Stock and Financial Markets Stay Range Bound

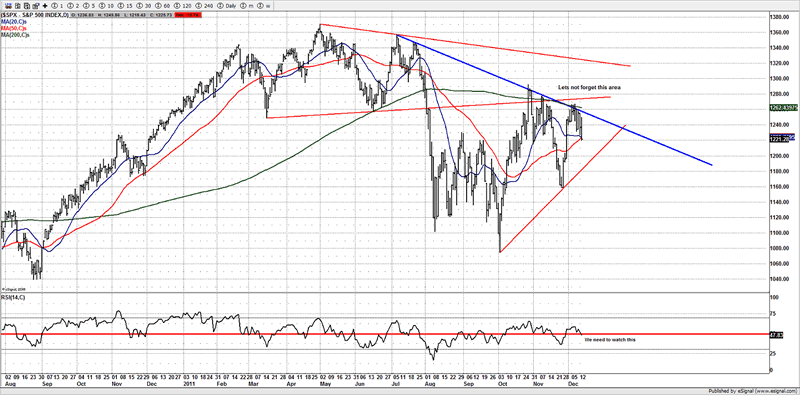

Stock-Markets / Financial Markets 2011 Dec 14, 2011 - 02:44 PM GMT The markets have spent the best part of 6 months doing nothing but causing pain to both bulls and bears, you only have to look at the triangle formation on the daily chart to note the wild swings we have been seeing over the past few months, those are not helping either side, this market has now become a traders play ground, it's not for the investor or swing trader imo.

The markets have spent the best part of 6 months doing nothing but causing pain to both bulls and bears, you only have to look at the triangle formation on the daily chart to note the wild swings we have been seeing over the past few months, those are not helping either side, this market has now become a traders play ground, it's not for the investor or swing trader imo.

As I write this article the markets have gone a grand total of 5 points from the highs made in April 2010 nearly 20 months on, yet the trader that was active has I would suspect made more than 5 points.

The markets appear to be in a transition period where they are trying to find a balance between which side will finally take the market in its true direction.

But currently it's stuck in a sideways trend, although from our perspective it's a traders dream, as long as the bureaucrats stay out the markets, and let the markets fight it out, it most defiantly become a traders playground, active traders only need apply.

Although at some stage this will resolve itself in either direction.

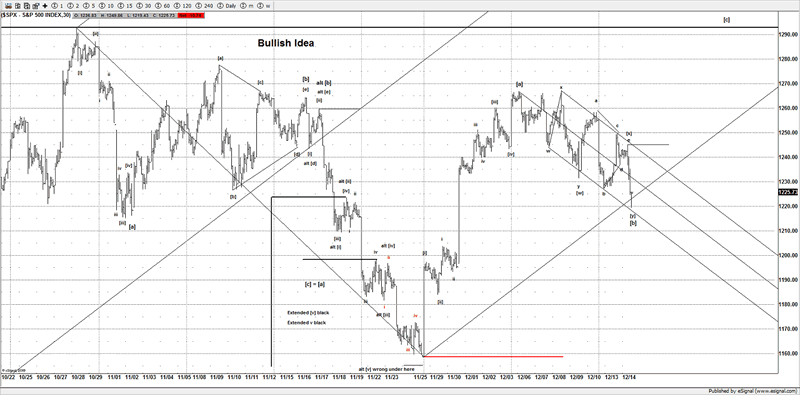

The move off the lows made on 25th Nov, appear to be a very impulsive leg, and we currently still imo are in some sort of correction to that move.

In my last article I wrote that I was expecting a pullback to reset the oscillators and to kill off some the bullish euphoria from Bernanke's "stick save". Already with the markets down nearly a 50% retrace, it appears some bears are back into their bear suits.

Now nothing is ever perfect in the land of trading, but price action imo don't quite lend itself to an aggressive heavy decline, what we appear to be doing is some sort of correction, and although it may not be over, it's still far from what I would consider a setup for far lower price just, yet.

