US Dollar Technical Update

Currencies / US Dollar Dec 05, 2011 - 01:37 AM GMTBy: Tony_Pallotta

In the coming weeks you will hear me discuss the current trade as a "credit event that equity will be forced to acknowledge." It is important to understand what will drive equity prices. The main stream media will make up "excuses" for price action but I believe as always they will be misguided.

In the coming weeks you will hear me discuss the current trade as a "credit event that equity will be forced to acknowledge." It is important to understand what will drive equity prices. The main stream media will make up "excuses" for price action but I believe as always they will be misguided.

The role the currencies will play in this trade is that of the mechanism that connects credit to equity. Many market participants ignore credit but when they see movement in the currencies they will be forced to change their perception. There is simply a shortage of the world's reserve currency combined with investors switching their focus from the return on capital to the return of capital.

The US dollar and US Treasuries will be the "safe haven" trade. This does not mean those two asset classes are sound and secure but in a world of fear and uncertainty the US still remains the place where capital will flow. Simply stated the supply of USD is falling as credit markets freeze up while the demand is rising.

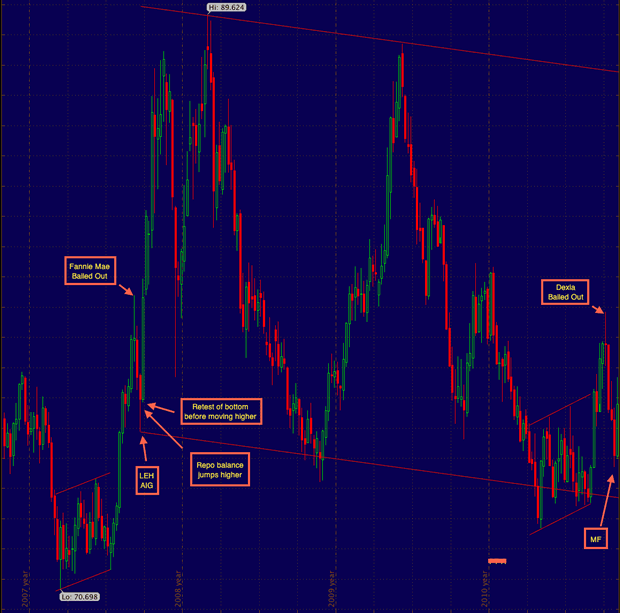

Five Year Weekly Chart

Notice the bear flag that failed to play out in 2008 resulting in an epic move higher in a very short period of time. The same pattern is in play right now. Even the news flow is similar.

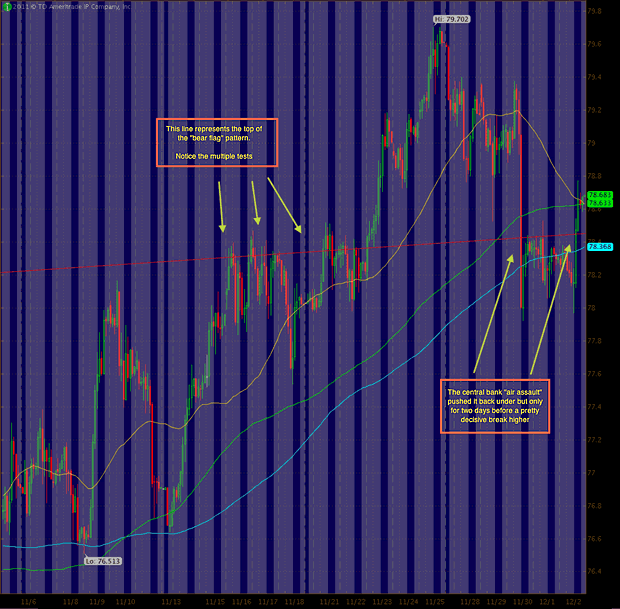

20 Day Intraday Chart

Notice the line that price has fought above and below. This decides which way the bear flag pattern plays out. After a pretty lengthy war which included an "air assault" from the central banks last week it looks like the USD is repeating the same pattern of 2008. Once again it appears this bear flag pattern will in fact break in a bullish fashion.

In other words if this is a war and the central banks unleashed a massive air campaign on the USD the fact that it took back a key level speaks volumes. The thirst is unquenchable.

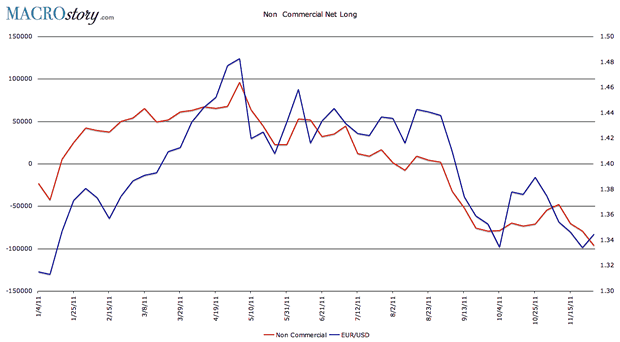

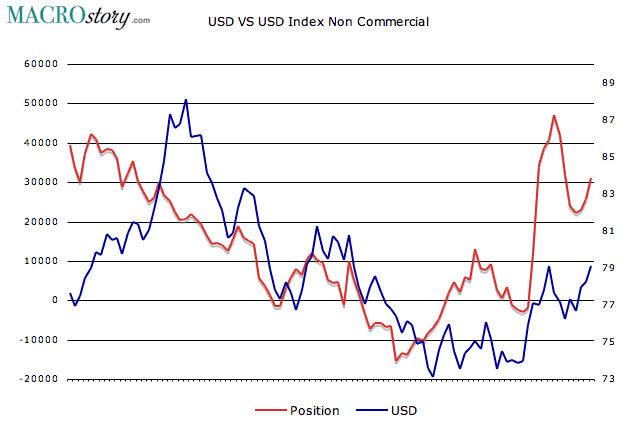

Commitment Of Traders Report

The COT report confirms that probability favors the EUR moving lower and the USD higher based on current positions of non-commercial (large speculators) and previous correlations with such currency pairs.

By Tony Pallotta

Bio: A Boston native, I now live in Denver, Colorado with my wife and two little girls. I trade for a living and primarily focus on options. I love selling theta and vega and taking the other side of a trade. I have a solid technical analysis background but much prefer the macro trade. Being able to combine both skills and an understanding of my "emotional capital" has helped me in my career.

© 2011 Copyright Tony Pallotta - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.