Paper Banknotes and the Indebting Of Nations, Banking, War And Bankruptcy

Interest-Rates / Fiat Currency Nov 22, 2011 - 05:30 AM GMTBy: Darryl_R_Schoon

On April 3, 1024, “the imperial Sung Dynasty began to print and circulate chiao-tzu notes [paper money] in the province of Szechwan”.

On April 3, 1024, “the imperial Sung Dynasty began to print and circulate chiao-tzu notes [paper money] in the province of Szechwan”.

p. 11 Ralph Foster, Fiat Paper Money: the History and Evolution of Our Currency, 2nd ed., 2008

In China, paper money was a monetary form of ‘Hamburger Helper’, an addition to the royal treasury that allowed Chinese dynasties to stretch their budgets by allowing them to spend what they didn’t have.

In the West, paper money had a different purpose. There, the invention of paper money would also allow governments to spend more than they possessed; but, in the West, governments would have to borrow their own money from bankers.

When money is issued as debt, everyone becomes a debtor

TERMINALLY INDEBTED GOVERNMENTS: A PHENOMENA CREATED BY THE CHINESE, SCOTS AND JEWS

Paper money and fractional monetary reserves appeared first in China in 1024 and, although China’s monetary advances were noted by Jewish traders, it would be the Scots who 600 years later would transform China’s paper money into a credit-based conveyer of debt in the West.

Note: It’s no coincidence that today’s largest bank in terms of market value and profits is HSBC, incorporated by Sir Thomas Sutherland in 1865. Sutherland was a Scot.

In 1694, a Scottish banker, William Patterson, convinced England’s King William III to establish a central bank that would issue debt-based paper money alongside gold and silver coins. The king agreed to do so in return for loans to pay his war debts and more loans to fight more wars.

The Scots’ bogus paper banknotes—marginally backed by gold—would eventually replace gold as money throughout the world, proving again the ancient dictum, bad money drives out good.

Invented in China and transformed by the Scots, it would be the Jews, however, who would leverage paper money and credit and debt into untold wealth and power. William Patterson’s combination of paper money and money lending would catapult the Jews from societal outcasts to rulers of the financial world; but because of deeply ingrained anti-Semitic attitudes in the West, it would take almost a century for this to occur.

After Patterson’s invention of debt-based money, the highly profitable world of banking remained off-limits to Jews during the 1700s; but as the century ended, banking’s doors opened to the Jews because of the West’s need for money to fight their wars.

…prior to the beginning of the revolutionary wars in France, in the mid-1790s, European merchant banking was dominated by non-Jews, including the “Barings of London, the Hopes of Amsterdam and the Gebrüder Bethmann of Frankfurt”. The financial demands of war opened room for newcomers, including a German-Jewish group with the Oppenheims, Rothschilds, Heines, and Mendelssohns among them.

http://en.wikipedia.org/wiki/Rothschild_family

Paul Johnson, A History of the Jews, pp. 314-315

The West’s costly wars gave Jewish bankers entry into the exclusive and waspish world of banking; and one family in particular, the Rothschilds, would leverage this opportunity into the financial equivalent of world dominion.

The Rothschild’s ascent would be fueled by their highly profitable trade in sovereign debt, i.e. government bonds, whereby governments could spend whatever they wanted by indebting their citizens ad infinitum—an indebtedness limited only by government’s ability to borrow.

ROTHSCHILD & SONS: BANKERS PAR EXCELLENCE AND INDEBTORS OF NATIONS

The way to a man’s purse is through his ambitions and the most costly of these is war

Wars are expensive and the Rothschilds discovered a highly lucrative way to profit by loaning money to nations preparing for war. The Rothschilds allowed nations to fight wars on credit by their underwriting and sale of government bonds.

… the Rothschilds created the world of banking as we know it today. Nathan [Rothschild] operated principally as an underwriter and speculator in the early 19th-century bond market. He and his brothers invented, or at any rate popularised, the government bond, which allowed investors, big and small, to buy bits of the debts of sovereign states by purchasing fixed-interest bearer bonds.

Governments liked this because they could use them to raise colossal sums of money. Investors liked them because they could be traded - at prices that fluctuated in relation to the performance of the issuing government - and shrewd investors could make big sums... The Rothschilds got a cut of everything. https://plus.google.com/...

Through the sale of British bonds, the Rothschilds profitably underwrote England’s wars and the spread of its empire. Later, England would return the favor by sponsoring a Jewish state in Palestine, much to the dismay of the Arab world.

BANKING, WAR AND BANKRUPTCY

It was the cost of war whereby William Patterson was able to convince King William III to issue debt-based paper banknotes; just as it was the cost of war that gave Jews access to the bankers’ trough of greed.

But, in the end, it would be war that would take away everything the bankers’ paper money built. The costs of war would end up costing bankers the gold their paper banknotes required.

At the end of WWII, the world monetary system was backed by 21,775 tons of US gold. But two decades later, most of that gold was gone, spent to maintain America’s vast overseas military presence; and, in 1971, the US was forced to end the convertibility of US dollars to gold.

