How to Survive and Prosper in the Coming Financial Meltdown

Stock-Markets / Financial Crash Dec 07, 2011 - 03:03 AM GMTBy: Sam_Chee_Kong

The current global financial crisis can be said to be caused by the macroeconomic expansionary monetary policies of global governments and also at the same time the lack of regulatory framework from the authorities. As a result of the expansionary monetary policies the market is full of liquidity or in other words too much cash is available. The lack of regulatory framework from the authorities actually help to hasten the process of the financial crisis. The current financial crisis can be best described with the following three stages of manifestation.

The current global financial crisis can be said to be caused by the macroeconomic expansionary monetary policies of global governments and also at the same time the lack of regulatory framework from the authorities. As a result of the expansionary monetary policies the market is full of liquidity or in other words too much cash is available. The lack of regulatory framework from the authorities actually help to hasten the process of the financial crisis. The current financial crisis can be best described with the following three stages of manifestation.

Stage One - The Initiation of the Crisis

Western economies like their counterpart in China previously had been enjoying the highest standard of living in the last 200 years. Like China during her heydays, Western Countries are the leaders in innovations and their Industrial Revolution and is second to none. Their monopoly on most innovations makes them feel contended and stagnation is the end result. It had gone to the point that it is like a natural right for westerners to have McMansions, cheap gases, overseas travel, luxury cars in their garage and anything that can be bought by credit. All these are possible due to the sweat shop working conditions and meager wages of its overseas counter parts and also the strong currencies of the western countries.

They have been living beyond their means for many years because of its housing boom where real estate prices keep going up with wages unable to catch up. People are able to borrow more because their homes are worth more by the day. Thanks to those investment bankers who invented the ‘Liars loans’ and Robo signing procedures where people who are not qualified are able to borrow more and more. All the borrowers need to do is just mention their annual income and without any due-diligence and credit check, their loans will be approved in the next few days.

Due to the advancement of computer technology, it enabled financial institutions to bundle together smaller loans into standard debts securities through a process called securitization.

Through the process of securitization, investment bankers invented the MBS or Mortgage Back Securities and they had those rating agencies assigning AAA ratings into these products. By putting a AAA tag into these products, they then be able to sell to pension funds around the world.

What these investment bankers did with the MBS mortgage was slicing and dicing the original security. At the end of the day you have multiple MBS lying on top of the original security, some up to 8 levels. So when the Bank foreclose the original property, they are unable to sell because there are about 7-8 owners attach to the property. It is estimated that more than 20% of home mortgages in the US are under water.

Stage Two – The Sub-prime Crisis

According to the Federal Housing Finance Board (FHFB) the formula for affordability of the mortgage to property price should be between 2 to 2.5 times their gross annual income. In other words, a couple earning $100,000 per annum, by theory can only afford a property with a value up to $250,000.

If you were to take this formula as a basis for affordability then most Americans will not be able to afford a home because their median household income in 2003 was $43,318. This means the maximum price of a house they can afford is $108,295, which means they can’t afford anything because the median price for a home is about $283,800 at that time.

So what do those potential house buyers do? A lot of them are turning to ARM or Adjustable Rate Mortgage. ARM is a financial instrument that enables homebuyers to pay a low or zero interest for the first few years, normally three or more years. This means that homebuyers are only paying the interest part of the loan for the first 3 years and the interest plus principal part on the fourth year.

For example, if you borrow a $100,000 loan with a tenure of 25 years. It comes with a three year interest only (three-year ARM) at 6% interest and the rest or 22 years with interest plus principal. Your payment would be $500 per month (($100,000*0.06)/12 = $500) for first 3 years. After that , you will have to start repaying the principal. Base on the same interest rate, the payment would now increase to $644.29 a month, which is about a 29% hike. That is if the rate of interest remains unchange.

