Euro Dollars - The Great Dollar Overhang and Missing M3 Component - Gold and Silver

Currencies / US Dollar Dec 03, 2011 - 03:54 AM GMTBy: Jesse

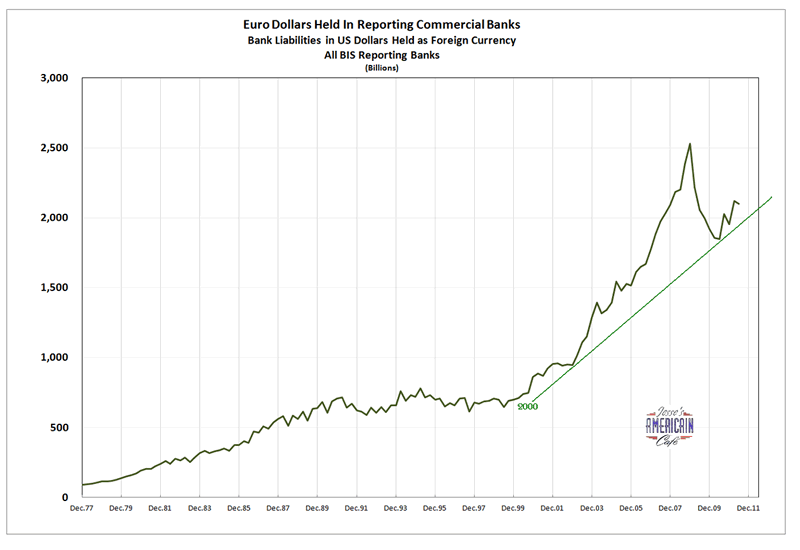

These figures are from the Preliminary BIS Reports of November 2011 which reflect reporting bank positions as of the Jun 2011 quarter. Obviously therefore they do not yet reflect the recent Fed expansion of the swap lines for dollars. The first chart represents the total dollars held by banks as 'foreign currency.'

These figures are from the Preliminary BIS Reports of November 2011 which reflect reporting bank positions as of the Jun 2011 quarter. Obviously therefore they do not yet reflect the recent Fed expansion of the swap lines for dollars. The first chart represents the total dollars held by banks as 'foreign currency.'

As you will recall, a 'euro dollar' is any US dollar being held overseas, in currency or in electronic digits, whether in Europe or Asia. I should add that a certain amount of physical dollars in private hands overseas are held outside the official banking system, particularly in the illicit substances and materials sector.

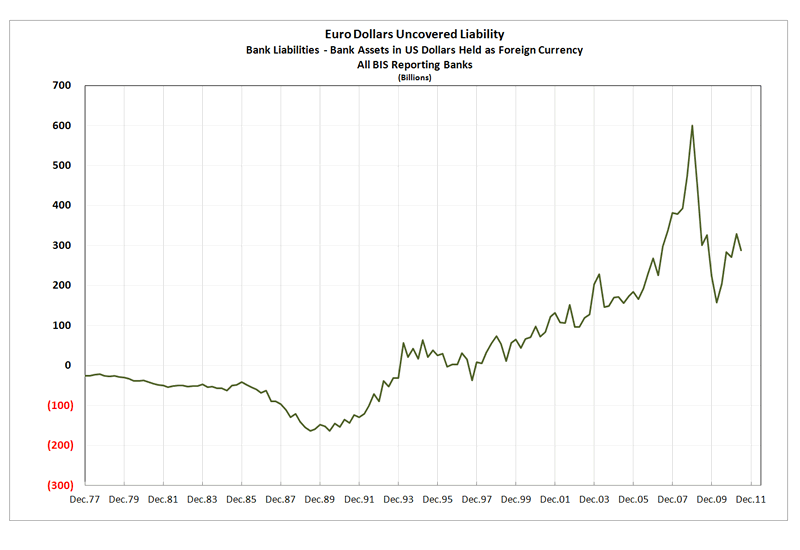

The 'Euro Dollar Gap' Chart which is the second chart reflects the difference between the reporting banks Liabilities and Assets in foreign held dollars. This gap can cause a Eurodollar short squeeze such as we had seen in 2008, and to a lesser extent in 2010. We are also in a eurodollar short squeeze now, as exemplified by the recent Central Bank effort to make more dollar swaps available to Europe. The BIS figures have obviously not yet caught up with this yet, but they will in time.

