Current Stock Market Conditions from both a Dow Theory and a Cyclical Perspective

Stock-Markets / Dow Theory Dec 29, 2007 - 11:45 AM GMTBy: Tim_Wood

As I'm sure you all know, I have been saying for quite some time that the equity markets have been operating within one of the longest 4-year cycles in stock market history. This is not some hollow or shallow opinion in which I'm letting the wish father the thought. In reality, I wish that I could tell you the 4-year cycle low is behind us, because that would certainly make my job much easier as that is what the majority of the public seem to want to believe. In any event, I do not align myself with popular opinion to make my job easier. Rather, my opinion is based strictly on statistical analysis and very specific indicators. As we move into 2008, the statistics nor the indicators have changed in regard to this matter. Therefore, my opinion continues to be that the 4-year cycle low still lies ahead.

As I'm sure you all know, I have been saying for quite some time that the equity markets have been operating within one of the longest 4-year cycles in stock market history. This is not some hollow or shallow opinion in which I'm letting the wish father the thought. In reality, I wish that I could tell you the 4-year cycle low is behind us, because that would certainly make my job much easier as that is what the majority of the public seem to want to believe. In any event, I do not align myself with popular opinion to make my job easier. Rather, my opinion is based strictly on statistical analysis and very specific indicators. As we move into 2008, the statistics nor the indicators have changed in regard to this matter. Therefore, my opinion continues to be that the 4-year cycle low still lies ahead.

Prior to the current 4-year cycle, the previous 4-year cycle of similar duration ran 62 months from low to low and the longest 4-year cycle ever weighed in at 68 months in duration. December 2007 will conclude the 62 nd month for the current 4-year cycle, which now makes this the second longest 4-year cycle since the inception of the Dow Jones Industrial Average in 1896.

I also want to remind you that on November 21, 2007 The Dow Jones Industrial Average closed below the pervious closing low of the previous secondary low point. With the Transports already below their August secondary low point, the confirmation by the Industrials on November 21 st served to confirm that in accordance to Dow theory, the Primary Trend has turned bearish.

Thus, as we move into 2008, the market is not only operating within the context of the second longest 4-year cycle since 1896 and the pressure associated with this over-extended cycle and uncorrected move, but it is also entering the new year with the Primary Trend Bearish, in accordance to Dow theory. So, as we move into 2008 the evidence emphatically suggests that the now Primary Bearish Trend, in accordance with Dow theory, should take the equity markets down into the very over extended 4-year cycle low in 2008.

That being said, I also want to make it perfectly clear that cycles have absolutely nothing to do with Dow theory. These happen to be totally different disciplines. But, I can tell you that the vast majority of 4-year cycle tops also occur with a Dow theory non-confirmation just as has occurred since October.

In a purist sense, Dow theory is a study of price action only as related to the Dow Jones Industrial Average and the Dow Jones Transportation Average. The Dow theory looks at such things as confirmation and non-confirmation, Dow's three movements, which is a means to separate and understand the short, intermediate and long-term movements, market phasing and value. Many think that the Utilities are a part of Dow theory, but they are not. As a matter of fact, the Utility average didn't even come to be until after Charles Dow's death. The Dow theory only looks at the Industrials and the Transports. For more on the history of Dow theory, please visit www.cyclesman.com/Articles.htm and be sure to read the articles on William Peter Hamilton, Robert Rhea and George Schaefer as well.

My use of cycles simply allows me to quantify the moves within the broad context or framework of Dow theory. On page 42 of 'The Stock Market Barometer,' William Peter Hamilton gives the dates and directions of the “Primary Trend.” These dates happen to correspond exactly with the price action of the “4-year cycle.” In 'The Story of the Averages,' Robert Rhea quantifies each “Primary Swing” and “Secondary Reaction” throughout this entire 200 page document. These dates also correspond with 4-year, annual and intermediate-term cycle highs and lows. So, regardless of the label we pin on these movements, these price movements are one in the same. The cycles work is simply another completely separate discipline that allows me to quantify the movements regardless of their names. Furthermore, cycles allow for the development of expectations based on the statistical quantification of prior moves of the same degree. Cycles also allow one to look at the market in several dimensions, just as Charles Dow did with his three-movement concept. Ultimately, the cycles work allows me to apply the historical quantifications in order to develop future expectations in which the Dow theory does not.

In regard to Dow's three movements, Dow, Hamilton and Rhea also spoke of the market having “three well defined movements” or dimensions. Hamilton said, “There are three movements of the averages, all of which may be in progress at one and the same time. The first, and most important, is the primary trend: the broad upward or downward movements known as bull or bear markets, which may be of several years' duration. The second, and most deceptive movement, is the secondary reaction: an important decline in a primary bull market or a rally in a primary bear market. These reactions usually last from three weeks to as many months. The third, and usually unimportant movement, is the daily fluctuation.” Cycles are simply another way of looking at these movements.

