Gold Is Crucial Diversification - Hedge Against Monetary and Systemic Risk

Commodities / Gold and Silver 2011 Dec 07, 2011 - 07:27 AM GMTBy: GoldCore

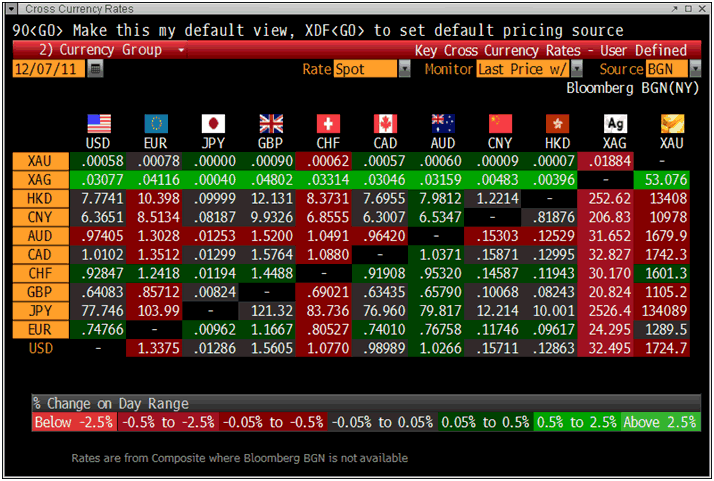

Gold is trading at USD 1,724.70, EUR 1,289.70, GBP 1,099.30, CHF 1,105.5, JPY 134,050 and AUD 1,679.4 per ounce.

Gold is trading at USD 1,724.70, EUR 1,289.70, GBP 1,099.30, CHF 1,105.5, JPY 134,050 and AUD 1,679.4 per ounce.

Gold’s London AM fix this morning was USD 1731.00, GBP 1108.20, and EUR 1,289.96 per ounce.

Yesterday's AM fix was USD 1,720, GBP 1,098.76, and EUR 1,284.54 per ounce.

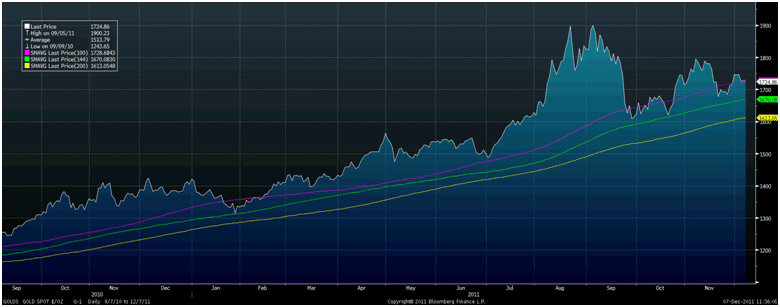

Gold in USD – 1 Year (100, 144 & 200 DMA)

Gold is marginally lower in most currencies today except for the euro and Swiss franc after seeing a 0.44% gain in dollar terms yesterday. Technically, gold is back above the 100 day moving average (see chart) which could result in some traders going long again.

It will be interesting to see if gold repeats its trading pattern from last year when it eked out very marginal gains in November and December prior to falling in the first month of 2011.

The price falls in January led to further cries that the gold “bubble” was bursting and indeed led some investors to nervously sell prior to the strong, steady gains seen from February through to August.

Equities have made tentative gains but investors remain cautious ahead of another European Union summit where hopes are again high that politicians find a way to resolve the Eurozone’s 2 year old debt crisis, prevent contagion and the end of the euro as it we know it today.

Cross Currency Rates

Markets remains tentative after Standard & Poor's fired a second warning shot at the euro zone in 24 hours, threatening to cut the credit rating of its financial rescue fund. S&P said the EFSF may lose its AAA rating if any AAA euro zone country is downgraded.

The UK Prime Minister has increased nervousness about the summit. As the scale of the planned “fiscal union” became clear, including proposals for the EU to have “intrusive control” of national budgets, Cameron said that the UK will not sign a new European Union treaty unless certain safeguards are built in.

