Will Stock Market Turn Positive For Thanksgiving Holiday?

Stock-Markets / Stock Markets 2011 Nov 22, 2011 - 03:29 AM GMT SPX back-tested the bottom trendline of the Broadening Wedge and Cycle bottom Resistance at 1200.64. There are two potential paths for the SPX from here. The first pattern would recognize the top of wave ii at 1277.55. That suggests a further drop to 1145, fulfilling the minimum target for the upward-slanting Head & Shoulders neckline before a bounce back to Cycle bottom resistance, or higher. I favor that pattern, although it has some flaws.

SPX back-tested the bottom trendline of the Broadening Wedge and Cycle bottom Resistance at 1200.64. There are two potential paths for the SPX from here. The first pattern would recognize the top of wave ii at 1277.55. That suggests a further drop to 1145, fulfilling the minimum target for the upward-slanting Head & Shoulders neckline before a bounce back to Cycle bottom resistance, or higher. I favor that pattern, although it has some flaws.

The second scenario recognizes the top of wave ii at 1266.98. This normally envisions a potential rally to 1224.80, a 50% retracement, prior to the next decline. That would be the minimum expected in what is normally one of the most positive seasons of the year for stocks. However, if we're in a bear market, cycle bottom resistance will remain exactly that… through the wave three decline.

In other words, the crash could began overnight.

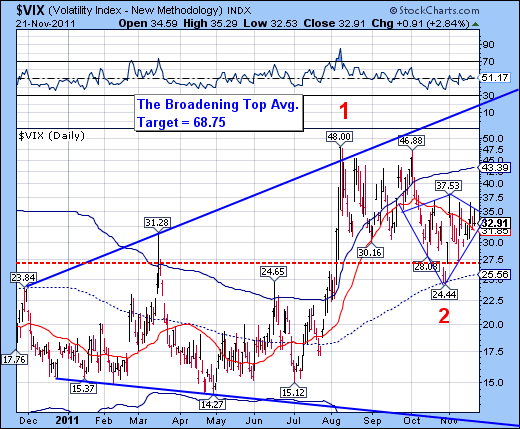

Allow me to draw your attention to the diamond formation in the VIX. The VIX has closed above intermediate-term trend support at 31.85. RSI has also closed above 50, which implies strength in the VIX. If intermediate-term trend support holds overnight, we may see a breakout from the diamond formation as early as the open of the market tomorrow. That action would support the crash scenario in stocks. A further rally in stocks, on the other hand, may produce sideways action in the VIX, only postponing the inevitable crash until next week.

The cycles allow only two more days available to complete any rally stocks. As I said earlier, this is normally the positive season for stocks. Maybe the big boys will pull a rabbit out of the hat.

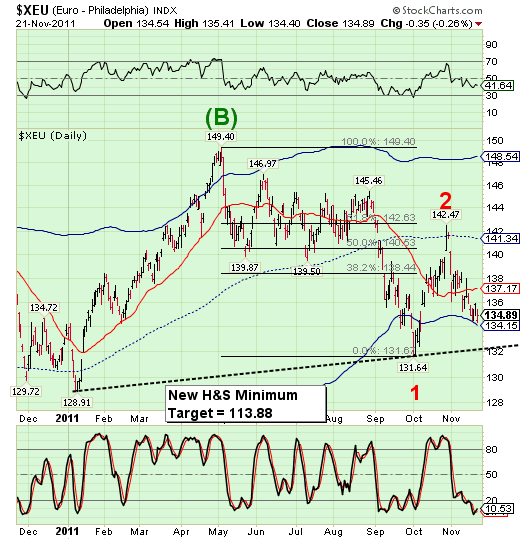

Finally, the XEU is being held at bay above its massive Head and Shoulders neckline. The bounce off cycle bottom support at 134.15 is rather anemic and appears to be finished. I wouldn't trust the support to hold, even though XEU remains oversold. The RSI suggests that it simply has no strength to rally. A breakdown of the Euro through the Head and Shoulders neckline would be accompanied by a crash in stocks as well. Be wary of bad news from Europe.

Good luck and good trading!

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.