Global Balance Sheet Depression Making Second More Dangerous Credit Crisis Inevitable

Economics / Great Depression II Nov 22, 2011 - 03:23 AM GMTBy: John_Mauldin

I have been reading and talking with Simon Hunt for a long time. He is a very thoughtful Brit who spends a lot of time in China and thinks about copper and commodities and cycles. He has enough seasoning to have seen a few cycles himself. This piece summarizes rather well the view that he has expressed for some time. And while I am generally skeptical of relying too much on cycles for specifics (they work until they don't), I think Simon has some very powerful conclusions. From his summary:

I have been reading and talking with Simon Hunt for a long time. He is a very thoughtful Brit who spends a lot of time in China and thinks about copper and commodities and cycles. He has enough seasoning to have seen a few cycles himself. This piece summarizes rather well the view that he has expressed for some time. And while I am generally skeptical of relying too much on cycles for specifics (they work until they don't), I think Simon has some very powerful conclusions. From his summary:

"The world is in a balance sheet depression which will make a second and perhaps more dangerous credit crisis almost inevitable. That should break out next year or in 2013.

"The three global pillars of the world economy, the USA, Europe and China, each have their own problems, but their impact is global because of the feedback loops from the financial sector to the economy.

"The USA has a debt and deficit profile which is unsustainable; the Euro Zone has to decide whether it can forge a fully fiscal union or whether the costs are too great, in which event membership will be restructured; and China is trying to put its economy on a more sustainable growth path at a time of leadership change.

"Debt and demographics will be the determining forces to global growth. Markets will no longer countenance indecision and pushing debt problems under the table by lending more funds to indebted governments. Politicians want to postpone what they know is inevitable: debts must be repaid."

This is a very interesting Outside the Box and one I suggest you put some thought into, as to how its conclusions may affect you.

I write this from Dr. Mike Roizen's office in Cleveland, where I will be at the Wellness Clinic tomorrow to do a general physical and to find out specifically what is wrong with my right arm. Nothing life-threatening here, as I told my daughters last night. Just life-annoying.

I get back to Dallas in time to go shopping for Thanksgiving dinner and start the cooking. Some things just have to be done overnight. I love this week! 40-plus people coming to dinner. And I hope you have a great holiday as well. And if you are not in the US and don't celebrate Thanksgiving, then make up an excuse and get your family and friends together and have a great meal, emphasis on together. We should do things like this more often!

Your enjoying life more and more (even with the damn arm) analyst,

John Mauldin, Editor

Outside the Box

JohnMauldin@2000wave.com

Simon Hunt Strategic Services

Simon Hunt November/December Economic Report

"Four years into the crisis it is surely time to accept that the underlying problem is one of solvency not liquidity – solvency of banks and solvency of countries. Of course, the provision of additional liquidity support to countries and institutions in trouble can buy valuable time. But that time will prove valuable only if it is used to tackle the underlying problem.......But the underlying problems of excessive debt have not gone away. As a result, markets are now posing new questions about the solvency of banks and indeed governments themselves." Mervyn King, Governor of the Bank of England, 18th October 2011.

1. Summary

• The world is in a balance sheet depression which will make a second and perhaps more dangerous credit crisis almost inevitable. That should break out next year or in 2013.

• The three global pillars of the world economy, the USA, Europe and China each have their own problems, but their impact is global because of the feedback loops from the financial sector to the economy.

• The USA has a debt and deficit profile which is unsustainable; the Euro Zone has to decide whether it can forge a fully fiscal union or whether the costs are too great in which event membership will be restructured; and China is trying to put its economy on a more sustainable growth path at a time of leadership change.

• Debt and demographics will be the determining forces to global growth.

Markets will no longer countenance indecision and pushing debt problems under the table by lending more funds to indebted governments. Politicians want to postpone what they know is inevitable: debts must be repaid.

• European banks are under duress; government debt represents a large proportion of their asset base. They are also the largest lender to all the major regions of the world. To shore up their own balance sheets they will be cutting credits etc.

