Stock Market Journey to Nowhere, Been a Wild Trip Since August

Stock-Markets / Stock Markets 2011 Dec 07, 2011 - 10:28 AM GMTBy: Trader_Mark

Futures are being pushed around by the normal push-pull of the rumor mill out of Europe - it has reached the point of jump the shark. Late yesterday the market rallied for about an hour on news of a second bailout fund to run along the already mocked ESFS. Then the question of how it would be funded came to be asked, and the market sold off. It's just trial balloon after trial balloon. Tomorrow (morning for Americans) we hear what the ECB is doing with interest rates - a cut is expected, but will it be 25 or 50 basis points and most important are there any 'additional cookies' to be handed out to the class of unruly 2nd graders demanding Oreos by the dozens. Then Friday everyone awaits a new bazooka.

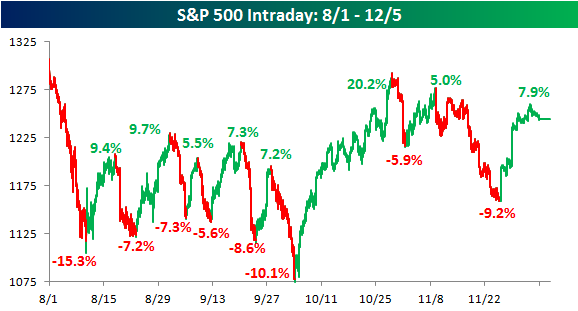

Anyhow, Bespoke has charted the action since August 1, and it shows the extreme volatility we've been experiencing.... and why this sort of period is nearly impossible to outperform an index (gone haywire). It is stunning, especially the August and September movements - we have seen EIGHT moves to the upside of at least 5% and EIGHT moves to the downside of at least 5% since August 1. Bespoke points out there were entire years in the 1990s we did not have ONE 5% move. Now we've just had 16 in just over 4 months? Are you kidding me....

As a trend trader if these moves were spread out over 10-12-16 weeks it would be quite possibly the best environment possible for those who have the ability to flip the switch from unhedged to hedged, but the fact almost all these moves happened in 5-7 market SESSIONS is simply jaw dropping. (also recall much of the action is Europe driven so many of these moves were mostly made in premarket) You can't even begin to get into positions before you'd be stopping out... and then two weeks later trying to chase back in.... and then be stopped out again. The only winner is the broker collection the commissions. Which is why sometimes you just have to stand on the side of the road.... be boring... and wait for a more sensible period.

In the end the market has gone nowhere since Aug 1.... but the journey to nowhere has been neck snapping.

By Trader Mark

http://www.fundmymutualfund.com

Mark is a self taught private investor who operates the website Fund My Mutual Fund (http://www.fundmymutualfund.com); a daily mix of market, economic, and stock specific commentary.

See our story as told in Barron's Magazine [A New Kind of Fund Manager] (July 28, 2008)

© 2011 Copyright Fund My Mutual Fund - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.