Two Roads Out of the Global Financial Crisis

Stock-Markets / Credit Crisis 2011 Dec 11, 2011 - 03:12 AM GMT The international political economy and global financial markets are deep in the woods. A long wave winter season is blowing cold, and getting colder. Decades of excess leverage in the banking system and sovereign states is coming to an end. Government and consumer spending are hitting a wall. A critical fork on this wintry road is coming up fast.

The international political economy and global financial markets are deep in the woods. A long wave winter season is blowing cold, and getting colder. Decades of excess leverage in the banking system and sovereign states is coming to an end. Government and consumer spending are hitting a wall. A critical fork on this wintry road is coming up fast.

A transformational long wave crisis that spans the globe is under way. Tough decisions must be made to pull us out of the long wave winter crisis and into a new spring day on the other side. There are two different roads beckoning us out of this long wave wintry mess. Make no mistake; the choice leads to distinctly different destinations.

Oscar Wilde, in his essay The Decay of Lying, famously penned the words, "Life imitates art far more than art imitates life." Along this line of thinking, Robert Frost's famous poem, with only one word edited (wintry), is in order. It offers new meaning as the world grapples with the global financial, economic and political crisis. It speaks to the far-reaching implications of the important decisions required now for the uncertain road that lies ahead.

The Road Not Taken

by Robert Frost

Two roads diverged in a (wintry) wood,

And sorry I could not travel both

And be one traveler, long I stood

And looked down one as far as I could

To where it bent in the undergrowth;

Then took the other, as just as fair,

And having perhaps the better claim

Because it was grassy and wanted wear,

Though as for that the passing there

Had worn them really about the same,

And both that morning equally lay

In leaves no step had trodden black.

Oh, I marked the first for another day!

Yet knowing how way leads on to way

I doubted if I should ever come back.

I shall be telling this with a sigh

Somewhere ages and ages hence:

Two roads diverged in a wood, and I,

I took the one less traveled by,

And that has made all the difference.

Investors and traders should recognize that global markets will discount the unknown future on the road ahead far more than most are expecting as this long wave winter bottoms in the years directly ahead, whatever road we take. Markets do not like the unknown and buyers of the future will require a hefty discount to the cash flows it offers, especially when perceived risks are rising fast and show no sign of abating.

After this final phase of the long wave winter that puts the future on sale, we can get on with building a global economy that is better than what we are leaving behind. The real question is what road we will take. One road leads to the serfdom and dependence on government promises, the other to individual freedom and unlimited potential. The road chosen will make a big difference in the world we live in during the coming long wave spring season and global boom that lies ahead.

The low road offers more of the same Keynesian hopes that created this crisis. It shows more wear. It offers greater intervention from government in hopes that the state, even in light of recent evidence to the contrary, has the answers. The low road grants greater powers to government and vastly higher levels of debt, fighting debt with debt. Along this road greater national and individual sovereignty and liberty is a required sacrifice offered to the deity of the state and its various temples of centralized control.

The high road offers the hope that the grand experiment of big government is actually ending world over. The dissemination of information on the Internet suggests the old media is losing its grip on public consciousness and its role of kingmaker. Centralized political power is doomed. Rather than centralizing power, there are signs the information age and technology is in the process of a quantum leap, transforming political power in the process and returning it to its rightful owner, the individual and their important role in society and community. The latent potential that can be unleashed on the high road is astounding, and it is the same world over.

Advocates of the high road recognize that radical pro-growth and pro-job corporate tax policies are urgently required. A low flat corporate tax rate of 15% or less in the U.S. will force the world to follow and trigger a global growth boom and new long wave spring. The fair-tax makes even more sense, but that is likely asking too much of politicians that appear to have trouble understanding that they were not elected to only enrich themselves. Have courage, this ilk is on the way out. Most politicians believe tax reform is granting tax breaks in the tax code for kickbacks in one form of another.

If government spending cuts are combined with pro-growth corporate tax policies, the next wave of Internet driven innovation will trigger a global boom in a new long wave spring season beyond 2012. Political leaders can pursue policies that accelerate these trends, or they can try to hold on to their rapidly failing grip on power.

