions regarding gold could lead to poor and imprudent investment decisions.

In December 2009, when gold was at $1,100/oz, he said that "all the gold bugs who say gold is going to go to $1,500, $2,000, they're just speaking nonsense."

One of our clients actually sold their gold allocation on the basis of this statement. Despite gold being the one asset class that had protected them during the crisis.

It is possible we have misunderstood Dr Roubini and his opinions regarding gold and we would welcome a television debate on this matter with him.

He advocates printing money to help the economy and people. He should also encourage people to protect themselves by diversifiying and owning some gold, which can offer a hedge to the possible consequences of currency debasement.

Roubini has been fairly good at calling world economic events in recent months, however his investment ‘advice’ has been poor and he appears to not understand ‘investments 101’ which is diversification.

SILVER

Silver is trading at $29.73/oz, €22.90/oz and £19.23/oz

PLATINUM GROUP METALS

Platinum is trading at $1,448.75/oz, palladium at $617.50/oz and rhodium at $1,425oz

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.