Europe Entering a Decade Long Recession

Economics / Great Depression II Dec 06, 2011 - 01:52 AM GMTBy: Mike_Shedlock

If French president Nicolas Sarkozy gets his wish to "Level the Playing Field" on sovereign bonds, a decade-long European recession is on its way.

If French president Nicolas Sarkozy gets his wish to "Level the Playing Field" on sovereign bonds, a decade-long European recession is on its way.

French President Nicolas Sarkozy made it clear in a speech in Toulon last week that he wanted the private sector to be given a more-level playing field when it came to the threat of having to bear losses on their investments.

He said Greece, where there have been drawn-out negotiations between the government and the private sector over how much of a hit banks and insurance companies should take under a debt restructuring, should be a unique case.

"It must be clear that what has been done for Greece, in a very particular context, will not happen again, that no other state in the euro zone will be put into default," he said.

"It must be absolutely clear that in future no saver will lose a cent on the reimbursement of a loan to a euro zone country."

Reflections on the Un-Level Playing Field

What could possibly be more un-level than guaranteeing banks and bondholders will never take losses? When there are more losses, and there will be, the only way to guarantee banks do not take them, is to have someone else take them, namely taxpayers.

While pondering that, take look at the action in Portuguese bonds.

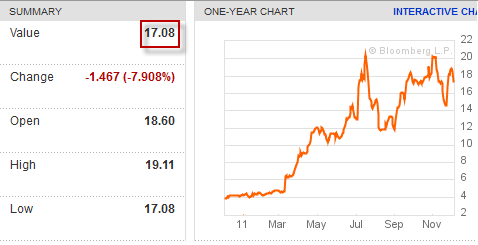

Portugal 10-Year Government Bonds

Portugal 2-Year Government Bonds

Do either of those charts suggest there will be no more losses? If there are, who will pay them?

If Sarkozy gets his wish, taxpayers, not bondholders will pay the price.The same holds true for Ireland, Spain, Belgium, and Italy.

The only true way to level the playing field is to make banks and bondholders who take foolish risks to pay the price for their foolish actions.

Monti's "Save Italy" Package Sure to Cause "Super Recession"

Yesterday I wrote Monti's "Save Italy" Package Sure to Cause "Super Recession"

Super Mario has a five-point plan to "Save Italy".For there to be no more losses, we will need still more austerity measures in France, Spain, Portugal, Italy, Greece, and Germany.

- Raise more than 10 billion euros from a new property tax

- Impose a new tax on luxury items like yachts

- Raise value added tax

- Crack down on tax evasion

- Increase the pension age

The above package was dubbed the "Save Italy" package by Prime Minister Mario Monti. Supposedly it will boost growth.

While I agree pension reform is much needed, there is not a single thing in the package to boost growth. Italy is in recession. Raising taxes in a recession is the last thing you want to do, yet four of Monti's five ideas raise taxes.

This proposal may temporarily placate the bond market, but Italy is headed for one "super recession" if Mario's mix of idiotic tax hikes passes. Instead, Italy needs to cut wasteful government spending and lower taxes.

Spanish unemployment is 22.6%, a 15-year high. Greek unemployment is a record 18.4%. What will more austerity measures do and what will cramming losses on taxpayers do to those rates?

The EU needs to reflect on the consequences of Sarkozy's ludicrous proposal to "un-level" the risks on piss poor lending decisions.

Two Consequences In Order

- Europe will slide into a multi-year recession

- Voters in Greece, Spain, Portugal (likely all) will have had enough

Then .... Eventually, Will Come a Time When ....

Eventually, there will come a time when a populist office-seeker will stand before the voters, hold up a copy of the EU treaty and (correctly) declare all the "bail out" debt foisted on their country to be null and void. That person will be elected.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2011 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.