Preparing for Gold 2012

Commodities / Gold and Silver 2012 Dec 12, 2011 - 12:09 PM GMTBy: Ned_W_Schmidt

Imagine most are anxious to put 2011 into the history book. Many of the hopes and dreams of a year ago certainly fizzled as time passed. A raging bull was converted to a bear in nearly all financial markets. So, we do hope for change in the new year, in the markets and especially in November. As we all prepare for 2012, we hope to provide some thoughts for your consideration.

Imagine most are anxious to put 2011 into the history book. Many of the hopes and dreams of a year ago certainly fizzled as time passed. A raging bull was converted to a bear in nearly all financial markets. So, we do hope for change in the new year, in the markets and especially in November. As we all prepare for 2012, we hope to provide some thoughts for your consideration.

Perhaps the most positive development to continue into 2012 is the ongoing, pain filled and righteous death of Keynesianism. That attempting to create prosperity by borrowing money was a flawed economy theory was known to many of us long before current times. Only the regime in power in Washington, D.C. and some deluded Keynesian economists in academia continue to worship the Keynesian fantasy. However, despite positive aspects of the ending the era of Keynesian induced poverty, world still has to deal with the ramifications of all the debt for generations.

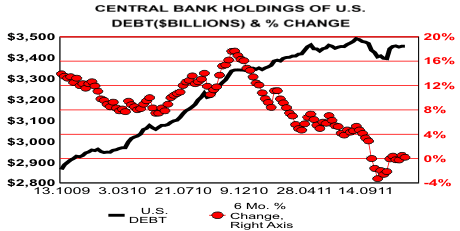

The path to financial purgatory for the U.S. has been paved with money from gullible foreign governments and institutions. These investors gorged themselves on U.S. debt. However, as the above chart might suggest, perhaps they have had their fill of this now bad tasting meal. That chart is created from data released weekly by the Federal Reserve. Black line is the holdings of U.S. government debt by foreign official institutions at the Federal Reserve, using the left axis. Red line, using right axis, is the rate of change in those holdings.

For whatever the reason, foreign investors seem to have lost their taste for U.S. government debt. The trends evident in the above chart continue to show a marked deterioration in the willingness of foreign investors to buy the sovereign debt of the U.S. Having been burned badly by Greece, Italy, Iceland, etc., have investors learned another important lesson?

What, however, are the ramifications of the trends in this chart? Are they positive or negative? If this reluctance to finance out of control spending of the U.S. leads to some financial discipline, this pressure will be good. If, however, the worshipers of the false god Keynes running the Federal Reserve simply monetizes the spending of the Obama regime, we must conclude that only a financial calamity will cure the debt addiction of the U.S. Latter possibility is one of the strong reasons for owning Gold.

A positive development as we enter 2012 is that QE-3 never happened. Some have tried to paint the recent action of central banks to provide targeted dollar liquidity to EU banks as another QE. That, however, is not the case, and perhaps demonstrates a misunderstanding of central bank activity. We also note, as we have previously, that with two of seven seats on the Federal Reserve board continuing vacant and with nominations to fill those seats unlikely to be approved, QE, with or without billboards, continues unlikely.

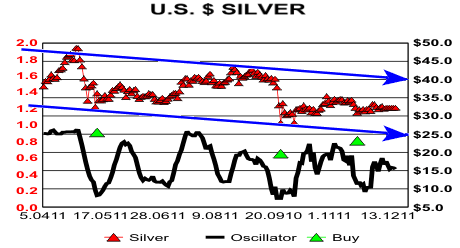

Another source of optimism is that the Silver Bear Market may end in 2012. In the above chart channel lines have been added to the price of Silver. The weight of that trend is unequivocally down. Having twice failed to make a new high and making a new low, down is the reasonable reading of the chart. Breaking $30 could have a black hole effect on Silver.

In George Lindsay and the Art of Technical Analysis by Ed Carlson(2011) we find the means for perhaps projecting the end of the Silver bear market. Our humble effort to use Lindsay's methodology suggests a bottom for Silver on 5 April 2012. As that is not an unbearable amount of time to wait, such is good news from Lindsay's research.

Lindsay also attempted to identify a means of estimating the price action. Our attempt to quantify the price risk using his techniques suggests a low, perhaps intra day, of ~$11. That is much lower than our previous view that the low would be ~$16. Investors might want to give some consideration to these two estimates as investment plans are developed for the coming year.

For more discussion on Lindsay see previous Gold Thoughts on your favorite web site or November and December issues of The Value View Gold Report.

By Ned W Schmidt CFA, CEBS

Copyright © 2011 Ned W. Schmidt - All Rights Reserved

GOLD THOUGHTS come from Ned W. Schmidt,CFA,CEBS, publisher of The Value View Gold Report , monthly, and Trading Thoughts , weekly. To receive copies of recent reports, go to www.valueviewgoldreport.com

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.