Although there is some evidence growing that lower prices might be in order if the market fails to clear some higher resistance clusters, but atm, I tend to think the market is still trying to carve a low, whilst we were looking for this pullback into 1230ES, it appears the market has a few tricks up its sleeve and "shake n baking" traders.

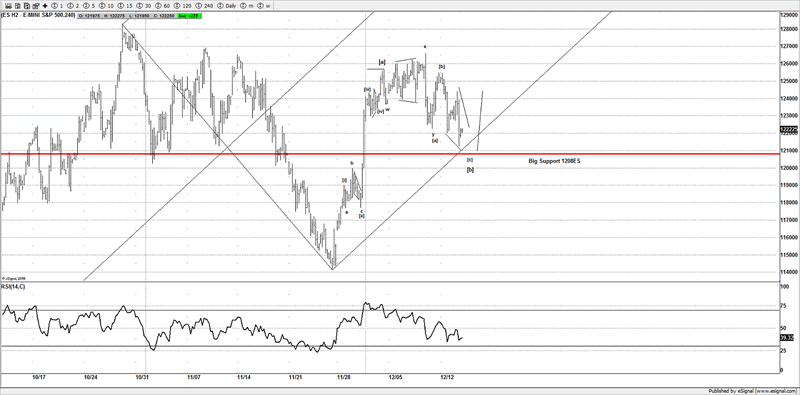

You can see by the trend channel it's currently locked in, that this appears to be a corrective decline; it would need a serious move under the 1210SPX to really start to get a bearish looking tape, and see a heavy break of the lower trend line.

ES

Another potential is that the market is trying to carve out an Ending Diagonal and it still has a bit of work to do, although we won't really know just yet unless we see a rejection, as I write this article the US markets have yet to open, so things may of changed in the coming hours, but we have some upside areas that we are focusing on, should the market fail to get above some key resistance clusters, then we are continuing to look lower, but we are focus around the 1208ES (MARCH) area for a potential low to be setting up.

I tend to think that the market really needs to try and find a base above the 1208ES.

Simple Elliott Wave Analysis

I get an occasional email asking why Elliott Wave is so hard to understand and why can't there be an easier way to look at Elliott Wave Theory.

I am currently in the process or trying to put something together that is going to simplify Elliott Wave for students of all levels.

I believe that it don't need to be as complicated as some make out it should be, I also believe that in order for others to accept the ideas and theory, knowledge should be staged and learnt slowly, not throw someone in on the deep end and ask them to swim straight away.

