Hundreds Of Old Gold Mines Are Reopening

Commodities / Gold & Silver Stocks Dec 14, 2011 - 04:02 AM GMTBy: MIN

New mining technologies combined with high metal prices are triggering a global re-activation of old mines including the Chitradurga mine in India, the Copper Mountain mine in British Colombia, the Sukari Mine in Egypt, the Orvana Mine in Northern Spain and soon the Lincoln Mine in California.

New mining technologies combined with high metal prices are triggering a global re-activation of old mines including the Chitradurga mine in India, the Copper Mountain mine in British Colombia, the Sukari Mine in Egypt, the Orvana Mine in Northern Spain and soon the Lincoln Mine in California.

It is true not all defunct mines host an economic deposit. Often the deposits were mined out, the current regulatory environment is unfavorable or the infrastructure is weak. However, in some instances, defunct mines can be profitably redeveloped.

The three key indicators for future profitability are:

- Mine de-commissioned during low metal prices

- Non-declining historical production rates

- Drill data confirming high grade intercepts at un-mined depths

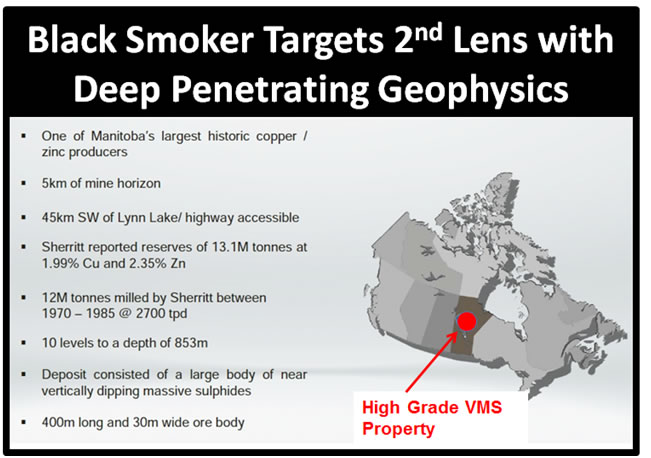

Black Smoker Ventures (BSM-CNSX), a public company headquartered in Vancouver, British Columbia is aggressively advancing a property that meets these three criteria, joining this global trend of developing projects encompassing former producing mines.

Black Smoker’s Fox Lake VMS property was historically one of Manitoba's largest VMS producers with in excess of 400 M tonnes of Copper mined from 1970 to 1985. Average grades of production were 1.82% Copper and 1.78% Zinc. However these grades increased as the mine went deeper. The property boasts excellent infrastructure with year-round access in a mining friendly community and has, until now, never been explored beyond the 1200 meter level.

Black Smoker CEO and Director Carson Seabolt is a partner at Skanderbeg Capital Group Ltd. Mr. Carson has extensive capital markets experience and invested early in winners like Bankers Petroleum (BNK-TSX), Underworld Resources (UW-TSX), Ventana Gold (VEN-TSX) and Energold Drilling (EGD-TSX) for an average gain of 230%.

“Fox Lake Mine was one of the largest VMS deposits in Manitoba,” says Carson, “When the mine closed the price of copper was about $.50/oz and the economics didn't justify continued exploration at depth. This has changed. George Gale, one of Manitoba's foremost authorities on VMS exploration joined us following the acquisition of Fox Lake, validating our exploration concept."

George Gale, a mineral deposit geologist for more than 40 years, has extensive experience working in Manitoba and led the exploration efforts with VMS Ventures (VMS-TSX) to discover the Manitoba Reed Lake VMS deposit in 2007.

Mr Gale has now joined Black Smoker Ventures, whose geological team successfully carried out a SQUID survey in June, 2011 on a grid overlying the historic Fox Mine. A total of 25.25 km data was collected over 13 profile lines.

A SQUID is a “Super-conducting Quantum Interference Device” originally deployed in the field of medical technology. The SQUID is extremely sensitive and produces little “noise” – thereby allowing confident and accurate interpretations of metallic anomalies.

Modelling of the results have identified three conductors in proximity to the Fox Lake Mine including (1) a large shallow anomaly interpreted as the historic mine workings, (2) an easterly trending conductor at depth and (3) a major anomaly spanning a depth of 1200 to 2000 meters, which has emerged as the primary drill target.

The results indicate that the known ore body extends deeper than the 850 meters where the previous mine ended. Carson and his team believe there is an opportunity for the discovery of additional VMS mineralization at depth.

If their belief is correct and Black Smoker is sitting on a new Volcanogenic Massive Sulfide (VMS) deposit, the company stands ready to reap the benefits of its potential $1 billion dollar value. This makes for a compelling risk/reward trade-off for a company with a current market cap of $4.7 million.

On December 5, 2011 BSM completed a $1.2 million Non-Brokered Private Placement to fund the upcoming drill program at Fox Lake. The placement was oversubscribed and attracted sophisticated metal and institutional investors.

With drilling to commence in early 2012, shareholders who like a fast moving plot will not be disappointed.

“Recently completed geophysical work at Fox Lake suggests Black Smoker has an excellent opportunity to target a major new copper and zinc discovery,” states Carson, “the upcoming drill program will be the first significant exploration program at Fox Lake since the mine closed in 1985 and we have the technical expertise to expediently execute this initiative.”

Black Smoker Ventures is part of a global trend of re-activating old mines. The clarity of their vision and promising geological data make BSM a stock to keep a close eye on.

Metal Investment News scours the global landscape looking for financial and political stories that affect metal markets and resource companies. Our team includes award winning journalists, analysts and financial writers.

© 2011 Copyright Metal Investment News - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.