As discussed previously, one of the reasons that European Banks require Dollars is because customers were demanding the return of their dollar deposited financial instruments while the Banks dollar assets had markedly decreased in value because of bad investments in Dollar denominated Collateralized Debt Obligations.

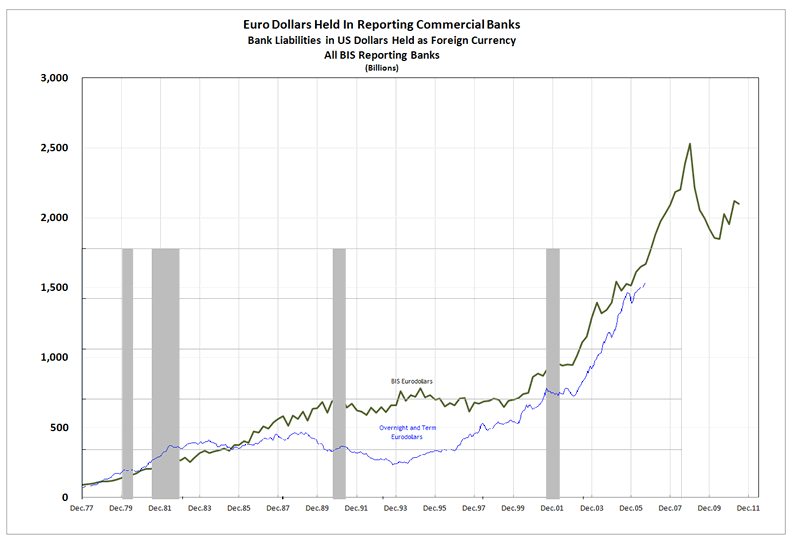

In the third chart I compare the Fed's Eurodollar figures in the series that was discontinued in the beginning of 2006. Although the lines are relatively similar, it should be noted that the magnitudes of the numbers just do not match, with the BIS reporting significantly higher numbers even though the relative changes in the lines are similar. I do not know, for example, if the Fed was including Central Bank Reserves or not.

But I think one takeaway is that the amount of Eurodollars are significantly higher now than they have ever been as a result of the growth of the dollar bubble in US financialization of debt, much of which had been purchased by European banks.

The gap between Dollar Assets and Liabilities creates short term demand spikes, as we have just recently seen in the actions by the Fed and a few other Central Banks to make more US dollars available in swaps.

There is another set of BIS reports I am examining that render higher figures with current Eurodollars in the neighborhood of 3.2 Trillion. I am trying to figure out what these amounts include that the other measurements do not. In the interim I am using the lower of the two.

The bigger picture is that this enormous growth in Eurodollars is a result of the US financialization, more colloquially known as 'The Credit Bubble' and the US ownership of what is still the world's reserve currency.

I have some queries into BIS to understand if these figures include official reserves held by Central Banks. I do not think they do.

However, IF the dollar is supplanted by something else, or some combinations of things, as the world's reserve currency, there are obviously going to be an excess of US dollars looking for some place to go from their current havens overseas. And it is mostly likely that they will come home to roost.

I am sure that the Fed has a plan to sterilize this expansion in dollars available for domestic use. Whether that plan can work is another matter altogether. I do not believe that there is any precedent for it.

But one thing that is clear to me is that since 2002 'we aren't in Kansas anymore, Toto,' at least with respect to the growth of the US dollar overseas. And I think there is a linkage between this and the rather impressive bull market in gold and silver.

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In providing information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2011 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.