Stock Market Cycle Turn Day

Stock-Markets / Stock Markets 2011 Dec 07, 2011 - 07:38 AM GMTGood Morning!

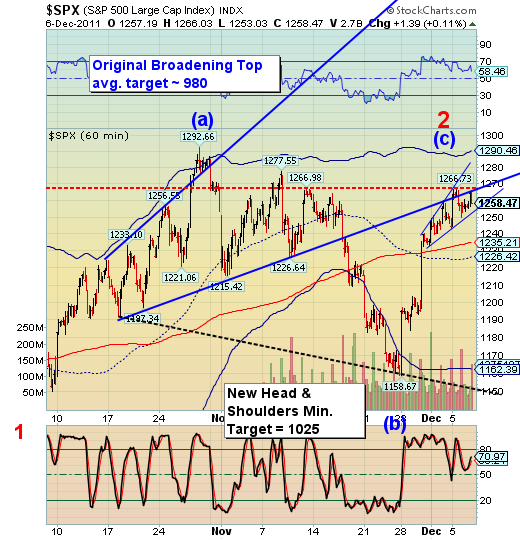

Today is the Trading Cycle turn date. You may recall that I had suggested that this may be an inverted cycle. I had originally inferred that the Master cycle low (November 25) would coincide with the Trading Cycle, which is normally a low. But the Master cycle bottomed 12 days too early. The Trading Cycle only allows 4 – 8 days for a turn window, which have now passsed. What’s left is an inversion, which sets us up for a potential crash.

There are two items worth mentioning about this (inverted) cycle high. The first is, it comes only 12 days from the beginning of a new Master Cycle. That makes the new cycle extremely left-translated. If the decline from here takes out 1158.67, that will give us approximately 7 weeks of falling market into the next cyclical low.

The second observation is this: The red line which has been acting as resistance since October 27is also the bottom trendline of the original Orthodox Broadening Top, with the original target below 1000 in the SPX. This rally has ended with a fractal repetition of the original Broadening Top with the nearly the same target. From this pattern I gather that, (1) The original Broadening Top may not have entered its crash phase yet, or (2) Having met with partial success, it may simply be having another go at it. In either case, I expect to see the SPX below 1000 by the end of January, and maybe sooner.

Today we begin to look for a decline below the following supports for confirmation of the reversal.

· Daily mid-cycle support at 1257.57

· Intermediate-term trend support at 1234.44

· The 50-day moving average at 1214.58

· Head & Shoulders neckline at 1150.00

Good Luck and good trading!

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.