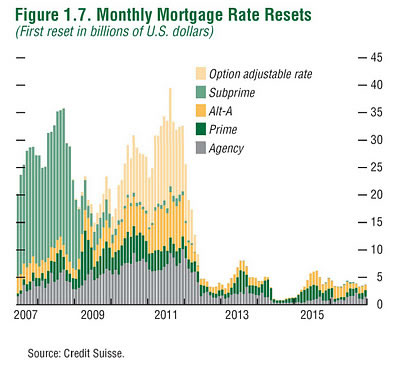

The whole problem is due to the timing for the resetting of the sub-prime mortgage. Most of the resets are due on 2007 onwards. Sub-prime mortgages are for people with low credit score and Alt-A are mortgages for borrowers with better than Sub-prime borrowers credit score. As you can see from the chart below, most of the Sub-prime mortgages are already resetting since 2007 and will go on until 2012. That’s means from now till 2012 there will still be Sub-prime resets and hence foreclosures.

Another thing that needs to be taken into consideration is that those groups belonging to the Option Adjustable Rate, Alt-A and the Prime mortgages have yet to be reset. These groups belong to the higher income group and also higher credit score and they will be the next group of people to be affected by the mortgage crisis. As you can see from the chart, these 3 groups of people will be affected by the mortgage reset beyond 2015 and that means the American mortgage crisis will lasts for many years to come.

Stage Three - The Blow off due to lack of regulatory framework

The seriousness of the current financial crisis is mainly due to the repeal of the Glass-Steagall Act. Due to the lack of the regulatory framework from the authorities at the Securities Exchange Commission and also the extensive lobbying efforts by Wall Street together with politicians the Act is finally repealed in 1999.

The Glass-Steagall Act, passed in 1933 acts to provide a firewall for the banking industry against the contradiction of commercial banks getting involved in investment banking activities such as betting on stocks, indulge in risky investments and other speculations.

After the repeal of the Act, commercial banks are able to underwrite and trade sophisticated derivatives products such as Mortgage Back Securities and Collateralized Debt Obligations. Before the repeal of the Act, Sub-prime only consisted of less than 5% of mortgage loans. However, during its peak in 2008 Sub-prime consist of close to 30% of all mortgage loans.

At the moment most Western nations are debtor nations, with the US being the biggest of all with close to US $ 15 trillion in debts. Debtor nations had no choice but to find ways to cover its interest payments and also the money to run its daily affair in its government machinery. They will have to raise funds either through printing money or issue bonds in the international markets. The real cause of the 2008 crisis is actually the black hole of finance namely the derivatives market valued at more than US$ 600 trillion (its about 20 times the world’s stock market). It is so serious that even Alan Greenspan during an interview in 1999 admitted that any attempt to reign in the derivatives market will result in an implosion in the market. Even Warren Buffet called it ‘Financial Weapons of Mass Destruction’.

Derivates are non productive financial tools and it is just an IOU and the prospectus for a typical CDO will run more than 60 pages. Most fund managers have problem understanding some of these toxic CDO. It is nothing more than lumping student loans, some crap mortgages and car loans and had some rating agencies assigning a AAA rating into the CDO and voila we have an investment grade asset. Then comes the Wall Street investment banker who will price the crap at whatever price they like and sell them to whoever that are interested. It may be investors in Greece, Singapore, Hong Kong and etc and they will also charge transaction and processing fees along the process. That is why the derivatives market is so lucrative because you are making money out of nothing.

Current Solutions Available

Currently there are two schools of thought that are available to deal with our international monetary system. One is the Keynesian and the other is the Austrian School of Economics.

Keynesian Approach

Keynesian theory mainly deals with the macroeconomic expansionary monetary and fiscal policies which they believe that somehow by ever increasing its spending through monetary and fiscal policies, it will be able to ‘spend its way out’. They also believed that when economies slow down or facing a crisis, government should step in to increase the level of economic activity that is absence from the private sector. Any further signs of downturn will be met by increase spending and which eventually leads to bubbles and inflation as a consequence. Another way for the government to combat the slowdown in the economy is by increasing the money supply in the economy. This can be done by reducing the interest rate.

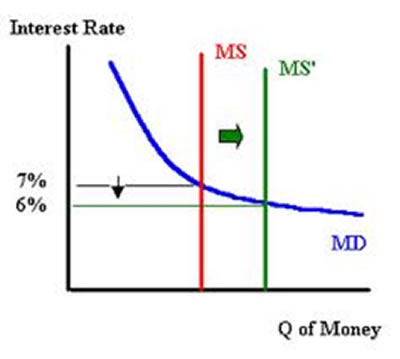

It can be describe with the above chart, where it shows how the money supply (MS) can be increase by lowering the interest rate and hence shift the MS curve to the right. A relatively new measure that has been used to increase the money supply in the economy is by printing more of it or Quantitative Easing so it called. To describe how Quantitative Easing causes inflation we shall use the following example.