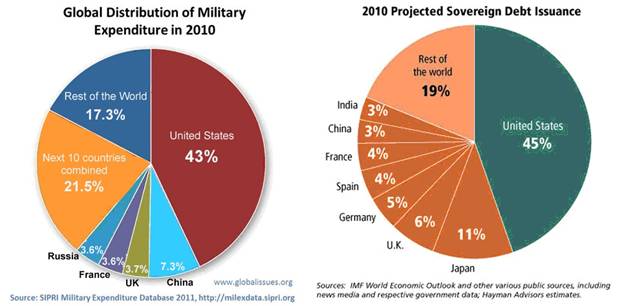

The removal of gold-backing from the US dollar would eventually undermine the world monetary system; leading to unrestrained global credit creation, runaway borrowing and dangerous destabilizing levels of debt—and the transformation of America from a creditor state into the world’s largest debtor.

US MILITARY SPENDING, DEBT AND FISCAL INSOLVENCY

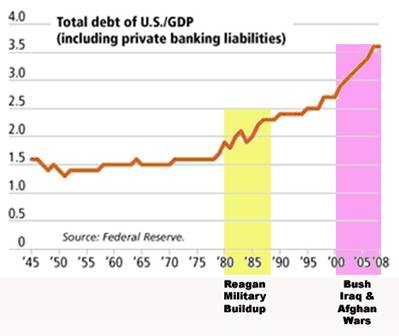

In the 1980s, no longer needing to exchange gold for US dollars, President Reagan used debt instead of taxes to pay for America’s military buildup. In only two terms, President Reagan tripled the US deficit. Two decades later, debt was again used by President Bush to fund America’s wars in Iraq and Afghanistan.

Although central banking and the debt-based warfare state had its genesis in England, it would reach fruition in America. There, the creation of the Federal Reserve Bank, a carbon copy of England’s central bank, allowed America to follow in England’s debt-based imperial footsteps.

America’s vast post-WWII military machine fueled by central bank credit and unprecedented borrowing propelled America, like England, to world dominion. That dominion, however, would cost America its gold reserves, its savings and its future.

CENTRAL BANKERS AND THE DEATH RATTLE OF DEBT

Today’s European debt crisis can be traced to toxic levels of government debt, a toxicity encouraged, aided and abetted by bankers. The desire of governments to spend what they don’t have has been more than equaled by bankers loaning money ad infinitum to governments irrespective of the ability to repay, e.g. Greece, Italy, etc.

The government bonds popularized by the Rothshilds are now the undoing of the world financial system. Bankers profit by the indebting of others and the Rothschild’s strategy of indebting governments was so successful that, today, both governments and banks are in serious trouble.

Central bankers are desperately searching for answers that do not exist. They caused the problem with excess credit and their role in doing so has blinded them to what’s obvious to others. Central bank credit caused the problem. Central banking is the problem.

In my youtube video, Dollars & Sense show #10, http://youtu.be/2FVcB9crFDo, I discuss three American central bankers. John Exter who saw the problem, Paul Volker who helped create the problem and Alan Greenspan who denied the problem.

Today US debt, not gold, is the foundation of the world’s financial system. US treasuries are thought by most to be a safe haven. In the short term, they are. In the long term, they’re not. In the long term, there is no short term.

In truth, America’s US treasuries are no safer than Europe’s troubled sovereign debt. The daisy chain of sovereign debt is now unraveling and although who’s next is of paramount importance to those betting on the declining value of government IOUs; almost all—creditors and debtors alike—will disappear into the gaping maw of the Rothschild’s now defaulting bonds. The last journey of paper money is a funeral procession.

TODAY, TOMORROW AND THE DAY AFTER

The Chinese experiment with paper money began almost 1,000 years ago. Today, paper money in the East and West is no longer is backed by gold and there’s nothing to prevent the economic chaos that ended the five Chinese dynasties that used paper money from ending the current Chinese regime as well.

Paper money is no respecter of ideology. State-sponsored capitalism will be no more effective than banking-sponsored capitalism in preventing the economic chaos inevitably spawned by fiat paper money.

We are living in extraordinary times. An economic paradigm is being swept away and another paradigm is about to take its place. Change always takes time and paradigm changes are deeper and more significant than others; and while it will be some time before the changes are over, they will happen with a rapidity and swiftness for which most are unprepared.

Better times are coming.

The first shall be last and the last shall be first

Jesus the Nazarene

Buy gold, buy silver, have faith.

By Darryl Robert Schoon

www.survivethecrisis.com

www.drschoon.com

blog www.posdev.net

About Darryl Robert Schoon

In college, I majored in political science with a focus on East Asia (B.A. University of California at Davis, 1966). My in-depth study of economics did not occur until much later.

In the 1990s, I became curious about the Great Depression and in the course of my study, I realized that most of my preconceptions about money and the economy were just that - preconceptions. I, like most others, did not really understand the nature of money and the economy. Now, I have some insights and answers about these critical matters.

In October 2005, Marshall Thurber, a close friend from law school convened The Positive Deviant Network (the PDN), a group of individuals whom Marshall believed to be "out-of-the-box" thinkers and I was asked to join. The PDN became a major catalyst in my writings on economic issues.

When I discovered others in the PDN shared my concerns about the US economy, I began writing down my thoughts. In March 2007 I presented my findings to the Positive Deviant Network in the form of an in-depth 148- page analysis, " How to Survive the Crisis and Prosper In The Process. "

The reception to my presentation, though controversial, generated a significant amount of interest; and in May 2007, "How To Survive The Crisis And Prosper In The Process" was made available at www.survivethecrisis.com and I began writing articles on economic issues.

The interest in the book and my writings has been gratifying. During its first two months, www.survivethecrisis.com was accessed by over 10,000 viewers from 93 countries. Clearly, we had struck a chord and www.drschoon.com , has been created to address this interest.

Darryl R Schoon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.