US $15 Trillion National Debt ‘Supercommittee’ Impasse Supports Gold

Commodities / Gold and Silver 2011 Nov 21, 2011 - 09:07 AM GMTBy: GoldCore

Gold is trading at USD 1,706.10, EUR 1,270.60, GBP 1,089.30, CHF 1,569.20, JPY 131,170 and CNY 11,190 per ounce.

Gold is trading at USD 1,706.10, EUR 1,270.60, GBP 1,089.30, CHF 1,569.20, JPY 131,170 and CNY 11,190 per ounce.

Gold’s London AM fix this morning was USD 1,704.00, GBP 1,085.42, and EUR 1,266.44 per ounce.

Friday's AM fix was USD 1,730.00, GBP 1,093.00, and EUR 1,279.87 per ounce.

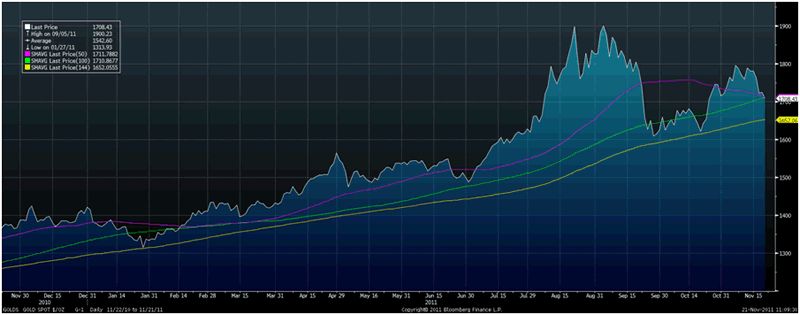

Gold in USD – 1 Year (Daily) – 50, 100 & 144 DMA

Gold is lower in all currencies today except Australian dollars and is down another 1% in USD and 0.5% in EUR.

Last week’s 3.5% fall (in USD) created negative short term technicals. Support is at the $1,700 and $1,680 mark. The 144 day moving average is at $1,652 and a further correction of just 3% could result in gold again testing and finding support at this level.

Equities in Asia and Europe have fallen and headline risk is to the downside. The crisis in Europe is unlikely to improve in the short term and the US cross-party ‘supercommittee’ established to negotiate budgetary savings seems destined to miss the deadline for reaching agreement.

Financial contagion in Europe is pushing already fragile global economies towards recessions, and the risk of slipping into global recession is rising significantly. Indeed, as we have warned for many months, there is a real risk of a global Depression given the scale of the debt levels in most western countries and the massive imbalances globally.

A senior Chinese official, Chinese Vice Premier Wang, said yesterday that a ‘chronic’ long term global recession is certain to happen and China must focus on domestic problems.

While all the focus has been on Europe in recent weeks, markets may again focus on the not inconsequential matter of the appalling US fiscal position which could see further market volatility and the dollar come under pressure again.

Washington's latest fractious effort to come to grips with its mounting debt looks set to end in failure today as negotiators look set to announce they have failed to reach a deal. The Congressional ‘supercommittee ‘charged with cutting the US government's crushing $15 trillion debt looks set to admit failure which should support gold.

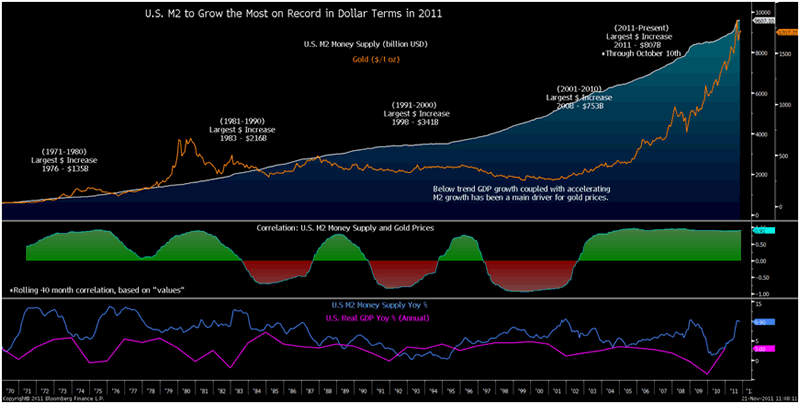

U.S. M2 To Grow the Most on Record in USD Terms in 2011

Safe haven demand has fallen both in Asia and in western markets. Dealers in Asia report demand continues but has fallen from the very high levels seen only a month ago. Western dealers continue to see safe haven demand but much of the buying is from existing clientele adding to allocations and the vast majority of the western public remains unaware and uninvolved in the gold market.

Speculators are showing renewed confidence and money managers, including hedge funds and other large speculators, have raised their bullish bets on gold futures and options to a two-month high.

SPDR Gold Trust, the world's largest gold-backed exchange-traded fund, reported a rise of 3.631 tons from a day earlier to 1,293.088 tons in its holdings, the highest in more than three months. The ETF witnessed an inflow of 24.422 tons last week, the biggest one-week rise in holdings since mid-August.

Commerzbank say they expect to see gold trading at $1,800/oz by the end of the year.

Barclays says it is sticking with a fairly bullish call for gold and says it sees the price at $1,875/oz in Q4, according to Reuters.

Deutsche Bank say they expect periods of risk aversion to remain through 2012 and their strongest conviction trade remains long precious metals and specifically gold, according to Reuters.

"In an environment where real interest rates are negative and the US equity risk premium is high we expect this will sustain strong private and public sector demand for gold. However, this week has shown that gold has become more vulnerable to environments where the US dollar is strengthening," DB say, adding that gold would need to rise beyond $2,170/oz to enter bubble-territory.

Gold’s record high adjusted for inflation is $2,500/oz. All talk of a gold bubble prior to reaching that level is uninformed.

SILVER

Silver is trading at $31.04/oz, €23.09/oz and £19.85/oz

PLATINUM GROUP METALS

Platinum is trading at $1,557.20/oz, palladium at $587.00/oz and rhodium at $1,575/oz.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.