ECRI Renews U.S. Recession Call Clashing with Wall Street Expectations

Economics / Recession 2012 Dec 12, 2011 - 06:38 AM GMTBy: EconMatters

The U.S. economy is showing signs of life with good economic numbers after the ECRI (Economic Cycle Research Institute) declared on 30 Sep. that the U.S. has already or is about to dip into recession.

WSJ Market Beat noted that even ECRI’s own weekly leading index (WLI) came in at 122.5 with the latest reading, the highest since early September. However, ECRI said it relies on the longer-term WLI (See Chart Below) when it made the dreaded 'R' call over two months ago. (The long-term WLI is available only to ECRI's paying clients, but the chart below was posted at The Big Picture via Jim Bianco on 9 Dec.)

The bottom line is that ECRI says its recession call still stands. Lakshman Achuthan, co-founder of ECRI said in a Bloomberg TV interview (Clip Below) on 8 Dec. that

“This one [downturn] is persisting. Give us a year, and you'll see if we are right on our recession call."

|

| Chart Source: The Big Picture via Jim Bianco, 9 Dec. 2011 |

Wall Street obviously has an entirely different view from the ECRI.

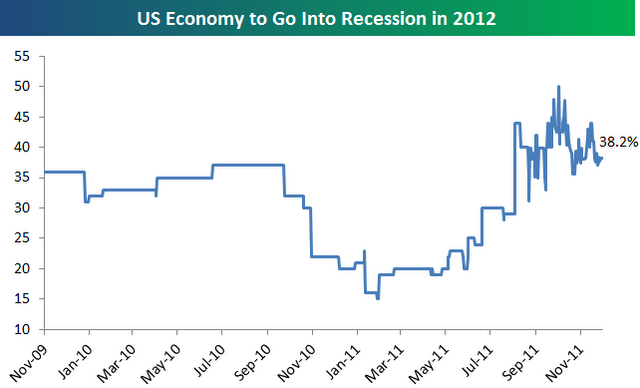

The chart below from the Bespoke Group shows the Intrade contract betting on whether the US will go into a recession in 2012. For the contract to pay out, US real GDP would need to be negative for two consecutive quarters. Right now, the odds of a recession in 2012 are at 38.2% based on actual monetary bets, down from a high near 50% in early October as U.S. economic data have gotten much better since.

|

| Chart Source: Bespoke Group, 9 Dec. 2011 |

For now, we'd agree with Achuthan when he remarked, “You’re not going to know whether or not we’re wrong until a year from now.” Only time will tell if ECRI or Wall Street has the brighter crystal ball.

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2011 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.