To address how inflation is eroding your purchasing power, for simplicity, say we are in closed economy that produces only 1000kgs of rice and the total money supply is $10,000. So the average cost of a kg of rice is $10,000/1000 = $10.

If the government decided to print another $10,000 and pump it into the economy then the total money supply will go up to $20,000.

The average cost of a kg of rice will then increase to $20,000/1000 = $20 with the output being constant. In other words the cost of a kg of rice doubled. The original $10 will now only but half a kg of rice or in other words the value of the dollar has eroded 50%.

However the Keynesian approach through expansion of credit and public spending on infrastructures will result in what term as ‘Short Term Gain but Long Term Pain’. It will only alleviate the credit crunch problem for a while because it might stir some economic activity along the way due to the multiplier effect. However the crux of the problem will not be solved because by adding more money into an economy that is already being oversupply of money will not solve its problem as demonstrate by the above example and will only leads to an inflationary effect on the economy.

Austrian Approach

The Austrian approach disagrees with government intervention in the monetary system.

They believe that weak and troubled banks and corporations should be allow to fail due to excessive risk taking instead of given bailouts because this will encourage repeated offence in the future.

If they know that if the government will always step in to bail them out, they will engage in higher risk undertakings such as bigger bets and higher risk ventures. This eventually will set a precedence and send the wrong message and creates moral hazards which means any wrongdoings will eventually be rewarded. This is exactly what is happening to our financial systems all around the world. Too big to fail banks and financial institutions are rewarding their people with hefty bonuses, hefty pay rise, massive golden parachute and handshake compensations even though the companies are incurring massive losses. At the same time they are unloading all the debts to the public while keeping the profits.

Joseph Schumpeter, from the Austrian school , in his “Creative Destruction” describes the process how companies that are dynamic and innovative will survive while older companies that resisted changes will lose out and eventually shuttered. Creative destruction promotes survival of the fittest and due to the social cost associated with it like jobs lost and shuttered business it has never been popular.

Companies will always resist change and this will only hamper their incentive to innovate, produce new products or invent new production methods. End result will be inefficiency and cost overruns which eventually lead to closing down of business. Companies fall into this category include Polaroid, Kodak and Xerox where once they dominated their industries. Companies that reinvent and prosper includes Intel, Microsoft, Gillette and many more that not only survived but thrived in their respective sectors.

Schumpeter also viewed that economies need to go through periods of boom and bust so that in the process ineffective and old companies be allowed to fail so that new and more dynamic companies will take over and hence begins a new cycle of growth. It is a belief in survival of the fittest, rather than creation of “too big to fail” banks and companies which needed constant bailouts to stay afloat even though they are insolvent as what is happening now.

The Austrian School employs a different approach which is more conservative but its policy will result in ‘Short Term Pain and Long Term Gain’.

Why current Quantitative Easing and Pump Priming won’t work

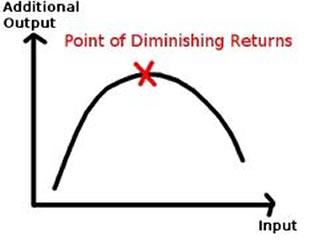

The following two examples illustrate the effects of the Law of Diminishing Returns on two different economies with different scenarios. One which is broke and embark on an expansionary monetary policy through Quantitative Easing to print its way out. The other is loaded with cash and tried to Pump Prime its way out through expansionary fiscal policy. It can be best describe with the following chart.

The following conversation illustrates why Quantitative Easing will not work.

Obama May I know what the hell is happening down in Wall Street? Those guys from OWS (Occupy Wall Street) are protesting day in and day out. Where is Hilda Solis (U.S Secretary of Labor) anyway? Isn’t she supposed to sort out this unemployment issue?

Geithner Oh, Mr President, Hilda is down in Mexico meeting up with some government officials discussing the issues on illegal Mexican immigrant working in restaurants and construction sites all over America. They are taking all the jobs away from the locals and it’s killing us.

