Global Systemic Crisis: Decimation of the Western Banks

Companies / Credit Crisis 2011 Nov 21, 2011 - 04:41 AM GMTBy: LEAP

As anticipated by LEAP/E2020, the second half of 2011 is seeing the world continuing its unstoppable descent into global geopolitical dislocation characterized by the convergence of monetary, financial, economic, social, political and strategic crises. After 2010 and early 2011 which has seen the myth of a recovery and exit from the crisis shattered, it's now uncertainty that dominates the States’ decision-making processes just like businesses and individuals, inevitably generating increasing apprehension for the future. The context singularly lends itself: social explosions, political paralysis and / or instability, return to the global recession, fear over banks, currency war, the disappearance of more than ten trillion USD in ghost-assets in three months, widespread lasting and rising unemployment...

As anticipated by LEAP/E2020, the second half of 2011 is seeing the world continuing its unstoppable descent into global geopolitical dislocation characterized by the convergence of monetary, financial, economic, social, political and strategic crises. After 2010 and early 2011 which has seen the myth of a recovery and exit from the crisis shattered, it's now uncertainty that dominates the States’ decision-making processes just like businesses and individuals, inevitably generating increasing apprehension for the future. The context singularly lends itself: social explosions, political paralysis and / or instability, return to the global recession, fear over banks, currency war, the disappearance of more than ten trillion USD in ghost-assets in three months, widespread lasting and rising unemployment...

Besides, it’s this very unhealthy financial environment that will cause the "decimation (1) of Western banks" in the first half of 2012: with their profitability in freefall, balance sheets in disarray, with the disappearance of trillions of USD assets, with states increasingly pushing for strict regulation of their activities (2), even placing them under public supervision and increasingly hostile public opinion, now the scaffold has been erected and at least 10% of Western banks (3) will have to pass that way in the coming quarters.

However, in this environment, increasingly chaotic in appearance, trends emerge, the outlook sometimes appears positive... and most importantly, the uncertainty is much less than one might think, if only one analyzes the changes in the world within the framework of the world after the crisis rather than with the criteria of the world before the crisis.

In this GEAB issue, our team also presents its 2012-2016 "country risk" forecast for 40 States, demonstrating that one can depict the situations and identify strong trends through the current "fog of war" (4). In such a context, this decision-making tool is proving very useful for the individual investor as well as the economic or political decision-maker. Our team also presents the changes in the GEAB $ Index and its recommendations (gold-currencies-real estate), including of course the means to protect oneself from the consequences of the coming "decimation of Western banks".

For this GEAB issue, our team has chosen to present an excerpt from the chapter on the decimation of Western banks in the first half of 2012.

First half of 2012: Decimation of Western banks

In fact, it will be a triple decimation (5) culminating in the disappearance of 10% to 20% of Western banks over the next year:

. a decimation of their staff

. a decimation of their profits

. and lastly, a decimation of the number of banks.

It will be accompanied, of course, by a drastic reduction in their role and importance in the global economy and directly affect banking institutions in other regions of the world and other financial operators (insurers, pension funds ...).

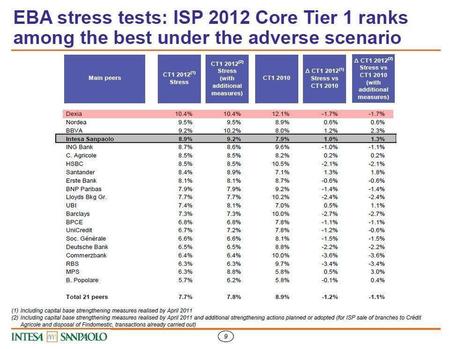

An example of bank information at the time of a global systemic crisis Intesa SanPaulo’s stress test results compared to its European competitors (and compared to the first casualty: Dexia) (6)

Our team could address this issue like the Anglo-Saxon media, the president of the United States and his ministries (7), Washington and Wall Street experts and, on a wider basis, mainstream media (8), have done recently over all aspects of the global systemic crisis, that’s to say by saying, "It’s Greece and the Euro’s fault!" It would obviously be a virtue to reduce this part of the GEAB to just a few lines and suppress any hint of analysis of the possible causes in the US, the UK or Japan. But, coming as no surprise to our readers, it won’t be LEAP/E2020’s choice (9). As the only think tank to have anticipated the crisis and rather accurately foreseen its various phases, we’re not now going to give up an anticipation model that works well, benefitting from prejudice without any predictive power (Don’t let’s forget that the Euro is still alive and well (10) and that Euroland has just completed the small feat of, in six weeks, putting together the 17 parliamentary votes needed to strengthen its financial stabilization fund (11)). So, instead of echoing the propaganda or "readymade thought" let’s remain faithful to the method of anticipation and stick to a reality that we must uncover in order to understand it (12).

In this case, for ages, when one thinks of "banks" one thinks first of all of the City of London and Wall Street (13). And with good reason, London for over two centuries and New York for nearly a century have both been the two hearts of the international financial system and the lairs par excellence of the world’s major bankers. Any global banking crisis (as any major bank event), therefore, begins and ends in these two cities since the modern global financial system is a vast process of incessant wealth recycling (virtual or real) developed by and for these two cities (14).

The decimation of the Western banks that begins and will continue in the coming quarters, an event of historic proportions, cannot therefore be understood without first of all measuring and analyzing the role of Wall Street and London in this financial debacle. Greece and the Euro will undoubtedly play a role here as we have discussed in previous GEAB issues, but these are triggers: Greek debt is yesterday’s banking venality that is exploding in the public arena today; the Euro is the arrow of the future that is piercing the current financial balloon. These are the two fingers that highlight the problem, but they aren’t the problem. This is what the wise man knows and the fool doesn’t, to paraphrase the Chinese proverb (15).