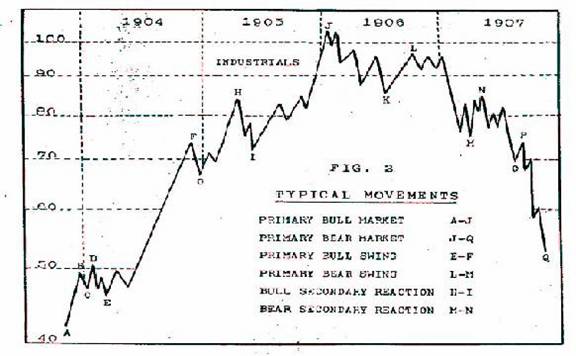

As an example, the diagram below was taken from 'The Story of the Averages' by Robert Rhea. Notice that Mr. Rhea labels the move from Point A to Point J as the Primary Bull Market, and the move from Point J down to Point Q as a Primary Bear Market. From a cyclical perspective, the move from Point A to Point J was the move from the 4-year cycle low to the 4-year cycle top. The move from Point J down to Point Q was the move from the 4-year cycle top into the 4-year cycle low, and the complete move from Point A to Point Q was one complete 4-year cycle. From a cyclical perspective the moves from Points A to C and from C to E were the movements of the short term trading cycle. Movement G to I was an intermediate-term cycle while the movement from Point E to Point I constituted one complete annual cycle.

Rhea labels the movement H to I as a “Secondary Reaction” in the Bull market. If I put my cycles hat on, that same movement becomes the downside piece of both a intermediate-term and an annual cycle. Movements from Point K to Point L and M to N were both “Secondary Reactions” in the Bear market. I might add that this advance from K to L topped out in only 3 months and there was a slight Dow theory non-confirmation at this top.

From a Dow theory perspective, this non-confirmation was a warning, and when the movement from Point L to M violated the Point K lows, the bear market was confirmed. Through my eyes as a cycles analyst, the upside piece of this move from Point K to L was both a intermediate-term and an annual cycle advance that topped in only 3 months. My work with cycles tells me that any annual cycle that tops out in 6 months or less has a 73% probability of moving below the previous annual cycle low, which was Point K. The same is also true for the advance between Point M and N in that M was expected to have been violated based on the cyclical quantifications. This same cycles work tells me that the average decline for all annual cycles topping in 6 months or less, and that failed to move above their previous annual cycle high (in this case Point J) is 26.59%. In this case the decline that followed into the 4-year and annual cycle low, Point Q, was 45.22%. Dow theory does not tell us these things. Statistics such as these only come from cyclical or trend quantifications and can be used to complement other methods of market analysis, including the Dow theory and the current setup.

The bottom line is that the market can do anything it wants and only a fool would say that he knows for sure what is going to happen. But, based upon the fact that 90% of the previous Dow theory bearish primary trend changes have been significant market developments along with the ongoing statistics and indicators surrounding the 4-year cycle, all appearances are that the 4-year cycle low still lies ahead. Also, in accordance with Dow's three movements, the advance out of the November low has been a counter-trend “Secondary Reaction” in opposition to the Primary Trend change that occurred on November 21 st .

The fact that this 4-year cycle has stretched to this extent has caused many to dismiss the significance of the 4-year cycle. Likewise, the rally that has occurred since the November 21 st Primary Trend change has caused many to dismiss the Dow theory. In my opinion it is this type of complacency in the wake of this overdone 4-year cycle and now confirmed Primary Bearish Trend that makes this setup so dangerous. The straw that finally breaks the camel's back may be closer than you think. You have been warned!

I have begun doing free Friday market commentary that is available at www.cyclesman.com/Articles.htm so please begin joining me there. In the December issue of Cycles News & Views I reviewed all Primary Bear markets going back to 1896 in an effort to answer the question of how far this decline could potentially go. I also have a very detailed slide show presentation on cycle quantifications, which gives a statistical analysis surrounding the overdone 4-year cycle that I have been warning about as well. A subscription includes access to the monthly issues of Cycles News & Views, which included Dow theory, a very detailed statistical based analysis covering not only the stock market, but the dollar, bonds, gold, silver, oil and gasoline along with short-term updates 3 times a week.

By Tim Wood

Cyclesman.com

© 2007 Cycles News & Views; All Rights Reserved

Tim Wood specialises in Dow Theory and Cycles Analysis - Should you be interested in analysis that provides intermediate-term turn points utilizing the Cycle Turn Indicator as well as coverage on the Dow theory, other price quantification methods and all the statistical data surrounding the 4-year cycle, then please visit www.cyclesman.com for more details. A subscription includes access to the monthly issues of Cycles News & Views covering the stock market, the dollar, bonds and gold. I also cover other areas of interest at important turn points such as gasoline, oil, silver, the XAU and recently I have even covered corn. I also provide updates 3 times a week plus additional weekend updates on the Cycle Turn Indicator on most all areas of concern. I also give specific expectations for turn points of the short, intermediate and longer-term cycles based on historical quantification.

Tim Wood Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.