Regarding the OWS, it’s just a minor issue, they are protesting because they said that the fat cats in Wall Street are getting hefty bonuses, pay rise and golden parachute compensations, while they are getting the crumbs. And they are also complaining about high cost of living, unemployment and wages just can’t catch up with spiraling prices of almost everything.

Obama Didn’t we already sorted it out during the previous two QEs? I mean where have those money gone to? Not to the populace?

Geithner Oh yes, but those Wall Street boys reckoned that they needed some extra cash to run their business and also to touch up their bank’s balance sheets and end of year staff parties. So we gave them the lion’s share of the money. Anyway they are now a happy lot, and promised to double up their contribution to our fund raising campaign.

Obama Goodness! At least have a piece of good news. Anyway, our reputation as the world’s largest capitalist and democratic country is at stake. I want this OWS issue to be sort out immediately because I don’t want this Arab Spring thingy coming to America.

Call up Ted Turner, Rupert Murdoch and rest of the boys and tell them not to create too much awareness on this OWS thingy. Where Ben anyway?

Geithner He is now in the printing plant doing his rounds and according to him the stocks of the fresh FRNs (Federal Reserve Note) are getting low and they are behind schedules.

Obama Call Ben and tell him to gather whatever FRNs they have in the plant and load it into the FED’s choppers and start dropping it into Main Street and not Wall Street this time round. I hope we can tame those OWS guys until after our election next year, ok.

Also tell him to double up the plant capacity and hire more workers and make sure it runs 24/7/365 non stop and I will deal with Congress on this. Move now or else we will be out of job soon before the next election. I don’t want to be in the unemployment statistics. Don’t you?

Geithner Of course not , Mr President. I will get those choppers organize straight away.

Meanwhile on the other side of the Pacific, China is facing another issue of having too much money and trying to build its way out of the crisis.

Hu Jintao Wen, what’s the problem out there? People are protesting everywhere and I heard there is this woman self immolates?

Wen Jiabao Yes, the woman self immolates because of the ravaging effects of inflation that is making life tough. People are protesting outside the developers offices because they have just lost 30% of the value in properties they bought a few months ago. They blame it on the developers for reducing the prices of unsold units by 30-40% recently. The peasants are protesting in the countryside because of the high unemployment rate and prices of essential goods are shooting through the roof.

Hu Jintao Why can’t we solve the damn problem by building more stuff like hospital, roads, bridges, schools and anything that has to do with infrastructure so that more people get to work and also to maintain the property prices?

Wen Jiaboa But Mr President we have already overbuilt ! We have 64 million unoccupied apartments, the world’s largest shopping mall The South China shopping mall which is unused, countless empty office buildings from Shenzhen right up to Zhejiang plus a completely empty city called ORDOS in Inner Mongolia.

Hu Jintao Well, just use your imagination, remember we just completed the Lhasa Express railway line? Why not extend it from there and go straight down to Singapore. We will finance the project with Yuan denominated loans and in turn barter trade with them for whatever products they have. Grains from Nepal, Jute from Bangladesh, Minerals from Burma, rice from Laos, cement from Vietnam, rubber from Thailand, palm oil from Malaysia and high tech products from Singapore.

Wen Jiaboa Wow ! What an excellent idea, the Americans have their debt/equity, interest rate and currency swaps and now in China we have created this debt/commodity swap which will certainly complement our line of exotic Yuan based treasury products. We might as well throw in our Yuan based currency forward contracts and call options so that we are not in for any currency shocks or ‘ping-pong effect’ when our Yuan becomes fully convertible and tradable in international markets.

We can kill four birds with one stone. Firstly, we can internationalize the use of the Yuan which helps it to be the next world reserve currency to replace the US dollars.

Secondly we are getting all those much needed raw materials and food from those countries at a song.

Thirdly, we will employ all the laborers with our own kind preferably the peasants so that they will stop protesting.

And lastly, we will write Yuan denominated Call Options. Voila ! with Yuan Call Options we will have limited downside and unlimited upside potential. Mr President, you are brilliant.