Cameron has threatened to veto the deal which is ostensibly to save the euro unless he wins safeguards for the UK with regard to national budgets, the City of London and the European single market.

Commentary continues to suggest that gold's safe haven appeal has been tarnished in recent weeks. Similar commentary was seen in the aftermath of price falls in 2007, 2008, 2009, 2010 and now again in 2011.

Obviously, gold is often correlated with risk assets in the short term. Turmoil in financial markets squeeze funding and forces speculators and more short term investors to close profitable gold positions to cover losses elsewhere.

However, the same market turmoil and uncertainty leads less speculative market participants, investors and store of wealth buyers to buy physical bullion as a long term wealth preservation strategy which leads to gold’s inverse correlation with equities and bonds over the long term.

This lack of correlation with riskier paper assets has clearly been seen throughout history. It was graphically seen in the last decade, since the outset of the global financial crisis in 2007 and will be seen again this year and in the coming years.

New Independent Research Confirms Gold Crucial Diversification, Hedge Against Monetary and Systemic Risk

More excellent independent research was released yesterday confirming gold's unique role as a diversifier and foundation asset in the portfolios of investors, especially at a time of heightened currency and investment risk.

The independent research from highly respected New Frontier Advisors (NFA) confirms the importance of gold as a portfolio diversifier to investors in Europe and to investors exposed to the euro.

During a period of extraordinarily serious economic uncertainty in the Eurozone, continued concerns about economic growth in the US heading into an election year, and the possibility of an economic slowdown in China, the World Gold Council (WGC) wanted to examine the relevance of gold as a strategic asset for euro-based investors to protect their portfolios and to mitigate the systemic risks being faced.

Euro Versus G10 Currencies and Precious Metals (YTD)

The report, ‘Gold as a strategic asset for European investors’, commissioned by the World Gold Council, explores gold as a strategic asset across five sets of asset allocation studies, including four using historical data spanning 1986 to 2010, and one using the 1999 to 2010 time frame.

The third party research builds on the now considerable research and academic literature showing that gold adds significant diversifying power due to its low or negative correlation with most other assets in an investment portfolio.

Gold’s relevance as a strategic asset is continuing to grow. This will continue in a world facing the real risk of a global recession and even a Depression, poor investment returns, currency devaluations and wars and very high monetary and systemic risk.

Put simply, when used as a foundation asset, gold has preserved wealth throughout history and again today.

Gold’s unique properties will protect savers and investors in Europe and internationally against the monetary and systemic risks being faced in 2012 and in the coming years.

Chavez Announces Second Batch of Gold in Venezuela

Venezuelan President Hugo Chavez said that a second shipment of gold reserves being repatriated from banks in Europe and North America arrived today in Caracas. He spoke today during a press conference from the presidential palace without providing more details according to Bloomberg.

Venezuela’s central bank received the first shipment of gold on November 25 without providing details on the amount. Venezuela had 211 tons of gold reserves held abroad as of August.

Venezuelan President Hugo Chavez on Tuesday announced the arrival of the second batch of gold in the country, coinciding with the 13th anniversary of his first electoral victory according to Prensa Latina.

"I was just informed that a second truck carrying gold passed by the Miraflores Palace," Chavez told international reporters.

The president said that there is nothing more exposed than keeping that auriferous resource in Europe and the United States. "I have nothing against Europe. I am just telling the truth," reiterated Chavez.

"How long will we keep that gold there? Who knows if a king or NATO (North Atlantic Treaty Organization) comes and issues an insane decree-law? That gold is ours," added the Venezuelan head of State.

The first shipment of gold, which was in European banks, was repatriated to Venezuela on November 25.

Last August, Chavez announced that he would bring back the 211.35 tons of gold that Venezuela had abroad, worth 11 billion dollars.

SILVER

Silver is trading at $32.30/oz, €24.16/oz and £20.68/oz

PLATINUM GROUP METALS

Platinum is trading at $1,511.70/oz, palladium at $671.02/oz and rhodium at $1,500/oz.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.