Stocks Bull Market is Resuming

Stock-Markets / Stocks Bull Market Dec 11, 2011 - 03:01 AM GMTBy: Tony_Caldaro

A choppy and somewhat volatile market in the US this week that ended on a positive note. Global markets were not as fortunate as the DJ World index ended -0.4%. Positive economic reports again outnumbered negative ones 2:1. On the downtick: factory orders, ISM services, and the Trade deficit increased. On the uptick: consumer credit, wholesale inventories, consumer sentiment, the M1-multiplier, the WLEI, and weekly jobless claims declined. Consumer sentiment has been improving since its 30 year low in mid-August, and the economy appears to be making a u-turn after its double bottom low in mid-October. For the week the SPX/DOW were +1.15%, and the NDX/NAZ were +0.75%. Asian markets lost 2.5%, and European markets gained 0.1%. Next week there is a plethora of economic indicators and the FOMC meeting on tuesday.

A choppy and somewhat volatile market in the US this week that ended on a positive note. Global markets were not as fortunate as the DJ World index ended -0.4%. Positive economic reports again outnumbered negative ones 2:1. On the downtick: factory orders, ISM services, and the Trade deficit increased. On the uptick: consumer credit, wholesale inventories, consumer sentiment, the M1-multiplier, the WLEI, and weekly jobless claims declined. Consumer sentiment has been improving since its 30 year low in mid-August, and the economy appears to be making a u-turn after its double bottom low in mid-October. For the week the SPX/DOW were +1.15%, and the NDX/NAZ were +0.75%. Asian markets lost 2.5%, and European markets gained 0.1%. Next week there is a plethora of economic indicators and the FOMC meeting on tuesday.

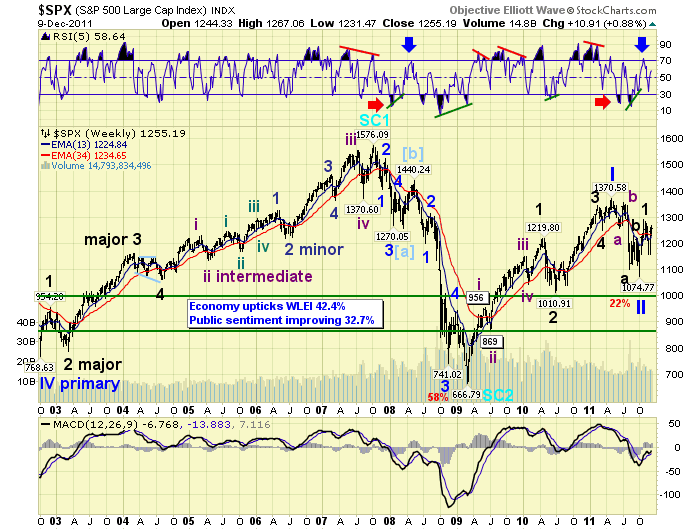

LONG TERM: OEW patterns bullish

The year 2011 has been a difficult one on many fronts. The year started off with the bull market still underway from the Mar09 SPX 667 low. The market made a new bull market high in February at SPX 1344. Then after a one month correction to SPX 1249 in March. The bull market made new highs in April and hit SPX 1371 on May 2nd. After that the market started to get choppy as foreign markets were declining. This was our first signal the US market could be headed for trouble. When the SPX bottomed in June at 1258, and then rallied in a choppy wave pattern into a July 1356 high we turned defensive. A nasty July/August market plunge followed. When many foreign indices had confirmed bear markets we felt a bear market confirmation was highly probable in the US.

We could count five waves up from the Mar09 Supercycle low: an extended first wave, then a simple third and fifth wave. At first we labeled it the end of Cycle wave [1]. After a review of our historical charts we realized a 26 month bull market is actually too short for a Cycle wave, and relabeled the May11 high as Primary wave I. As the European debt crisis deepened equity markets, worldwide, became quite volatile. After hitting a low in August at SPX 1102, the market experienced wild swings of 100 SPX points nearly every week to two weeks for the next two months. After an uptrend high in late August at SPX 1231 the market started to make new lows in October. We had identified four previous waves heading into those lows, and counted it as the fifth wave. On October 4th the SPX hit 1075 and started to reverse. The EU announced they were going to re-capitalize european banks and fix the sovereign debt crisis.