Hu Jintao On top of that remember our remote outpost in Sin kiang bordering Kazakhstan ? Why not we built another railway line that connects Sin Kiang to all the CIS countries and all the way to Eastern Europe. It will be a new frontier for us. Since the Russian have the Trans Siberia Railway, it’s about time we have our own Trans Europe Railway, right? We will do the same as in South East Asia and barter trade their oil and gas products.

Wen Jiabao But Mr President, the Sin Kiang to Europe route is very treacherous and it will pass through some areas that are no man’s land. Can’t you see it’s a waste of effort, time and resources?

Hu Jintao Oh no, we give work to our unemployed peasants and this will also help us to achieve full employment. We are going to show the world how great Red China’s centrally planned economy is. By gaining full employment and setting a new plateau in the economic growth every year, our economic model will be the envy of the West. Long live Red China !!

The Laws of Diminishing Returns

As you can see, America on one side is broke trying to print its way out of the mess. The laws of diminishing returns apply because there is only so much you can print. Any further Quantitative Easing will only result in hyperinflationary effects and misallocation of limited resources and will only bring negative effects to the economy.

As for China, which is loaded with cash, is trying to spend its way out of this mess. Again, the laws of diminishing returns apply because you can only build so much in order to reap the maximum positive economic effects. Any further expansionary fiscal policy by building more roads to nowhere, empty cities and high rise buildings will have no extra effects on the economy. By throwing good money after bad investments will only result in inflating the prices of goods and services because there is too much money chasing after too few goods.

A real life example is the recent announcement by the state government of Penang which lies in Northern Malaysia. There is already a 13.5km bridge and a ferry service linking island state to Mainland Malaysia. The second link which cost RM 3 billion is already on the way and is expected to be completed by Nov 2013. Even before the completion of the second link, the state government last week announcement the third link which is a 6.5km underground tunnel with an estimated cost of RM 5 billion - RM 8 billion.

So, how the laws of diminishing returns work its way through in this case? Of course, the first link will have the best effect because it will ease congestion, move more people and goods in and out of island and hence provide a plus for boosting economic activities. When the second link is completed no doubt it will help clear up the traffic congestion , lower traveling time and cost but the effect won’t be as great as the first because there is only so much traffic to clear and traveling time to cut.

In the new few years when the third link starts operation it will not be able to create that much extra economic activity to justify the cost of building the underground tunnel. Hence the more bridge they build the less return they will be reaping from their investments.

The current situation

The market is now waiting for a catalyst for it to blow off. The source where the crisis begins normally started in places where it is least expected. During the 1998 Asian Financial Crisis, it is not started in financial centers like Tokyo, Shanghai or Hong Kong but little known Bangkok. Due to the devaluation of the baht, the crisis cascade through several Asian countries including Malaysia, Indonesia and South Korea.

Similarly, the current financial crisis that is ravaging the Western Economies did not start from the financial centers of London, New York or Frankfurt but in Athens, Greece. It’s a bit of an irony that Democracy started in Greece and ended there as well.

So what and when will be the next catalyst going to lit the fuse of the financial time bomb in America? Seriously we don’t know, all we can do is make sure we are prepared for whatever that is coming. Just to give you a simulation of events to expect and how it will manifest itself when the systemic crisis hits America. Consider the following :

Say, we are now in June 16th 2012, and the time is 17:45 and ECB (European Central Bank) has decided to devalue the euro by 30% and is now trading below parity of the US dollar. What do you expect to happen next? The following chronological of events may best describe will be in store for you.

18:00 You are packing up your office and ready to hit home. Promised to be early home for dinner.

18:30 You get into the car and start driving home. On the way you notice there is a huge traffic jam ahead. So you decided to take a longer route through one of the suburbs.

19:00 Gas running low on car so decided to lookout for a gas station nearby. Found one but the queue is too long probably about 100 cars in front. Maybe another station down the road has stock out. Anyway decided to go Wall-mart to get some groceries.

19:30 Reach Wall-Mart but cars are jammed up till the front gate, no way to get in so might just head home for dinner.

19:45 Pass by a few banks but seems strange because the queue is very long. Up to 30 people on the queue. What is happening?

20:00 Reached home and straight head for the shower. Came out from shower and have dinner. Still haven’t got a clue of what is happening.

