Stock, Gold, and Bond Markets Holiday Observations

Stock-Markets / Financial Markets 2011 Nov 25, 2011 - 01:48 PM GMT The whole family is gathered here, and I haven’t heard so much laughter in a long time. We are also celebrating the arrival of a new granddaughter. I hope you all have much to be thankful for, too.

The whole family is gathered here, and I haven’t heard so much laughter in a long time. We are also celebrating the arrival of a new granddaughter. I hope you all have much to be thankful for, too.

The VIX appears ready to break out of its diamond formation. This will likely be manifest by a strong surge above its October 3 high. The diamond formation is a classic reversal formation usually accompanied by strong volume once the breakout occurs.

SPY continues to stair-step lower beneath cycle bottom resistance. This phenomenon may continue through the minute wave three decline. At some point buyers will tire of their trades being stopped out and simply refuse to put a bid under the market. I expect the conditions for a flash crash to continue through Tuesday, when minor wave three should finish.

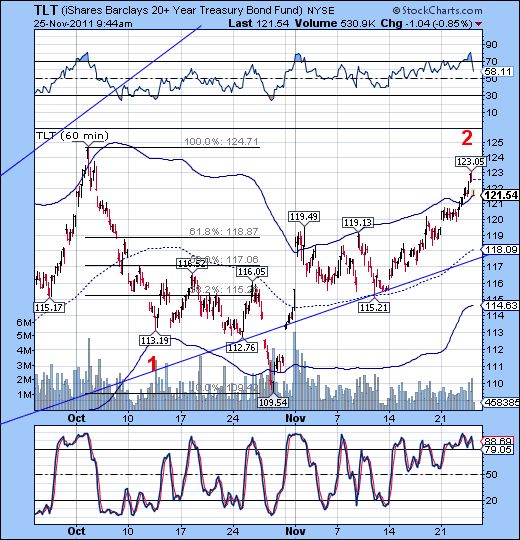

TLT reversed on Wednesday, as indicated by the Cycle Model. It appears that the long bond may now be joining stocks in their decline. The initial phase of this decline may last through the end of December. A drop through mid-cycle support at 118.09 gives TLT a potential target of 94.00.

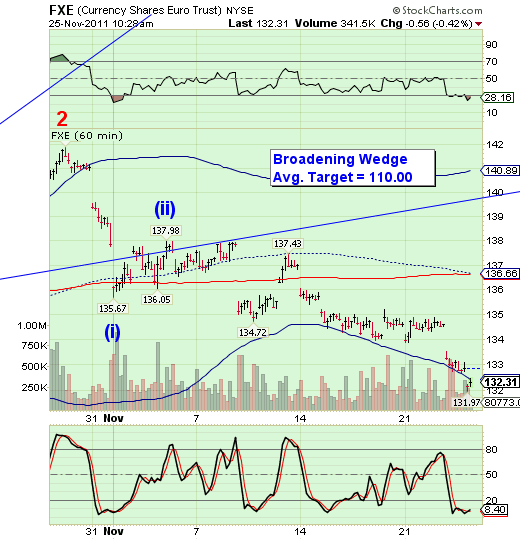

FXE finally drops beneath cycle bottom support. Unlike SPY, FXE is more likely to drop straight down, instead of the stair-step pattern in SPX/SPY.

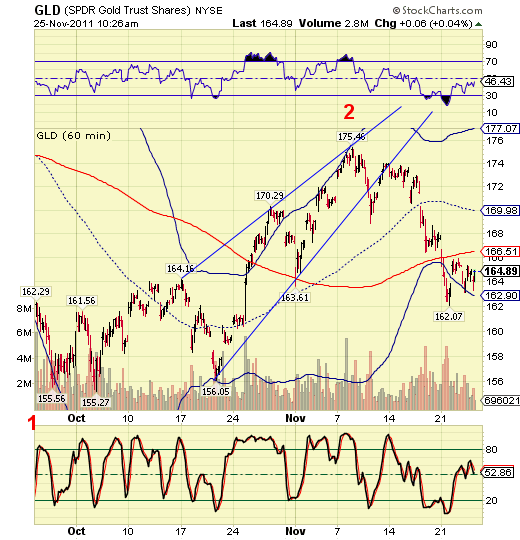

GLD is due for a trading cycle low today. However, the cycle may invert instead and test intermediate-term trend resistance at 166.51 before resuming its decline until the week before Christmas. A continued short position appears to be warranted.

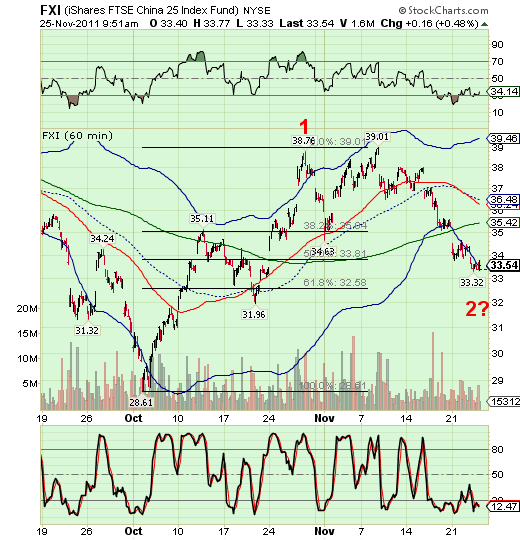

Today is a cycle reversal day for FXI and the Shanghai index. Although a reversal is not yet apparent, the Elliott waves and Fibonacci retracements appear to be completing for a retracement pattern. A small long position with a stop at 32.50 may be taken, then wait for additional confirmation of the buy signal above intermediate-term trend resistance at 35.42.

The Chinese market continues to have its naysayers, but if the reversal in treasury bonds is real, FXI may be a new safe haven for investors, much like Japan was during the 1970s.

Enjoy your Thanksgiving weekend!

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.