• The world will suffer from rolling recessions starting either next year or in 2013 lasting to about 2018. Global industrial production should fall by an average of 0.25% a year during this period.

• By then the process of deleveraging should have run its course. The world beyond 2018 will be a different place. World industrial production should average around 3% a year to 2030 compared with an average of 3.3% in the period 1990-2010. Monetary policy will also be quite different; global money supply will match global GDP, not the massive increase experienced since 2008.

• Asset inflation will be virtually non-existent as funds will experience solid long term growth in equities. CPI inflation will be contained at around 3% a year as a world average. This will be a golden period after the turmoil of the 2000 to 2018 years.

2. Introduction

Truth can be ugly and solutions often painful. The world is at the start of a balance sheet depression as Professor Rogoff stated in a German interview. But, policy makers will not own up to this simple description of the world economy, preferring to put band aids on gaping wounds. The truth, though both ugly and painful, is that the world is heading towards its second and, arguably, more serious global credit crisis within five years of the first.

Each of the three principal pillars of the world economy, the USA, Europe and China, has their own problems, but they boil down to two simple ingredients: debt and demographics. They may be special to their own countries/region but the impact is global because of the feedback loops from the financial sector, which is global in structure, into the world economy.

Few, if any, country will be spared from the rolling recessions and deflation which have started, will intensify and probably not end until around 2018. One example of this interrelationship is that European banks are and, have been, the principal providers of international lending. They account for more than 50% of international bank lending in all the major regions of the world, excepting Asia where it is just under 45%. These banks are under duress; they are probably already scaling back their international lending even to Asia. If this trend were to become significant, the contagion impact would be substantial.

This point was made by Mark Carney, the Bank of Canada governor and the first chairman of the Financial Stability Board. Market volatility is increasing and activity declining as global liquidity shrinks. He added, "The effect on the real economy will soon be felt." To meet tier 1 capital ratios by next June, European banks have to raise US$2.4 trillion with a good part being raised by asset sales. And this, of course, takes neither account of impaired sovereign, corporate or household loans nor the latest EMU guidelines "which ask banks to mark down distressed assets to better ascertain capital raising requirements", as GaveKal wrote yesterday.

The interdependency of governments and their banks is well and shrewdly described by Jim Millstein in today's FT.

"The financial fate of Europe's banks and its governments are inextricably linked: because the banks are the primary source of funding for government deficits, government debt represents a large proportion of the asset base of most eurozone banks. Insolvency of one therefore threatens the insolvency of the other...The truth, however, is that given the level of eurozone government indebtedness and the relative size of Europe's banks, Europe's largest banks are too big to save."

Such is the seriousness of the problems facing so many countries in Europe; their fate will have global repercussions. It is why a new, or, some would argue ongoing, global credit crisis is virtually inevitable.

Asia, so long thought of as the epicentre of global growth, will not be immune to the issues faced in the three pillars because exports to two of them will fall substantially and are likely to slow to the third, namely China. And, as the Euro Zone (EZ) becomes a more stressful region next year, European banks may well be forced to cut credit lines to corporates and governments in Asia even more.

3. Current Situation

As the global balance sheet depression takes hold, the world is moving from one crisis to another. It was only a few months ago that the market's focus was on the USA; then it was China and now it is the EZ.

Today's EZ's problems were caused by trying to cement together a ragbag of countries into the European Monetary Union which included Germany on the strong side and Greece, Ireland, Portugal, Spain and Italy on the weak side. The monetary assumption that was appropriate for Germany would be appropriate for all of the other members.

Herein lay the fault lines. The weak members were able to get a German credit rating which meant that they could borrow to consume goods and finance industry and infrastructure that otherwise would not have been possible. Banks, too, were happy to lend to the governments of these countries because they could take the loans to the ECB and use them as collateral for even more borrowing. A credit frenzy followed which has resulted in today's debt crisis.

