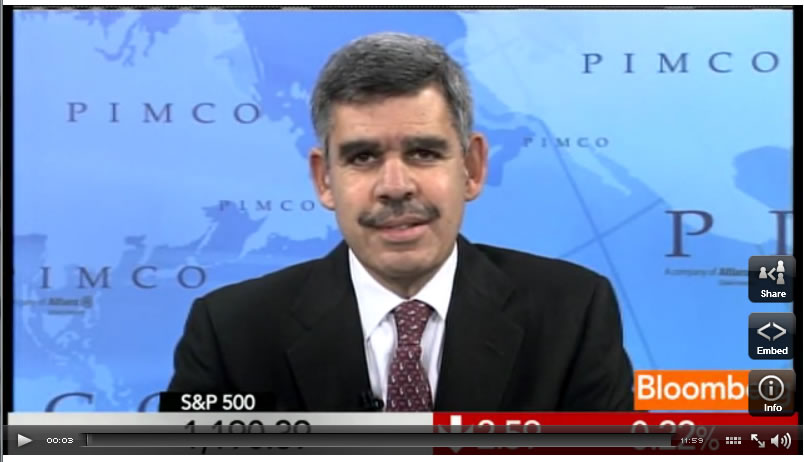

U.S. Going into Double Dip Recession, Pimco's El-Erian Calls U.S. Economy 'Terrifying'

Economics / Double Dip Recession Nov 23, 2011 - 12:25 AM GMTBy: Bloomberg

ONLY ON BLOOMBERG TELEVISION: Pacific Investment Management Co.'s Chief Executive Officer Mohamed A. El-Erian told Bloomberg TV's Betty Liu and Dominic Chu this morning that U.S. economic conditions are "terrifying" as the nation struggles to recover from recession. El-Erian also said the odds of the U.S. returning to recession are as high as 50%.

ONLY ON BLOOMBERG TELEVISION: Pacific Investment Management Co.'s Chief Executive Officer Mohamed A. El-Erian told Bloomberg TV's Betty Liu and Dominic Chu this morning that U.S. economic conditions are "terrifying" as the nation struggles to recover from recession. El-Erian also said the odds of the U.S. returning to recession are as high as 50%.

On the U.S. going into a double-dip recession:

"I am worried. We've had two bits of unfavorable news in the last 24 hours. One you reported this morning, which is that we have less economic momentum than we thought we had - 2% growth as opposed to 2.5%. The second is that yesterday we had no policy momentum. We're worried about the concept of stall speed, that 2% growth may not be enough for an economy that still has to de-lever. We put the chance of a recession at one-third to one half, which is really high given initial conditions."

On policy makers in Washington, D.C.:

"[Policy makers] are totally off the track. It's not a failure to agree on medium-term fiscal reforms, it's also a failure to give air cover for other things that need to be done -- in housing, in the labor markets, in credit. We have no policy momentum. Let me tell you what I find most terrifying: we're having this discussion about a risk of recession at a time when unemployment is already too high, at a time when a quarter of homeowners are underwater on their mortgages, at a time when the fiscal deficit is 9%, a time when interest rates are at zero."

On what factors could be driving a double-dip recession:

"This is a fragile economy. It doesn't mean we don't have strength, we certainly do - the corporate sectors are as strong as we have ever seen it in terms of balance sheets. We have incredible entrepreneurial spirit. But we're facing all these structural headwinds, and the big concern is the possibility of us being tipped over by Europe. Things in Europe, as you mentioned a few minutes ago, are getting worse, not better."

On solutions in the U.S.:

"Unlike Europe, the U.S. doesn't face an engineering problem - it faces a political problem. The solution is not an engineering nightmare. You can actually put it on paper and get it done. But it's been a political nightmare. What we'd like to see is the political class to come together and agree on the steps that need to be taken." "As you have heard us say over and over again, Bill Gross has been saying it, I've been saying it, other PIMCO colleagues have been saying it -- it's structural in nature. We need medium term structural reforms to increase the growth potential and job creation potential of this economy. We can do it. This is different from Europe. Europe has both a political problem and an engineering problem. Our problems are small relative to Europe, but if we wait they will become larger."

On the S&P's statement that US rating is unaffected by the supercommittee:

"That is what S&P is telling us. We have to remember that S&P still has us on negative outlook which means unless things improve over the next three years, there could well be another downgrade. The ratings agencies in general are in a very tough position. We talked about at PIMCO's investment committee yesterday. They've been beaten up a lot, both for what they have done and for mistakes that disrupted the markets for a while. It is hard to be a ratings agency today. You have to read these comments in that context. They are under fire."

On Joseph Stiglitz's comments that austerity measures make the crisis worse:

"I think [Stiglitz] is right, in the sense that the muddled middle, where Europe has been, is no longer sustainable. The crisis that started in the outer periphery, Greece, not only has shifted to the inner periphery and the outer core, Spain and Italy, but it has also impacted France which is the inner core."

"Europe needs to make a choice if it wants to save the euro, and it should save the euro. There's only two choices: one is a full fiscal union, a political decision with a very large bill. The other [choice] is a smaller, less-than-perfect euro zone, which has political implications but has a smaller bill. That is a political decision that Germany must take. The quicker it takes it, the more likely it will be able to save the euro."

On the options that could save Europe:

"There are no easy options. That's why the process is paralyzed. Wherever the policy makers look, they see tremendous costs and tremendous disruptions. The tendency has been to do too little, too late. There is no costless way forward at this point, and that is a problem that all of us have to internalize and understand, that there are no easy solutions."

On Europe being the single biggest threat to the U.S. economy:

"Left to our own, we would muddle along with the risk of stall speed, but one thing we cannot cope with is the major shock from one of the largest economic areas of the world, Europe. Already we're seeing investors stepped back from markets because of the anxiety. The more that happens, the more dysfunctional these markets become."

On whether the Fed should implement QE3:

"I smiled when one of your guests said earlier that the Fed has been the only adult in Washington. That is true. It has been the only institution willing to take steps. As you pointed out, because the Fed has taken these steps, it has taken pressure off of the rest of Washington to do its part…Other agencies haven't stepped up to the plate. It is time for other agencies to step up. The effectiveness of the Fed is declining, unfortunately, day in and day out."

On what the Fed should do:

"Chairman Bernanke has made it clear and he's repeating it three times, saying that when they look at these unconventional policies, they recognize the benefits but there are costs and risks. What we call collateral damage, unintended consequences."

"[Bernanke] recognizes that that equation, that balance, is shifting from potential benefits to costs and risks. Looking forward, if they were to do QE3, they may get some benefits, but I suspect there would also be quite a bit of collateral damage and distortions put into the system that would take us years to overcome."

"[Collateral damage would be] pressure on the currency. What you will see is pressure on the functioning of markets, you will see people stepping back, because more and more non-commercial forces will be determining market outcomes. We will also see questions about the credibility of the Fed and the political autonomy of the Fed."

Copyright © 2011 Bloomberg - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.