Gold For Bonds in Japan as Bond Buyers Get Gold Coins

Commodities / Gold and Silver 2011 Dec 06, 2011 - 07:27 AM GMTBy: GoldCore

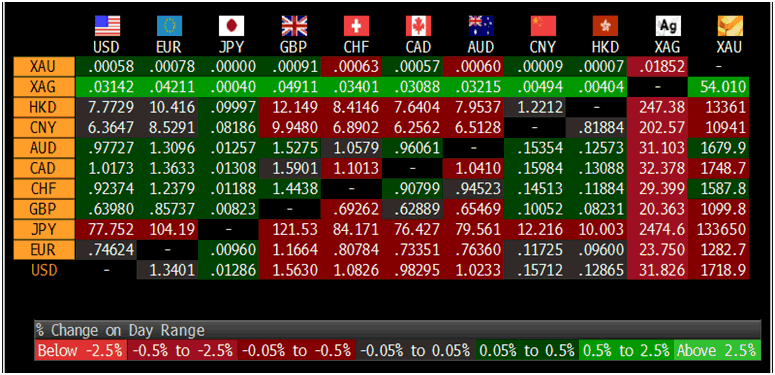

Gold is trading at USD 1,718.90, EUR 1,282.70, GBP 1,099.30, CHF 1,587.50, JPY 133,650 and AUD 1,679.40 per ounce.

Gold is trading at USD 1,718.90, EUR 1,282.70, GBP 1,099.30, CHF 1,587.50, JPY 133,650 and AUD 1,679.40 per ounce.

Gold’s London AM fix this morning was USD 1,720.00, GBP 1,098.76, and EUR 1,284.54 per ounce.

Yesterday's AM fix was USD 1,744, GBP 1,114.88, and EUR 1,296.08 per ounce.

Cross Currency Rates

Gold is marginally lower in most currencies (except the CHF and AUD) extending the 1.4% fall seen yesterday.

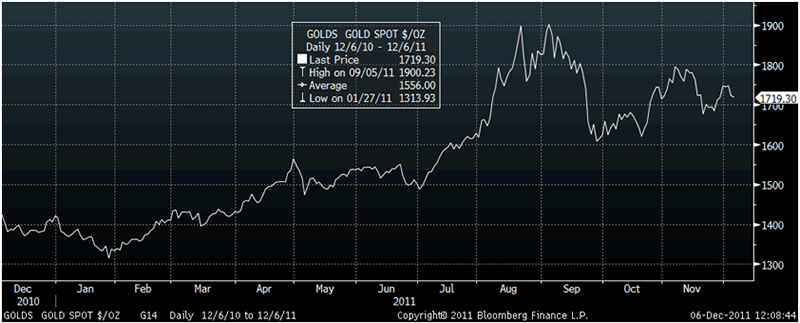

Gold traded below the 100 day moving average at $1,726.33, which it broke below yesterday and will need to rise above the 100 DMA in order to resolve the short term technical damage done.

Gold’s continuing failure to make strong gains given the heightened monetary and systemic risk continues to surprise many in the market. It may be due to further profit taking after last week’s 4% gain, 2011 year end book keeping and booking profits after a 20% gain and increased risk appetite in the wider markets.

Continuing fears about Europe's debt crisis and Standard & Poor's warning that it could downgrade euro zone nations are supporting gold at these levels as it appears to again be consolidating.

The rating agency's warning it may downgrade 15 countries, including Germany and France, came hard on the heels of a Franco-German initiative to enforce budget discipline across the 17-member zone through EU treaty changes.

Market participants may remain tentative ahead of the EU summit in Brussels on Friday where there will be attempts to create further fiscal integration. Failure at the summit could lead to a sharp increase in volatility and which should be supportive of gold and would again be supportive of gold in the medium and long term.

The likelihood of further downgrades of hitherto risk free government debt, including France and even Germany, is bullish for gold. Gold cannot be downgraded or debased by politicians or central banks.

Indeed, the sort of economic and political mismanagement we see today is what gold thrives on and should lead to further gains in 2012.

Gold is a safe haven and a hedge against political, financial & economic mismanagement and stupidity.