20:15 After dinner decided to switch on the television to check out today’s headlines. Headlines are just unbelievable,

EUROPEAN MARKETS TUMBLE

EURO DEVALUED 25%, BELOW US DOLLAR PARITY, EUR/USD = 0.78

FTSE -450pts, CAC 40 -278pts, DAX – 435, ATX -207pts, BEL-20 – 197pts

BANK RUN ACROSS EUROPE

MASS LOOTING AND PUBLIC DISORDER

GOLD UP BY $300 TO $3980

20:30 You feel panic and decided to switch on the PC to check on the internet. But the speed is just excruciatingly slow and it took ages to load a page.

21:00 Nation being address by Obama on TV live while Geithner calling for calm and assured investor that everything is alright and should be back to normal in a next few days.

21:30 Janet Napolitano, Secretary of Homeland Security declared all major US cities will observe curfew from 7 pm to 6 am starting from NOW. All citizens are advised to stay at home if possible and try not to get out of the house.

22:00 Breaking News, US Secretary of Treasury, Timothy Geithner declare Bank Holidays for 5 days starting from tomorrow. DOW JONES and NASDAQ lost 10% and circuit breaker activated.

When you turn on to CNBC, Jim Rogers seen to be reporting, ‘This is what the financial crisis looks like when the dollar collapse, and if you are not prepared, you will be wiped out’. About the same time, another news anchor reporting about empty shelves in supermarkets and ATM machines. This is total PANIC.

22:15 CNN is seen busy reporting fund managers and bankers jumping out of high rise and the Chairman of a large broking firm committed suicide due to the massive losses incurred to the company.

While on Bloomberg, news anchor reporting on empty supermarket shelves and gas stations, ATMs out of cash and looters and mobs are everywhere.

At the same time, someone twittered saying that police are putting up road blocks all over the place.

In the next morning, Asian Markets open and you will see the same headlines Tokyo -900pts, Hang Seng – 2000pts, Singapore – 210pts, Shanghai – 300pts. Meanwhile the US dollar is plunging by more than 20% in Asia, USD/SIN = 1.20, USD/AUD = 0.67, USD/MYR = 2.50, USD/HKD = 5.12, USD/YEN = 52.35.

Total panic is gripping Asia and financial markets are in total chaos, buyers nowhere to be found. Stocks limit down 30% and everyone is rushing out. Similar to America, total chaos is the order of the day, leaders are out to calm markets.

This is the type of scenario you will be seeing should there be a Global Systemic Meltdown. What happens this time round is we are not talking about a single country going down but simultaneously the whole world is going down due to the interconnectivity of the Global Financial Markets.

This is actually what is happening all around the world. Clueless, being in a sense of Denial and total chaos is the order of the day. Like the current coordinated efforts of the world central banks to provide liquidity to support the global financial system is just a stop gap measure. It will not solve the core of the problem but merely provide more time for them to think of other solutions.

As for now the train has already left the station, the best that can be done by the governments of the world is to manage the train so that it will create less havoc in its collision course or a ‘softer landing’ so as to say. I believe a solution can be found by implementing proper policies involving both Keynesian and Austrian School of economics approach.

Since the Keynesian approach produce ‘Short Term Gain and Long Term Pain’ while the Austrian School will result in ‘Short Term Pain and Long Term Gain’, a mixture of policies like providing bailout ‘with a price’ policies will certainly help. Or the coup de grace will be the return to some sort of partly gold backed economic system.

Professor Antal E. Fekete , one of the modern day authority in Austrian Economics, explained that fiat money is “Money that is not back by, or convertible to, any specific commodity and whose only value is that determine by the government” . He further reiterated that every fiat money system that have been tried and used in history is littered with failure.

How to prepare for survival

As you can see, there is no time for you to prepare. The sequence of events unfolding just overwhelms you. It is faster than the Japanese Tsunami, at least they have a few hours to prepare and get out of the situation. When a systemic financial crisis strikes, you are in for some serious trouble if you are not prepared.

How are you going to buy food, gas, water, get some cash from the ATM when everything is empty. There is no way you can get out from your house when curfew is declared and how about the mobs, rioters and looters that are roaming the streets. How about some firearms to protect your family? Have you stock up enough dry foods and water for the next 1-2 months? Have you got cash in hand because you can’t buy your necessity with gold bars and coins.