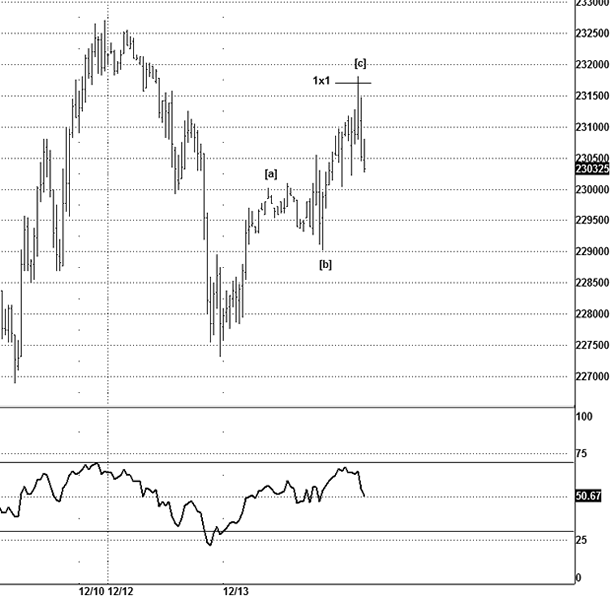

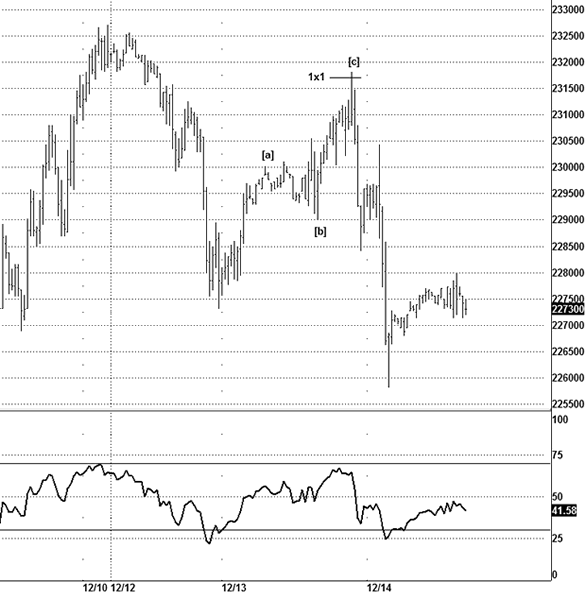

We used this chart yesterday Tuesday 13th Dec just as the markets open, we already rallied in globex and it appeared to be 3 waves, so the market was set to decide.

t want to rally past the 1x1 measured target? Or was that all it had to offer.

What you see there is a simple 3 wave move, traders see this all the time, yet they don't really understand what a simple setup this is, with what looked like a 3 wave move into a measured target, we had to be on out guard in case of a "bull trap", some of use bought the lows the day before, so seeing globex rally overnight was a result, but we also wanted to find out if the market was setting up a trap for the bulls.

We were also watching a key area of 47ES (DEC), both the ES and NQ only rallied 3 waves to virtually measured moves where wave [c] = [a] so approx 2 equal legs.

Just using a simple setup like that got us out of longs that we bought the day before and got us short again, as the failure to get above the 200DMA and a strong resistance area at 2300 was enough to suggest it was a "bull trap". And a new low was being suggested, this was way before the FOMC.

Before

After

Elliott Wave trading don't need to be complicated, I think people spend far too much time trying to look for the perfect Elliott Wave count, but not enough on price action, I tend to distant myself from the orthodox wave counters, as I also rely or fractals such as the one above, I simply never needed to know what the Elliott Wave count was, all I knew and told members was, we have a 3 wave move into resistance, failure to see upside and a rejection from this area suggests a new low.

Well the new has come, we traded that in real time, and we never even needed to look at a chart, we saw a simple 3 wave bounce into a measured [c]=[a] area and failure to get above its 200DMA and 2300 helped a lot. That's simply trading, it's what we try to do day in and day out.

This article is going to be short, but its right up to date, so I hope readers benefit from it, I will expand more on the next article over the weekend, as last weekend I had experienced some issues, and unable to find the time to write my usual weekend report.

Until next time.

Have a profitable week ahead.

Click here to become a member

You can also follow us on twitter

What do we offer?

Short and long term analysis on US and European markets, various major FX pairs, commodities from Gold and silver to markets like natural gas.

Daily analysis on where I think the market is going with key support and resistance areas, we move and adjust as the market adjusts.

A chat room where members can discuss ideas with me or other members.

Members get to know who is moving the markets in the S&P pits*

*I have permission to post comments from the audio I hear from the S&P pits.

If you looking for quality analysis from someone that actually looks at multiple charts and works hard at providing members information to stay on the right side of the trends and making $$$, why not give the site a trial.

If any of the readers want to see this article in a PDF format.

Please send an e-mail to Enquires@wavepatterntraders.com

Please put in the header PDF, or make it known that you want to be added to the mailing list for any future articles.

Or if you have any questions about becoming a member, please use the email address above.

If you like what you see, or want to see more of my work, then please sign up for the 4 week trial.

This article is just a small portion of the markets I follow.

I cover many markets, from FX to US equities, right the way through to commodities.

If I have the data I am more than willing to offer requests to members.

Currently new members can sign up for a 4 week free trial to test drive the site, and see if my work can help in your trading and if it meets your requirements.

If you don't like what you see, then drop me an email within the 1st 4 weeks from when you join, and ask for a no questions refund.

You simply have nothing to lose.

By Jason Soni AKA Nouf

© 2011 Copyright Jason Soni AKA Nouf - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.