Over the next two days the SPX rallied nearly 100 points. We then identified a diagonal triangle fifth wave at the October low and expected a full 50%, possibly 61.8%, retracement rally of the entire decline from May11 at SPX 1371 to Oct11 at SPX 1075. This retracement was expected to take the SPX into the 1250′s. The market rallied from SPX 1075 to 1293 in just 18 trading days. Exceeding our expectations, but also rising in an impulsive fashion. The latter was quite surprising. Bear market rallies should be corrective in nature, not impulsive. This market activity offered another potential count: a Primary wave II low at SPX 1075. The deciding factor would be how the next downtrend unfolded. If it was impulsive the bear market was resuming. If it was corrective the bull market had resumed.

The market corrected down to SPX 1159 on November 25th. Then it gapped up on monday November 28th, the next trading day, starting another strong rally. This one also looked impulsive. This week the DOW, our US bellwether, confirmed a new uptrend. This signalled the previous correction was over and it was corrective. As a result we turned long term bullish. All along, while the May11-Oct11 correction was unfolding, our technical analysis suggested a 2008 repeat was not in the cards. Currencies were not as weak as they were then, Bond risk was rising but modestly, internal market momentum was displaying a somewhat normal corrective pattern, and our long term indicators were holding sway.

Also, and probably most important, the European equity markets were displaying the greatest upside strength after the October low while surrounding the epicenter of the debt crisis. And, they continue to display that strength. Currently six of the seven European indices we track are in confirmed uptrends again. While the, less confident, other worldwide indices we track are only displaying confirmed uptrends in five of the thirteen. European investors are apparently more convinced of a positive resolution to their own debt crisis than the rest of the world. Quite interesting from an OEW perspective.

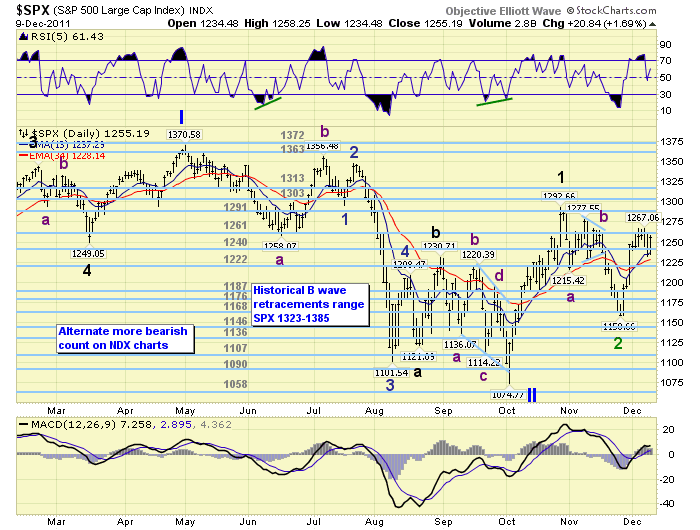

MEDIUM TERM: DOW in confirmed uptrend

During Primary wave I the waves, (trends), lasted between 2 and 7 months on the upside and 1 to 3 months on the downside. Since that high the waves, (trends), have accelerated in time. Each wave, both up and down, has only taken one month to unfold.

This volatility has a created a difficult time for investors and traders alike. Even trend followers have been whipsawed on a regular basis. Fortunately we identified this pattern early in the process. The 2007-2009 bear market started with exactly the same one month per trend pattern. But its uptrends never turned impulsive until the market bottomed in Mar09. Recently, we labeled the Major wave 1 high at SPX 1293 after the secondary high at SPX 1278. Then we projected a downtrend low should occur around November 28th. That downtrend dropped a bit more than expected, but the low occurred the trading day before at SPX 1159, ending Major wave 2. Now we’re projecting a potential uptrend high around December 29th, between the SPX 1313 and 1363 pivots.

On an intermarket basis there is support for this uptrend scenario. Recently Bonds confirmed a downtrend. The USD appears to have put in a double top. The VIX is now downtrending. Corporate bond risk is declining. And, Crude remains in an uptrend. This is popularly known as the risk on trade. Also we have five of the nine SPX sectors in confirmed uptrends.