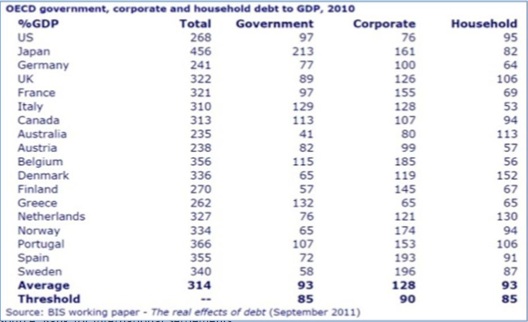

Chart 1: Household, Corporate & Government Debt as % of Nominal GDP

Source: Bank for International Settlements

Now many of these countries are in a critical condition. This table produced by the BIS in their September report breaks down a country's total debt by household, corporate and government for some European countries plus the USA and Japan. There are three countries whose debt is above the BIS threshold level for all three categories – the UK, Canada and Portugal – and ten whose debt is above the threshold level for two of them.

Once again markets tend to focus on one culprit at a time starting with Greece, now to Italy and then perhaps to France, Spain and Belgium. The reality is that markets are going to have to focus on all of the weak countries because the numbers are just too large.

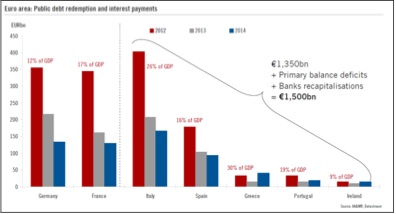

Chart 2: E1,500bn to be financed in peripheral euro area states between now and 2014

Source: Pictet, Decision Time for Monetary Union, November 2011

Sovereign refinancing by 2014 will be huge and this ignores the sums required to recapitalise the banks: in total we are talking of between E3trillion and E4trillion. As a percent of GDP, the refinancings are alarming for four of these five countries – Greece 30%, Italy 26%, Portugal 19% and Spain 16% for next year.

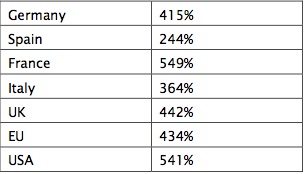

That is not the end of the story. Analysts conveniently forget the future liabilities such as pension funds. If these are added to the debt set out in the previous chart total government liabilities as a percent of GDP become quite extraordinary. As of last year they were:

Chart 3

Thanks to Niels Jensen of Absolute Return Partners in their November 2011 letter, our attention was drawn to the work of Egan-Jones, a credit rating company whose revenues originate from institutions and who have a powerful track record. They state that Greece cannot reasonably support more than E40bn in taxes, equivalent to only 10% of the amount outstanding. "That's why debt holders are likely to face a 90% haircut.....And unless trends reverse, Spain, Italy and Belgium will follow."

This brings us to an awful truth: will Germany allow the ECB and/or the EFSF to effectively print money to enable the weak members to repay their debts. The problem is that the Bundesbank and Germany's Constitutional Court will not allow Germany to participate in such a program for their own historic reasons and because, quite sensibly, printing money does not work. Future stability, together with fiscal and structural reforms, would disappear risking a substantial rise in the cost of living (CPI inflation) as well as asset inflation.

The choice before Germany is then simple but harsh. Either to throw caution to the winds and hope that by printing money the Euro Zone can be saved and stability created or to accept the painful truth that "the Euro is an incoherent nonsense which, in its current form, is doing far more harm than good", as Liam Halligan wrote on Sunday.

There are sign that German and other officials are quietly preparing for the possible departure of weak countries from the EZ. The heads of Germany and France have publically acknowledged that euro membership is not permanent. This could mean either that the weaker members leave or that the stronger leave and reconstitute the Euro around a smaller number of countries. Either way the cost would be considerable but arguably less than attempting to force the high spending countries into a German fiscal and monetary structure.

