Gold Falls Again on Options Expiry, Supported by Global Debt Crisis & Iranian Oil Jitters

Commodities / Gold and Silver 2011 Nov 22, 2011 - 10:52 AM GMTBy: GoldCore

Gold is trading at USD 1,696.10, EUR 1,252.60, GBP 1,083.30, CHF 1,546.20, JPY 130,370 and CNY 10,780 per ounce.

Gold is trading at USD 1,696.10, EUR 1,252.60, GBP 1,083.30, CHF 1,546.20, JPY 130,370 and CNY 10,780 per ounce.

Gold’s London AM fix this morning was USD 1,697.50, GBP 1,083.90, and EUR 1,253.14 per ounce.

Yesterday's AM fix was USD 1,704.00, GBP 1,085.42, and EUR 1,266.44 per ounce

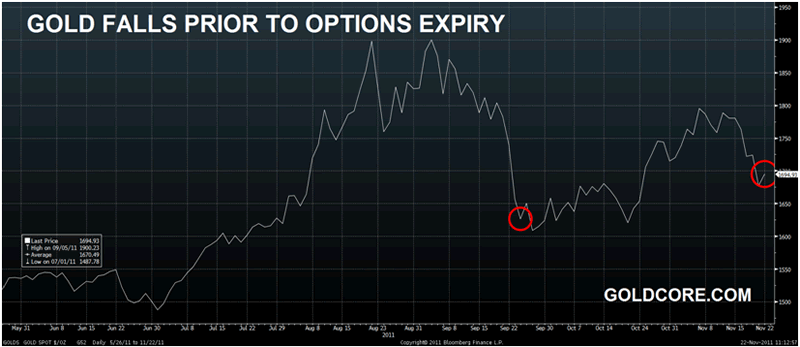

Gold in USD – 6 Months (Daily) and 2 Most Recent Gold Options Expiry (09/27/11 and Today)

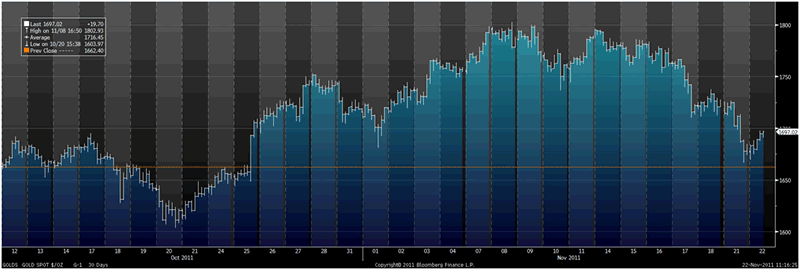

Gold is higher all currencies today and is up 1.2% in USD and 0.75% in EUR after yesterday's 2% fall and there are renewed reports of physical buying activity in Asia.

Yesterday's falls may been margin driven. There has been liquidation by speculators and investors covering losses elsewhere due to the renewed market volatility and losses seen in equity markets globally in recent days.

Gold in USD – 30 Days (Tick)

Recent years have seen a trend of gold and silver selling off aggressively in the run into options expiries. This pattern has been less marked in 2011 but was more frequently seen in recent years.

Investors have complained to the CFTC about violations of law in the gold and silver markets and some have sued JPMorgan Chase & Co and HSBC Holdings Plc accusing them of conspiring to drive down prices, and reaping an estimated hundreds of millions of dollars of illegal profits.

The sell off had all the hallmarks of a bear raid by concentrated leveraged longs as the news flow was extremely gold positive – both from Europe and the US.

This most recent sell off may again be completely coincidental but the CFTC might want to keep an eye on such unusual trends in the precious metal markets in order to ensure fair and free markets and protect the interests of all investors.

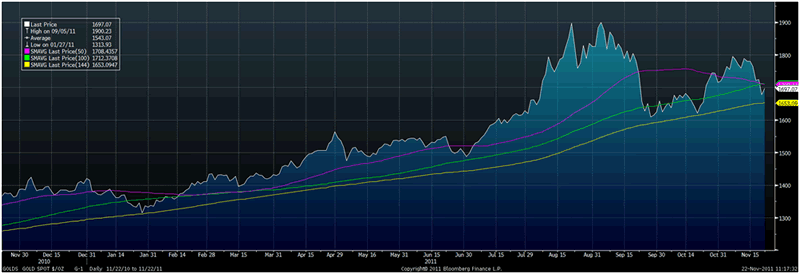

Such sell offs, whether manipulative and manufactured or not, should be used to accumulate physical bullion by buying on the dip.

The US Supercommittee’s abject failure to make any progress regarding the US budget woes yesterday is very bullish for gold.

Gold in USD – 1 Year (Daily) – 50, 100 & 144 DMA

Asian retail, high net worth and institutional buyers, and central bank buyers will take advantage of this latest correction and buy the dip as was seen in September.

Besides the ongoing global debt crisis, gold will also be supported by increasing geopolitical tension between Iran against Israel and its allies the US, Britain and Canada.

The US, Britain and Canada announced yesterday new sanctions on Iran's energy and financial sectors.

Iran and its powerful ally Russia criticized the new Western sanctions imposed on Tehran saying they were illegal and futile.

The unilateral measures against Iran's financial, petrochemical and energy sector sanctions were "unacceptable and against international law" according to Russia.

China had blocked any possibility of the steps going before the UN Security Council for approval. China is a major buyer of Iranian oil and a key investor that has stepped in to sign energy contracts left available by departing European companies.

Iran has warned it could close the strategic Straits of Hormuz if it became the target of a military attack. The straits are the entrance to the strategic Persian Gulf waterway, a major route for the supply of oil globally.

Oil has risen for the first time in four days as the sanctions against Iran raise concerns that supplies may be disrupted. Prices have gained 7% this year after increasing 15% in 2010.

A disruption of Iranian oil supplies would lead to oil prices surging and to increased safe haven demand for gold.

SILVER

Silver is trading at $31.71/oz, €23.42/oz and £20.27/oz

PLATINUM GROUP METALS

Platinum is trading at $1,550.20/oz, palladium at $589.25/oz and rhodium at $1,575/oz

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.