Quantitative Easing by the European Central Bank - A Matter of Time?

Interest-Rates / Quantitative Easing Dec 06, 2011 - 02:44 AM GMTBy: Asha_Bangalore

German Chancellor Merkel and French President Sarkozy announced a “comprehensive” agreement today pertaining to new rules to enforce fiscal discipline among members of the eurozone. Essentially, elements of the Maastricht economic criteria (3.0% budget deficit and 60% debt-to-GDP ratio) that had to be met in order to belong to the Euro Club are being enforced once again under new guidelines. An active audit committee to monitor national budgets to prevent profligacy is not part of the agreement, instead member states will be responsible and each will have to enshrine debt limits in their constitution. The European Court of Justice will have the authority to rule if members are not compliant and sanctions will be put in place by a vote of the European Council if members do not meet the fiscal thresholds. Giving new life to old rules, is that a big step?

German Chancellor Merkel and French President Sarkozy announced a “comprehensive” agreement today pertaining to new rules to enforce fiscal discipline among members of the eurozone. Essentially, elements of the Maastricht economic criteria (3.0% budget deficit and 60% debt-to-GDP ratio) that had to be met in order to belong to the Euro Club are being enforced once again under new guidelines. An active audit committee to monitor national budgets to prevent profligacy is not part of the agreement, instead member states will be responsible and each will have to enshrine debt limits in their constitution. The European Court of Justice will have the authority to rule if members are not compliant and sanctions will be put in place by a vote of the European Council if members do not meet the fiscal thresholds. Giving new life to old rules, is that a big step?

Are these new rules precisely what President Mario Draghi of European Central Bank alluded to last week? President Draghi mentioned that a “fiscal compact” could make way for aggressive European Central Bank (ECB) action. In particular, he noted that agreement holding governments to strong rules on public finances “would be the most important element to start restoring credibility with financial markets.” A skeptic would wonder if the Maastricht criteria have been violated and not been successful, what is different this time around. In any case, the EU Summit of December 8-9 supposedly should result in more concrete steps to address the sovereign debt crisis.

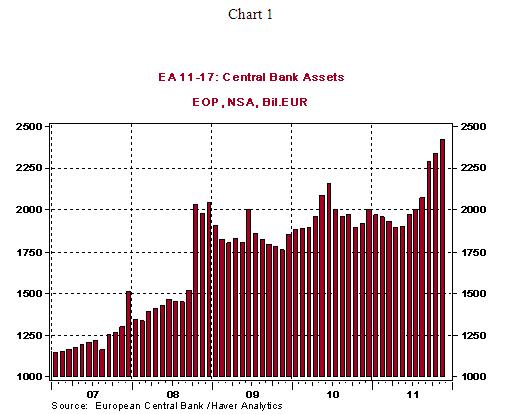

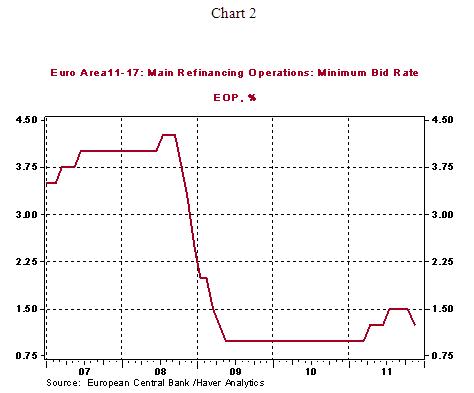

In the meanwhile, economic data from the eurozone, particularly the factory survey shows that the Purchasing Managers’ Index fell below 50.0 once again in November. It is nearly certain the region is likely to experience a recession in the quarters ahead. Persistent financial market strains led to the joint action of central banks on November 30 for dollar funding. The outcome from the Bank of England and ECB meetings of this week should offer additional guidance. The ECB lowered its policy rate at the November meeting and markets are expecting additional monetary policy easing. The current policy rate at 1.25% allows for more time before the ECB engages in quantitative easing (QE). The ECB has purchased Spanish, Italian, Greek, Irish, and Portuguese government debt in the second market under the Securities Markets Program in recent months. The balance sheet of the ECB has risen despite its abhorrence of quantitative easing.

Weakening economic conditions call for additional policy support to prevent a severe decline in business activity. Will the new fiscal rules initiative announced today be adequate for the ECB to engage in quantitative easing? This is a question that will be answered after the ECB has lowered the main policy rate to the near zero level from the current level of 1.25%.

In addition to weak economic conditions, the beleaguered banking system of the eurozone needs to be fixed. A good question to mull over is the possibility of a TARP style program which was the road Henry Paulson, Treasury Secretary of US, took in 2008 to recapitalize banks. However, the complexities of the region suggest that the ingredients (speed and flexibility) of a successful program may not be available and creativity in implementing such a program will be necessary. The main point is that the eurozone needs policy support to pull the region away from an economic precipice. Therefore, quantitative easing, TARP, or something different will emerge soon.

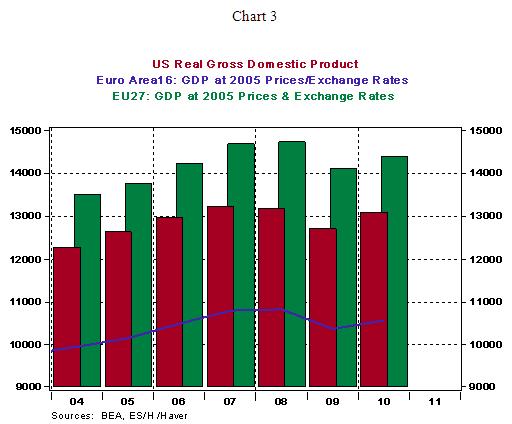

If EU policymakers fail to cement together a feasible plan in the next few days, the economic future of the region and the world stands to be affected severely. The EU-27 is the largest economic bloc in the global economy. The direct and indirect impact of the protracted economic crisis in the region will be significantly negative on the U.S. economy just when it has shown compelling signs of improving conditions in the past month. But then, that is an alternate adverse scenario we all have in mind.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.