The prospect of a temporary return to sanity in Italian and Greek politics with the swearing in of Mario Monti as Italy's new Prime Minister and the appointment of lucas Papademus in Greece raises market expectations that both countries will begin the process of making their economies more competitive and in a position to repay debt etc. Both are well respected technocrats but both are unelected officials. Both countries will introduce some of the right measures but the question of implementation remains. For Greece, the arrival of the troika to help run the economy is likely to provoke anger in the country; and for Italy, whilst Berlusconi has lost office, his influence will still be felt in parliament via his party members who had supported him.

Implementation of the technocrats' policies will be the real problem. This is possibly the EU's last throw of the dice. If their policies are not fully implemented a change in the membership structure of the EZ will be unavoidable.

In summary, our best guess is that there will be a temporary honeymoon as markets react positively to the appointment of the two technocrats. Other problems will surface in some of the other weaker members of the EZ. Eventually, there will be a restructuring of the EZ centred on Germany, the northern members and France though the latter country might find the disciplined approach to fiscal and monetary policies of Germany too difficult for them to swallow.

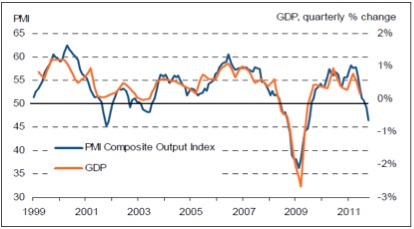

Chart 4: Markit Eurozone PMI & GDP

Source: Markit, Eurostaat, GDP = gross domestic product

Meanwhile, business is falling sharply in Europe as has been clearly shown by the various PMIs and the IFO data. The latest OECD Composite Leading Indicators also show that business activity is falling in Europe. However, it is not only in Europe that business is weakening.

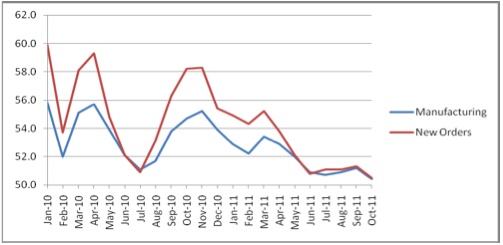

Chart 5: NBS China PMIs

Source: NBS

China's official GDP for the fourth quarter is likely to fall to around 8.5% in the fourth quarter and to remain at around that level in 2012. Its electricity production fell sharply in October (- 5.8%) versus September and by a massive 15% compared with August. Railway freight is growing by only 3.5% year-on-year and fell marginally month-on-month in October.

China is not immune to the twin global constraints of debt and demographics. We will expand on the latter later, but McKinsey estimated that China's total debt to GDP ratio was 159% at the end of 2008. It must now be considerably higher. A recent report, for instance, estimates that local government debt is as much as $473 billion or RMB 3 trillion when township government debt is included which was not the case under the nation's audit office.

Imbedded inflation is a growing problem due to rising cost inputs for foods, grains and soya for pigs and fertilizers for corn etc. Per capita meat consumption is rising; wages are increasing at a rate faster than productivity and soon the costs of water and electricity will have to be increased even faster.

Managing the transition from an export model to a domestically driven consumption one is proving difficult and will become even more so should the world economy slump into recession, a likely scenario. And managing the leadership transition is more fraught than usual. We suspect that once the new leadership takes full control in 2013 there will be a period of „clamp down' as government digests the hangovers from years of growth beyond sustainable rates.

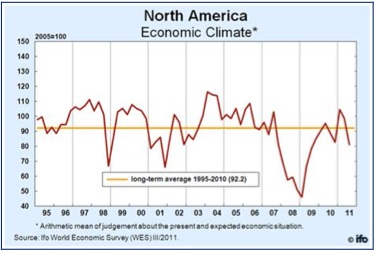

Chart 6: IFO North American Economic Climate

Most forward-looking indicators are suggesting either that the US economy will slip into recession if not next year then in 2013. The just released OECD Composite Leading Indicators also signal a slowing economy. Rail freight data for October was up by only 1.7% on 2010 despite the fact that October is almost always the top month for intermodal traffic as it is the month when retailers do the bulk of their stocking for the holidays.