While the western public does not realize this - most major banks, bullion, commodity and foreign exchange analysts do.

Yesterday we reported how gold in euros was one of the 2012 top trades of Bank of America. Today, Deutsche Bank said in a report that their conviction trade is long precious metals and especially gold.

Negative real interest rates and a high U.S. equity risk premium will drive demand for gold they say.

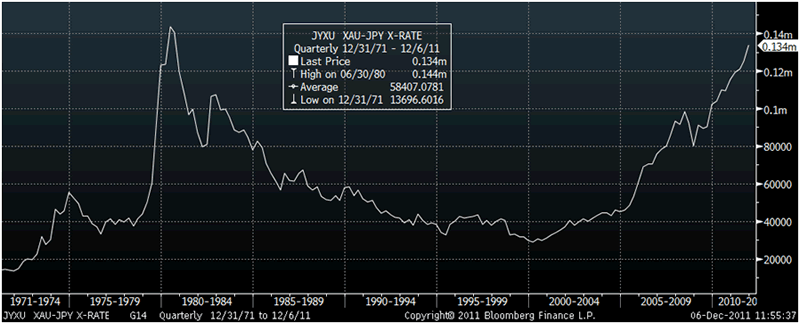

Gold in Japanese Yen – 1970-2011 (Nominal Yen, Not Adjusted for Inflation)

The government and the department of finance of Japan also understands the value of gold.

Japan will reward investors who buy reconstruction bonds with half an ounce of gold, an added incentive that could boost the return by nearly six times according to Japanese Finance Minister Jun Azumi.

Individual investors who purchase more than 10 million yen ($129,000) in debt with a 0.05 percent return and keep it for three years will receive a gold commemorative coin weighing 15.6 grams (0.55 ounces), the Finance Ministry said in Tokyo today, worth about $948 based on current prices for the precious metal.

The offer suggests the return could be boosted to 89,000 yen should gold prices remain at current levels, more than the approximate 15,000 yen one would receive from the bond.

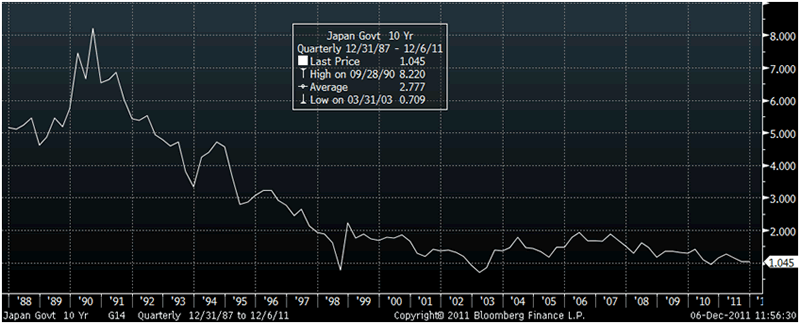

The coupon on conventional three-year retail government debt to be sold on Jan. 16 is 0.18 percent. 10 year debt remains near multi record lows of 1%.

Silver coins weighing 31.1 grams issued as 1,000 yen currency will be distributed to those who own more than 1 million yen of the bonds, the government said. The coins will be offered for debt going on sale in March.

All investors receive a thank-you note from the minister, who showed his to reporters in Tokyo today as proof of his purchase.

Chief Cabinet Secretary Osamu Fujimura also bought the bonds, Azumi said, without saying how much.

This is a sign that the Japanese government like governments internationally is very concerned that they will not be able to sell their government debt.

This is especially the case given that they are engaged in monetary easing, foreign exchange intervention and currency debasement.

It looks like a desperate attempt to bolster demand for their debt which is understandable given the poor state of Japan’s finances and the recent IMF warning that Japan’s debt could “quickly become unsustainable”.

Will a spoonful of gold and silver help the prodigious amount of debt medicine go down?

SILVER

Silver is trading at $31.84/oz, €23.76/oz and £20.37/oz

PLATINUM GROUP METALS

Platinum is trading at $1,509.75/oz, palladium at $639.75/oz and rhodium at $1,500/oz.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.