Bank of Korea Increases Gold Reserves by Massive Nearly $1 Billion or 39% in November Alone

Commodities / Gold and Silver 2011 Dec 02, 2011 - 07:16 AM GMTBy: GoldCore

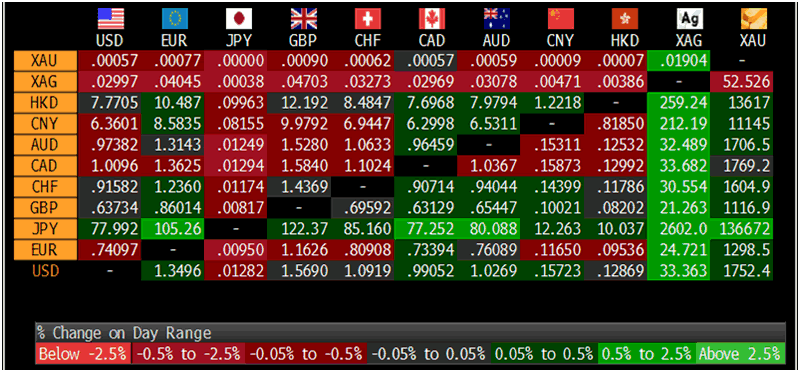

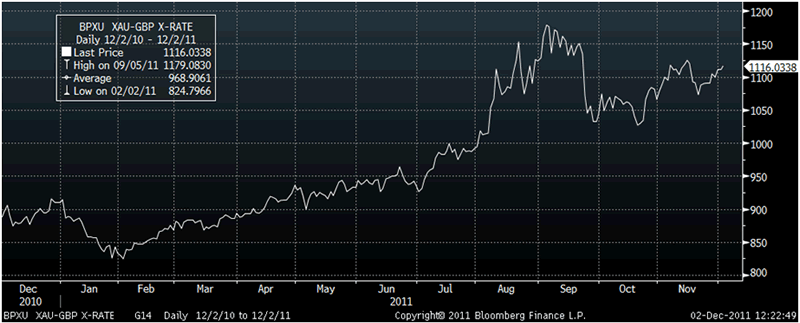

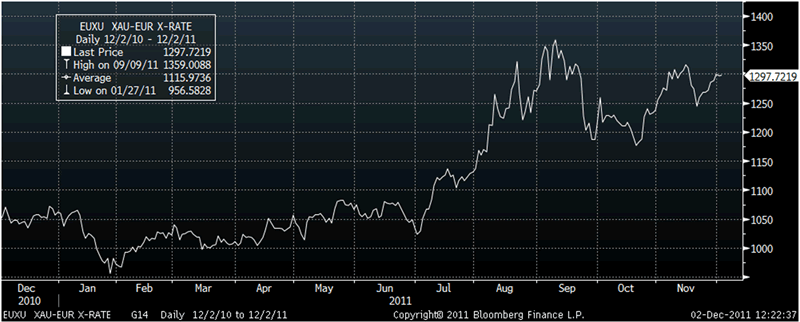

Gold is trading at USD 1,752.90, EUR 1,298.30, GBP 1,116.10, CHF 1,604, JPY 136,700 and AUD 1,706.4 per ounce.

Gold is trading at USD 1,752.90, EUR 1,298.30, GBP 1,116.10, CHF 1,604, JPY 136,700 and AUD 1,706.4 per ounce.

Gold’s London AM fix this morning was USD 1,751.00, GBP 1,116.50, and EUR 1,298.29 per ounce.

Yesterday's AM fix was USD 1,750.00, GBP 1,113.02, and EUR 1,298.03 per ounce.

Cross Currency Rates

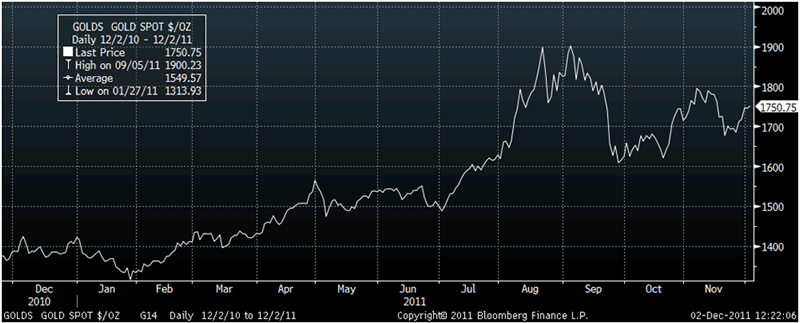

Gold is marginally higher in most currencies and is headed for its biggest weekly advance in six weeks after also seeing a gain of 1.8% in November. Gold’s technical picture has become positive again and is now aligned with the very positive fundamental backdrop.