Debt, of course, is on an unsustainable path. Politicians seem incapable of devising a credible long-term deficit reduction program. Some foreign holders of Treasury paper are becoming frustrated by the antics of Washington. At some point over the coming six months a shock will be imposed which will bring down the US dollar; the index (DXY) could then fall below the 70 level so resulting in a full blown run on the currency. Markets will be sufficiently frozen that the politicians will be forced to devise a sensible long-term plan to reduce the deficit; the run on the US$ should also force the Federal Reserve to raise interest rates. The US dollar will then recover very sharply into 2013 at least, though we suspect that its recovery will be longer lasting.

In summary, current indicators suggest that at the very best global growth will be slow next year. There is a risk that the Federal Reserve will have another drive to pour liquidity into the system to be followed by the ECB having to act as lender of last resort. If this does occur asset prices will rise, but the impact of such monetary ease on the real economy will be anaemic. It is likely to be followed by a crash in 2013. We rate this scenario as a 40% chance.

The more likely outcome is that the ECB continues to operate under the Bundesbank mantra providing token relief to the weak members. Europe will remain in recession. The US economy, despite any action by the Federal Reserve (pushing on a string) will have very slow growth at best but will return to recession in 2013. Asia will be affected by banks in Europe having to raise capital together with much reduced exports outside the region. And in China growth will be slower so experiencing a reduction in exports. World industrial production will be very weak with a recession in 2013. We rate this outcome as a 60% chance.

4. The 2013 & Beyond

The period starting in 2013 – and it could be in 2012 – will be fraught as the world deleverages after a generation of governments promising more than they can pay for and in many countries households borrowing more than they can afford. This is a bad enough environment but it is made worse by society aging in so many countries: there will be far fewer workers to support retirees.

Professors Reinhardt and Rogoff have well documented what happens to economic activity in their book, "This Time is Different: Eight Centuries of Financial Folly." "The aftermath of systemic banking crises involves a protracted contraction in economic activity and puts significant strains on government resources." More recently they add that you can't get rid of debt quickly and you can't get rid of it nicely. The bullet has to be bitten meaning that debt must be repaid rather than one institution lending to another so that the latter can repay its debt.

Anyone who had listened to what the Bank for International Settlements was saying since 2005 would have been well prepared for the shocks that began towards the end of 2007 and then blew up in 2008. They are now issuing a new warning in their September 2011 report, The Real Effects of Debt. We should heed this warning. They conclude,

"Our examination of debt and economic activity in industrial countries leads us to conclude that there is a clear linkage: high debt is bad for growth. When public debt is in a range of 85% of GDP, further increases in debt may begin to have a significant impact on growth (in 1st qtr 2010 USA's debt: GDP ratio was 117%)....A clear implication of these results is that debt problems facing advanced economies are even worse than we thought. Given the benefits that governments have promised to their populations, ageing will sharply raise public debt to much higher levels in the next few decades. At the same time, ageing may reduce future growth and may raise interest rates, further undermining debt sustainability. So, as public debt rises and populations age, growth will fall. As growth falls, debt rises even more, reinforcing the downward impact on an already low growth rate."

They conclude, "In the end, the only way out is to increase saving." This is part of the process of deleveraging which is likely to take until around 2018 to run its course. These years will be characterised by rolling recessions and deflating asset prices interspaced by short periods of recovery.

The second dynamic which will help shape the world economy will be the demographic changes with so many countries' population age profiles changing for the worse and far outnumbering those that will continue to have positive demographic profiles, India, Indonesia and Brazil to name just three.