SHORT TERM

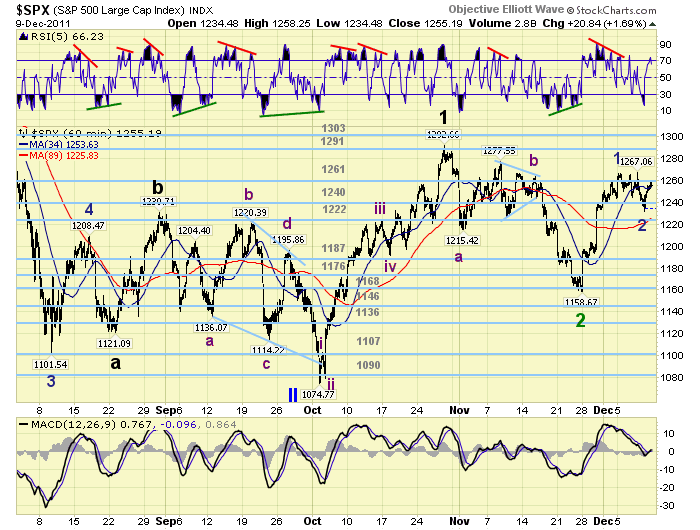

Support for the SPX is at the 1240 and 1222 pivots, with resistance at the 1261 and 1291 pivots. Short term RSI momentum ended the week just below overbought. This uptrend continues to look impulsive and we have labeled the SPX 1267 high as Minor wave 1 and the SPX 1231 low as Minor wave 2. Minor wave 3 should have kicked off on friday.

During the October Major wave 1 uptrend, the market rose in thirteen waves with each of the pullbacks between 21 and 36 points. This uptrend is a bit different. Minor wave 1 has unfolded in nine waves with each of the pullbacks between 11 and 17 points. Minor wave 2, of course, pulled back 36 points. This pattern suggests Minor wave 3 should also have smaller pullbacks, in the teens, as it unfolds. Minor wave 4 will then have a larger 21-36 point pullback. Then Minor wave 5 will complete the uptrend.

Our short term OEW charts swung positive again on friday after dipping into negative territory for one day during the pullback. Support for this short term trend is around the SPX 1250 area. Since this market has had a difficult time breaking through the OEW 1261 pivot, it may require a gap up opening to do it. Gapping over OEW pivots has been quite a frequent event over the past few months. Short term resistance after that is in the upper 1270′s and then the 1291 pivot, which halted the Major wave 1 uptrend at SPX 1293. Short term support is at the OEW 1240 pivot, the lower 1230′s, and then the 1222 pivot. At this stage of the uptrend we can not rule out a retest of the low 1230′s. But a drop into the 1222 pivot area would be considered a negative both short and medium term. Best to your trading!

FOREIGN MARKETS

The Asian markets were all lower on the week for a net loss of 2.5%. Only one of the nine indices we track are in confirmed uptrends.

The European markets were mixed on the week for a net gain of 0.1%. Six of the seven indices we track are in confirmed uptrends.

The Commodity equity group were mixed on the week for a net loss of 2.8%. All three are in confirmed uptrends.

The DJ World index lost 0.4% on the week.

COMMODITIES

Bonds confirmed a downtrend this week losing 0.5%. Bond rates are in an uptrend confirming the downtrend in Bond prices.

Crude continues to uptrend but lost 1.2% on the week. Upside momentum does appear to be weakening.

Gold lost 2.0% on the week and is having a difficult time re-establishing its uptrend after hitting an $1804 high in early November. Silver and Platinum are in downtrends.

The USD appears to have put in a double top. It was flat on the week.

NEXT WEEK

A busy economic schedule. On monday the Budget deficit will be reported at 2:00. On tuesday, we have Retail sales, Business inventories and the FED will end its one day FOMC meeting. Wednesday, Export/Import prices will be reported. Thursday, weekly Jobless claims, the PPI, the NY FED, Industrial production and the Philly FED. Then on friday the CPI. Let’s see if the economic numbers can make it three weeks in a row with a 2:1 positive ratio. Best to your weekend and week!

CHARTS: http://stockcharts.com/...

http://caldaroew.spaces.live.com

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2011 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.