Few are aware that the object-oriented paradigm and the object-oriented code it spawned has played an essential role in the Internet revolution. The objectivation of the planet is turning the Internet into an empowering force for individual freedom and liberty. The Internet is decentralizing access to information and is radically changing the world, including putting political power into a state of flux.

The low road is simply more of the same that got us here and delivered the global system to the edge of the abyss. There are those that are loudly advocating this well-worn Keynesian road funded by government debt, i.e., the same map that got us here. Many advocating the low road are hoping for yearend bonus checks for all the bad debt they would like governments to back stop and transfer onto the backs of taxpayers. This low road is where society's resources are distributed both up to an elite class that socialize their losses and down to an entitlement class. The motto of the low road is clear, in the words of Ayn Rand, "From each according to his ability, to each according to his need."

The high road is seldom traveled these days. It is a road of individual responsibility and accountability for one's own decisions and actions, where thrift and prudence gain their just reward and are not punished by the greed of others that are too big to fail. This high road is where budgets are balanced and governments do not spend money they do not have and therefore must borrow, or steal from its rightful owners.

The two roads out of the global financial crisis are coming up as the world descends in the current business cycle. The call for the European Central Bank (ECB) to join with the U.S. Federal Reserve and promise unlimited quantitative easing (QE) has reached a fevered pitch. The ECB has been buying sovereign bonds on the margin, but the idea of the ECB ratcheting up the buying of any bonds issued by the profligate politicians is a low road choice by any standard. It is repulsive to those accustomed to living within their means and not interested in financing those that who do not.

The current global system is now struggling under its glaring contradictions. The long wave cycle points down and to a resetting of the global economic and financial order. The world has come to an important fork in the road in the current business cycle, the final business cycle of the long wave winter

The entitlement class is demanding the politicians serve up the wealthiest producers on a 1% prime mover platter, so they can, in their own words, "eat the rich". It will of course be their last meal, but this crowd does not think that far ahead. They have not considered that the next meal will be the wild-eyed comrade across the table, or it will be them and their family.

In short, the low road thinking suggests that it is possible to solve history's greatest debt crisis with more debt and deficit spending, keeping the entitlement class satisfied and growing. This may work marginally in this long wave cycle crisis and a somber spring will begin belatedly, but this low road will weaken international capitalism and likely trigger the collapse of capitalism in the next long wave winter season, delivering the global economy onto the cusp of a new dark age.

On the high road, governments will actually be required to stop spending money they do not have and balance their budgets. Investors that unfortunately make bad investments will have to take losses and not socialize them and pass them on to taxpayers. This appears to be a rather novel concept for many. The media and politicians jeer at it as old-fashioned nonsense. Those with the mistaken belief that the profits of capitalism will be able to pay the tab for the great entitlement banquet, are rejecting as "austerity" what is only common sense and the way our grandparents lived.

Advocates for the low road gained the upper hand in the 2008-2009 phase of the financial crisis. Many are now rightfully questioning this direction. Although we are now moving toward the low road, there remains time to change, to take the high road.

All eyes are now on Europe. There is hope that Europe could switch to the high road, and force the U.S. and Asia to follow. This week we learned that the new ECB president Mario Draghi is suggesting that the ECB does not intend to backstop governments that cannot balance their budgets, or failing banks that fund them. German Chancellor Angela Merkel is suggesting government must bring their budgets under control before they receive any help from the ECB. In short, Europe is considering taking the high road. If they do, they could force the U.S. and even the world to follow. Merkel and Draghi are pointing us toward the high road. Those clamoring for more QE to off load their bad debts on you, your children and your grandchildren, so they can get their Christmas bonuses, typically work the tollgates on the low road.

The statement out of the European Union meeting this week suggests there remain leaders that are advocating the high road; let us pray they can provide the leadership to make it happen. They are asking governments to cut spending and move toward balanced budgets before the ECB steps in and buys larger amounts of sovereign debt. Draghi appears to be the sort that will wait for tangible evidence and real cuts before backstopping anyone. Chairman Bernanke should take notes and shake off his fear of deflation.