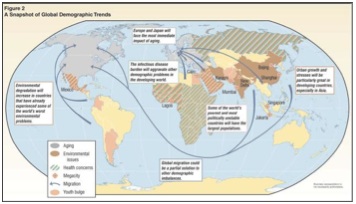

Chart 7: A Snapshot of Global Demographic Trends

Source: CIA, Long Term Global Demographics Trends: Reshaping the Geographical Landscape

Demographic change is not an abstract development; it will have serious consequences for future growth. The OECD, for instance, estimates that the impact of aging on GDP growth rates will be a decrease of growth in Europe to 0.5% a year, in Japan to 0.6% a year and in the USA to 1.5% a year in the period 2025-2050.

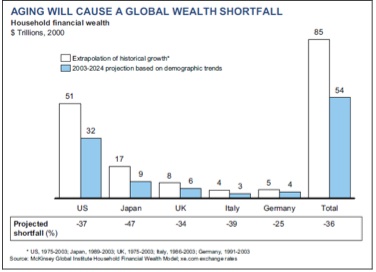

Chart 8: Aging Will Cause a Global Wealth Shortfall

Source: McKinsey & Company

Demographic changes will impact household wealth creation. In their report, The Coming Demographic Deficit: How Aging Populations will Reduce Global Savings, they wrote: "Aging will cause growth in household financial wealth to slow by more than two-thirds across countries we studied (USA, Japan, and W Europe), from 4.5% historically to 1.2% going forward. The slowing growth will cause the level of household financial wealth in 2024 to fall some 36% or by $31 trillion, below what it would have been had the higher historical growth rates persisted."

For Europe, the demographic profile is worrisome. According to data by Dr Clint Laurent and his team at Global Demographics, the number of 65+ aged group rises from around 19.6% of the population in 2011 to 29.1% in 2031 with the dependency ratio standing at just 2% by then.

Chart 9: Demographics of China & the USA

Source: Dr Clint Laurent, Global Demographics

A surprising development is that the demographic profile of the USA is so much better than that of China. Once the USA puts its financial house in better order, which it will if not willingly, its growth expectations will be better than China's. As we say in Yorkshire, "Think on".

For China, based on simple fundamentals, growth has peaked. The years of circa 10% growth are over because such growth is unsustainable and brings in its wake a package of problems. "One approach to forecasting total real GDP of a country is to combine the projected trend in the number of persons employed with the projected trend in the gross productivity per worker" writes Dr Laurent. He calculates that the trends in the education index of the country should give an expected productivity growth of 7.8% a year to 2016 and 5.8% a year to 2021. This equation gives a trend growth rate for real GDP growth of

• 7.5% a year to 2016

• 5.1% a year to 20121, and

• 3% a year to 2031

This slowdown will have a huge impact on China's future requirements of imported metals like copper. This trend is likely to be magnified also by US and other foreign companies vacating China and returning to their home bases – in the USA once the political system rolls back much of the red tape, health care costs and tax issues etc. There is a fundamental reason for companies to return home: it is that multinationals want their supplier chains adjacent to the market, not on the other side of the world.

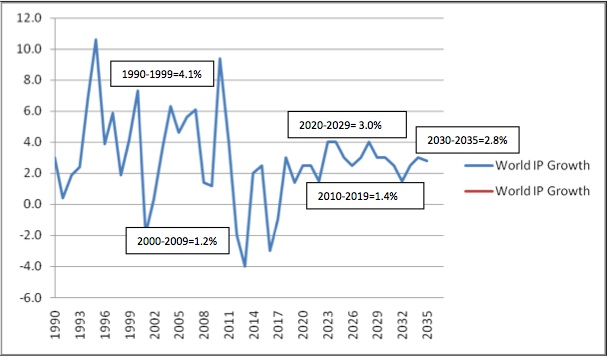

Thus, demographics and debt will be huge constraints on world growth. In the 2020-30 period it will partially be made good by technology so enhancing productivity per worker. The chart below sets out our forecasts of world industrial production to 2035 with average annual growth rates shown for each decade.

Chart 10: World Industrial Production - % Growth Per Annum

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.JohnMauldin.com.

Please write to johnmauldin@2000wave.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.JohnMauldin.com.

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2011 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.