The Bank of Korea’s continued diversification of its foreign exchange reserves is a bullish factor which may have led to the price gains today.

The central bank of South Korea announced that it had purchased 15 metric tonnes of gold in November to raise its reserve of bullion in an effort to diversify its portfolio of its foreign reserve investment and reduce risks caused by market volatilities.

According to the Bank of Korea (BOK), it made a purchase of 15 tons of gold last month to increase the nation’s gold reserves to 54.4 tons worth $2.17 billion as of the end of November.

It boosted the size of its gold reserves by US$850mn in November, up a massive 39% from the previous month. Its total gold reserves are now worth US$2.17bn.

The purchase was the central bank’s second acquisition of gold this year. It bought 25 tons of bullion in June and July for the first time in 13 years.

Thanks to the buying, the gold reserves of Asia’s fourth-largest economy jumped by three notches to 43rd in the rankings of the World Gold Council.

Based on the October reading, Korea is the eighth-largest holder of foreign exchange the world behind China, Japan, Russia, Taiwan, Brazil, Switzerland and India.

The Bank of Korea said its gold holdings account for just 1% of its foreign-exchange reserves.

“The BOK purchased gold last month in a bid to diversify its portfolio of foreign exchange reserves,” Lee Jung, head of the investment strategy team at the BOK’s Reserve Management Group, told reporters.

"Demand for gold is increasing as a hedge against global inflation amid the persistent sovereign-debt crisis in Europe," Lee was quoted as saying.

"The gold purchase will help us cope with volatile global financial markets and enhance investor confidence in Korea in times of crises."

The move comes as other central banks across the world are again diversifying into gold amid the worsening financial turmoil in the eurozone. The European sovereign debt crisis is lurching towards contagion and showing signs of spreading to France and Germany, the top two strongest economies in the region.

Mexico has bought 98 tons of gold this year, followed by Russia and Thailand, which purchased 63 tons and 53 tons, respectively, with the total official acquisition of gold reaching around 350 tons.

South Korea’s foreign exchange reserves stood at $308.63 billion at the end of November, down $2.35 billion from the previous month, as the euro, pound, yen and dollar all fell in value versus gold.

Foreign reserves consist of securities and deposits denominated in overseas currencies, along with IMF reserve positions, special drawing rights and gold bullion.

It is the second time Korea has bought gold to diversify its foreign exchange reserves this year. It purchased 25 tons of gold between June and July -- its first purchase since the 1997-98 Asian financial crisis.

No details were given as to from where the sizeable tonnage of gold was bought in November – whether it be inter central bank or from refiners or bullion banks. Nor was information forthcoming as to whether the Bank of Korea is storing their gold reserves in the central bank in Seoul.

Asian governments have become increasingly concerned about the problems in the West, with European leaders struggling under the weight of a crippling sovereign debt crisis that threatens the end of the eurozone and the euro.

The United States has a debt crisis of its own with politicians unable to agree a plan to bring down the country's titanic deficit, which sits at more than $15 trillion and increased another $160 billion in the last two weeks alone.

The ongoing woes have led to forecasts of further gold purchases, especially from Asia.

Gold is becoming increasingly attractive to central banks worldwide due to the global financial crisis and concerns for the outlook of the global reserve currency, the dollar and the euro and all fiat currencies.

European central banks have stopped selling gold. China, which has the world's biggest foreign-currency reserves, has been increasing its gold holdings mainly through domestic producers.

As we have been saying for some time, gold makes up a miniscule 1.6% of China’s foreign exchange reserves. People’s Bank of China buying alone could support gold prices in the coming months and years.

The world average for central-bank gold holdings as a share of foreign-currency reserves has increased marginally to 11%. The U.S., still the world’s largest gold holder of gold bullion, bullion makes up 74% of foreign exchange reserves.

The fundamentals for gold remain very bullish and yet gold remains largely taboo in the non specialist financial media. The fundamentals and the facts of the gold market remain unknown by the majority of the market which is bullish.

Total above ground stocks of refined gold bullion remain tiny vis-à-vis stock, bond, foreign exchange and derivative markets.

Even a small shift in allocations from these markets and into physical bullion has the potential to lead to much higher prices.

SILVER

Silver is trading at $33.51/oz, €24.78/oz and £21.32/oz

PLATINUM GROUP METALS

Platinum is trading at $1,561.50/oz, palladium at $649.25/oz and rhodium at $1,575/oz.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.