Great pressure is being applied to the ECB to jettison their single mandate of price stability in Europe and join the U.S. Federal Reserve by becoming the buyer of last resort. This is clearly a low road option. If the ECB caves to this pressure, odds rise sharply that the low road is our destiny. If the infrastructure obsessed Bank of China (BOC) keeps the monetary pedal to the metal it will also indicate the low road may be the one the world travels, but they may just take their cue from the ECB. There is evidence that even some of the leaders of communist-capitalism can recognize the advantages of the high road.

On the low road, concerted global QE will cause the global crisis and long wave winter to drag on longer than it will on the high road. With global QE that buys bad debt, the business cycle lows in 2016 will be inflation-adjusted long wave lows as debt is monetized and inflation steals from real returns. Capital will be slow to commit to the new global long wave spring season and it will get off to a much slower start than possible on the high road. Government picks winners and losers on the low road. That plan has not worked out so far, e.g. Solyndra, etc.

The map for the high road is real deficit reduction in the U.S. and in Europe, not just smaller increases, and aggressive pro-growth corporate tax reform; not endless talk, but action. On the high road, the decline of the business cycle will sharper and swifter than most expect. Required writedowns of bad debt investments, necessary government spending cuts and debt deleveraging will not come without pain. On the high road the decline of the business cycle will most likely be a sharp V shaped deflationary recession/depression into late 2012, and possibly mid-2013.

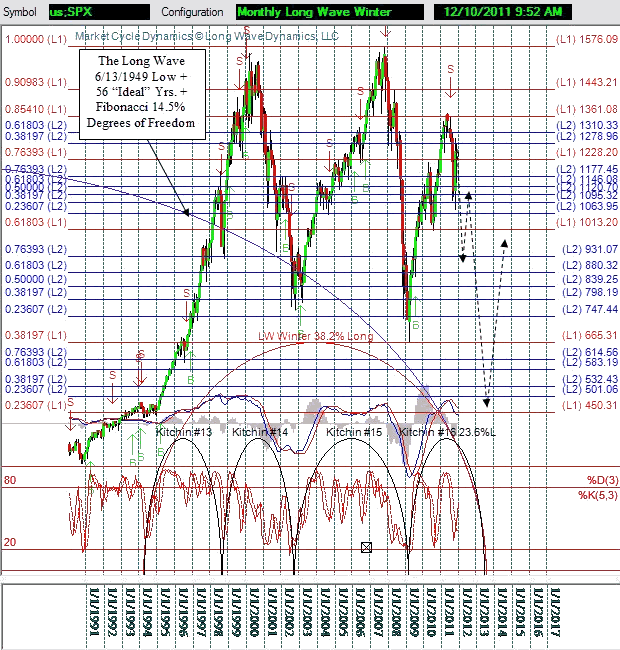

The chart below demonstrates this possible scenario using Market Cycle Dynamics software running with Metastock. The global economy and international markets are a complex system. The low road will not stop the cycles; it will only lengthen the cycles and lead the world inexorably toward chaos and a greater collapse. The high road will restore order and a global boom. A new long wave spring season of global prosperity is what the high road offers.

On the high road, the global economy will make the turn and come roaring out of the V shaped deflation and debt liquidation and into a new long wave spring within 18 months. Hard work, risk taking and ability are what will pick the winners along the high road. The road we choose to travel will determine how and when this business cycle and long wave winter season ends. The road we take will make all the difference.

David Knox Barker is a long wave analyst, technical market analyst, world-systems analyst and author of Jubilee on Wall Street; An Optimistic Look at the Global Financial Crash, Updated and Expanded Edition (2009). He is the founder of LongWaveDynamics.com, and the publisher and editor of The Long Wave Dynamics Letter and the LWD Weekly Update Blog. Barker has studied and researched the Kondratieff long wave “Jubilee” cycle for over 25 years. He is one of the world’s foremost experts on the economic long wave. Barker was also founder and CEO for ten years from 1997 to 2007 of a successful life sciences research and marketing services company, serving a majority of the top 20 global life science companies. Barker holds a bachelor’s degree in finance and a master’s degree in political science. He enjoys reading, running and discussing big ideas with family and friends.

© 2011 Copyright David Knox Barker - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.