Venezuela Repatriates ‘People’s Gold’ Due to Gold’s ‘Historic’, ‘Symbolic’ & ‘Financial’ Value

Commodities / Gold and Silver 2011 Nov 28, 2011 - 07:33 AM GMTBy: GoldCore

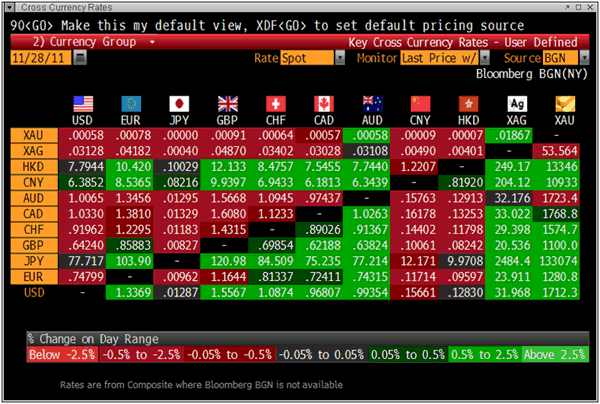

Gold is trading at USD 1,712.30, EUR 1,280.80, GBP 1,100.00, CHF 1,574.70 and JPY 133,080 per ounce.

Gold is trading at USD 1,712.30, EUR 1,280.80, GBP 1,100.00, CHF 1,574.70 and JPY 133,080 per ounce.

Gold’s London AM fix this morning was USD 1,714.00, GBP 1,100.41, and EUR 1,280.06 per ounce.

Friday's AM fix was USD 1,676.00, GBP 1,084.02, and EUR 1,263.86 per ounce.

Cross Currency Rates

Gold is higher in most currencies today. Gold is higher due to the dollar coming under pressure and oil prices (WTI) have surged over 3%.

Stock markets are also higher on fresh hopes Europe will unveil yet another set of measures to tackle the deepening contagion in the Eurozone.

Monetary and systemic risks remain and should see gold well supported at the $1,700/oz level. Indeed, gold could have bottomed on options expiry last week – as is often the case.

Western physical buyers continue to accumulate due to currency concerns. While, demand is robust, there is no panic buying or mass “flocking to gold”.

Physical buyers of gold in India, the world's biggest consumer of bullion, remain on the sidelines even though traders offered discounts of up to $5 per ounce to global prices, according to Reuters.

Chinese New Year buying should commence soon which will be supportive of prices and make up for the expected decline in Indian demand.

The currency war meme continues as seen in wild scenes of celebration in Caracas on Friday when Venezuelan citizens partied in the streets as their gold reserves were repatriated.

Reuters reports the first shipment of gold bars arrived home in Venezuela on Friday “amid wild celebrations.”

Excited crowds lined the roadside waving big Venezuelan flags and chanting "It's returned! It's returned!" as a convoy of soldiers and armored cars carried the gold ingots from Maiquetia airport to the central bank in Caracas.

The President of the central bank, Nelson Merentes traveled into the city at the head of the convoy. He did not say how much gold bullion was brought back in Friday's shipment but said the bullion came from several European countries.

"Our gold is being stored in the vaults," Merentes told the cheering crowds, sporting a baseball cap that read "The Central Bank of Venezuela with the People."

"It has historic value. It has symbolic value. And it has financial value," bank chief Merentes said about the first shipment.

"Each box of gold weighs 500 kilograms and is worth about $30 million,” Merentes said before cheering crowds. “We’ll bring the rest back little by little.”

Merentes is in favor of the move and said, "The country's finances will be backed by autonomous wealth, so we are not subject to pressure from anyone," UPI reported.

“This guarantees that if there are financial problems in the international markets our gold will be safe here at home,” Merentes said.

Drums and sirens sounded out across the square as many in the crowd sang "Forward comandante!" in support of the president. Some waved homemade signs that said: "The gold has returned thanks to Chavez!" and "Long live our sovereignty!"

Chavez addressed the nation on local television last week with the Council of Ministers, the Executive Cabinet and representatives of the Venezuelan Central Bank, including bank chief, Nelson Merentes.

Speaking from the Miraflores presidential palace Chavez said the move was giving back the country’s, “Body and soul,” and went on to say the return of the gold gave Venezuela more independence from what he described as imperialist powers. While brandishing a copy of the constitution he explained that the Central Bank would carry out the repatriation.

Chavez said the central bank would now be independent of foreign powers and subject only to the national constitution.

Chavez announced the repatriation in August as a "sovereign" step that would help protect Venezuela's foreign reserves from economic turmoil in the United States and Europe. Most of Venezuela's gold held abroad is in London.

"They say Chavez is going to take the gold to Miraflores (presidential palace) and is going to give it to Cuba as a gift," the president chuckled on Friday, mocking political rivals who accuse him of planning to sell the ingots to fill his electoral war chest ahead of next year's election.

"The gold is returning to where it was always meant to be: The vaults of the Central Bank of Venezuela."

“It’s our gold. It’s the economic reserve for our kids. It’s growing and its going to keep growing, both gold and economic reserves,” said Chavez. “Venezuela is going to become an economic power, not for the bourgeois or capitalism, but for the Venezuelan people.”

A central bank report released in August showed that Venezuela held gold reserves with the Bank of England, JPMorgan Chase & Co., Barclays Plc and Standard Chartered Plc among other banks.

Merentes said in August that Venezuela will look to deposit some of its $6.3 billion of cash reserves in emerging-market financial institutions in Russia, China and Brazil.

Like most of those gathered outside the bank, 62-year-old university professor Jose Escalona wholeheartedly agreed.

"There was no reason for it to be in England," he said. "This gold belongs to all Venezuelans," he told Reuters.

A senior government source involved in transporting the bars, which amount to 90% of Venezuela's gold held abroad, has told Reuters they will be shipped in several cargo flights that will be completed before the end of the year.

The total cost of the operation will be no more than $9 million, the source said, without elaborating.

Chavez often accuses previous presidents of selling off Venezuelans' national assets, including by storing most of the country's gold reserves with Western banks in the mid-1980s.

Chavez is worried about Venezuela's foreign reserves being frozen by sanctions.

By repatriating the bullion, he also reduces the risk of any seizure of assets related to arbitration cases, including those linked to the nationalization of multibillion-dollar oil projects run by US multinationals.

Critics have suggested that Mr Chavez is acting out of fears Venezuela's overseas assets could one day be frozen by sanctions, as happened to his friend and ally, the late Libyan leader Col Muammar Gaddafi.

Chavez, the Venezuelan central bank and some of its people clearly understand the value of gold.

This is in marked contrast to the majority of people in the western world who have forgotten gold’s ‘historic’, ‘symbolic’ & ‘financial’ value.

With increasing systemic and monetary risk, gold is reasserting itself as money and as an important safe haven monetary asset.

SILVER

Silver is trading at $32.03/oz, €23.98/oz and £20.58/oz

PLATINUM GROUP METALS

Platinum is trading at $1,551.63/oz, palladium at $590.50/oz and rhodium at $1,575/oz

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.