So the next question is, how are you going to prepare for the coming crisis? What you need to do?

We provide the following guidelines for you to follow so that even though the crisis may strike tomorrow, next week, next month or next year you will be prepared.

Things you should do

The following are the things you should do to survive the coming crisis.

First, you need to have at least three months income stashed away for hard times. Should there be any bank holidays then the cash should last you at least two to three months. Preferably the cash is stash somewhere in the house which is within reach and not in the bank. You need it in a short notice to get the things you may need.

Second, you need to do is store up at least a months supply of dry food. Preferably grains, rice, canned food and some other things that had a long shelf life. Also make sure you have adequate water supply equivalent to 2 months supply. Add to this cache an excellent quality first aid kit with a physician desk reference and a three month supply of any and all medications you need. Add a ninety day supply of multivitamins for each of your family members as well.

Third, I think a lot of people are going to against this. It is better to buy a small weapon like machete or knife and put it in a safe place. You will never know when you will need it and learn how to use them to protect you and your family if things get really bad.

Fourth, try to raise as much cash as possible by getting rid of unnecessary things like piece of art, antique or things that you don’t use too often. Try to refinance the home and credit card payments if lower interest rate is available.

Fifth, repeat this process with your credit cards and other lines of credit.

Sixth, make sure your investments are not based in currency instruments or paper. Switch them over to durable investments like gold, silver, wood, water, oil, food crops, etc. These have real value. Right now there is no real way to tell if any of the paper instruments have any value what so ever.

Seven, if you have problem keeping track on your money and investments, then there is one product for you (only for US readers).Use www.mint.com , it is a computer software where you can see all your balances and transactions together whether on your PC or Phone. It is connected with most US financial institution that provides internet banking. With mint you are able to see where your money is going, how is your investments doing and also where you can save money. It is very easy to use and only takes minutes to setup and the best thing is you don’t need to know anything about Book Keeping. Best of all it is FREE because the banks are paying them for introducing new customers.

Eight, if possible try to allocate about 20-30% of your portfolio into liquid investments like term deposits, short term bonds and treasuries. When the economy dives, anything can happen. Real estate, stocks and other investments can be bought by the penny to the dollar. That is the time where ‘Cash is king’, with liquid investments that is easily convertible to cash, you will be able to take advantage of opportunities that comes along. This will be once in a lifetime opportunity as real estate can be bought at below $10,000 and blue chips will be selling at 75% or more discount from current prices. To maximize your return on your investments it is best to have an asset allocation strategy.

How to prosper with Asset Allocation

The cornerstone of risk management is diversification. In the investment world there is this word call Asset Allocation. Asset allocation refers to a planning tool to allow an investor to structure his/her portfolio to achieve the goals that has been planned such as Income and Capital Growth models in the long run.

A portfolio may consist of multiple asset class of investment products such as stocks, bonds, land, building, term deposits, precious metals and etc.

If it is managed properly using the Working Capital model, its return will be able to beat the rate of inflation. The Working Capital model works best with dividend paying investment products such as Blue Chips stocks, high yield foreign currency accounts and

equities investments.

The amount of asset allocated on each type of investments depends on the risk appetite of individual investors. A younger investor may want a more aggressive investment portfolio and hence the allocation may be 75% equities and 25% income generating investment products.

A retiree or someone whose age is almost reaching retirement may opt for a portfolio that is less aggressive. Hence, the investor may opt for a 80% income generating and 20% equities portfolio. A middle age investor may opt for a ‘balance portfolio’ which consists of 50% equities and 50% income generating assets.

The Working Capital model is designed on the basis that the portfolio will be held intact even though the market goes through boom and bust until the goal of the investor is met. Hence, daily gyrations in the stock market has to be avoided. Additional investments either accrued through dividends or deposits will be reinvested evenly base on the percentage of equities and income generating assets.

by Sam Chee Kong

cheekongsam@yahoo.com

Investment Banking with experience in Capital Raising, Hedging and Risk Management.

B.Econs, Flinders University, Adelaide, South Australia

Post Graduate Diploma in Treasury Management, Treasury Management School of New Zealand

Specialize in Derivatives like debt/equity swaps, bonds, options, forwards contracts, interest rate swaps

© 2011 Copyright Sam Chee Kong - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.