In fact, one only needs to look at London and Wall Street to anticipate the future of Western banks, since it's quite simply there that the banking flock gathers together to come and drink its dollar dose every evening. And the condition of the Western banking system can be measured through changes in bank staff numbers, their profitability and their shareholders. From these three factors one can directly deduce their ability to survive or disappear.

The decimation of bank staff numbers

Let’s begin with the numbers then! Here the picture is bleak for banking sector employees (and now even for the "banking system stars"): since mid-2011 Wall Street and London have continuously announced mass layoffs, spread by the secondary financial centers such as Switzerland and Euroland and Japanese banks. A total of several hundreds of thousands of banking jobs that have disappeared in two waves: first of all in 2008-2009, then since the late spring of this year. And this second wave is gradually gaining momentum as the months go by. With the global recession now under way, the drying up of capital flows to the United States and the United Kingdom as a result of the geopolitical and economic changes under way (16), the huge financial losses in recent months, and all kinds of regulations which gradually "break" the super-profitable banking and financial model of the 2000s, the heads of major Western banks have no choice: they must, at any price, cut their costs as quickly as possible and deeply. Therefore, the simplest solution (after that of overcharging clients) is to lay off tens of thousands of employees. And that's what is happening. But far from being a controlled process, we see that every six months or so Western bank leaders find that they had underestimated the extent of the problems and are therefore obliged to announce further mass layoffs. With the political and financial “perfect storm” looming in the U.S. for next November and December (17), LEAP/E2020 anticipates a new series of announcements of this kind from early 2012. The “cost-killers” in the banking sector have some good quarters in front of them when we see that Goldman Sachs, which is also directly affected by this situation, reduced to limiting the number of green plants in its offices to save money (18). Although, after eradicating the green plants, it’s usually the “pink slips” (19) that flower.

The decimation of the number of banks

In a way, the Western banking system looks increasingly resembles the Western steel industry of the 1970s. Thus the "ironmasters; thought they were the masters of the world (incidentally actively contributing to the outbreak of World Wars); just like our "major merchant bankers" thought they were God (like Goldman Sachs CEO) or at least masters of the universe. And the steel industry was the "spearhead", the "absolute economic example" of power for decades. Power was counted in tens of millions of tons of steel just like the power of billions in bonuses for merchant bank executives and traders in recent decades. And then, in two decades for the steel industry, in two / three years for the banks (20), the environment has changed: increased competition, collapsing profits, massive layoffs, loss of political influence, the end of massive subsidies and ultimately nationalization and / or restructuring giving birth to a tiny sector compared to what it was at its heyday (21). In a sense, therefore, the analogy applies to what awaits the Western banking sector in 2012/2013.

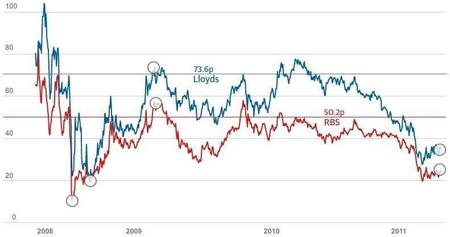

Share price changes (and, therefore, losses) for the British taxpayer following the partial government takeover of RBS and Lloyds - Source: Guardian, 10/2011

Already on Wall Street in 2008, Goldman Sachs, Morgan Stanley and JP Morgan had to suddenly turn themselves into "bank holding companies" to be saved. In the City, the British government had to nationalize a whole swathe of the country's banking system and to this day the British taxpayer continues to bear the cost because the banks’ share prices have collapsed again in 2011 (22). This is also one of the Western banking system’s characteristics as a whole: these private financial players (or market listed) are worth practically nothing. Their market capitalization has gone up in smoke. Of course this creates an opportunity for nationalization at low cost to the taxpayer from 2012 because it’s the choice that will be imposed on States, in the United States as in Europe or Japan. Whether it be, for example, Bank of America (23), CitiGroup or Morgan Stanley (24) in the United States, RBS (25) or Lloyds in the United Kingdom (26), Société Générale in France, Deutsche Bank (27) in Germany, or UBS (28) in Switzerland (29), some very large institutions "too big to fail" will fail. They will be accompanied by a whole swathe of medium or small banks such as Max Bank which has just filed for bankruptcy in Denmark (30).

Faced with this "decimation", States’ resources will be quickly overrun, especially in these times of austerity, low tax revenues and the political unpopularity of the bank bailout (31). Political leaders will, therefore, have to focus on protecting the interests of savers (32) and employees (two areas full of electoral promise) instead of safeguarding the interests of bank executives and shareholders (two areas full of electoral pitfalls, whose precedent in 2008 demonstrated its economic futility (33)). This will result in a new collapse in financial stock prices (including insurance, considered very "close" the banking situation) and increase hedge funds, pension funds (34) and other players’ turmoil traditionally closely intertwined with the Western banking sector. No doubt this will only strengthen the general recessionary environment by limiting loans to the economy just as much (35).

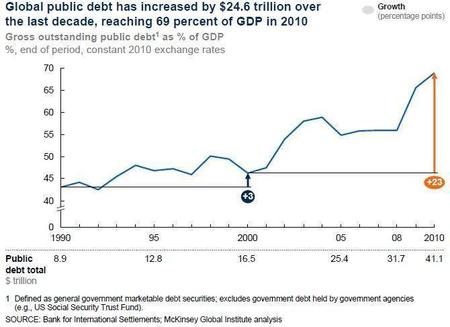

Global public debt (1990-2010) (as a % of GDP, constant 2010 exchange rates) - Sources: BRI / McKinsey, 08/2011

To simplify the view of this development, one can say that the Western banking market, significantly reducing its scope and the number of players in this market, has to downsize proportionally. In some countries, especially those where the very large banks account for 70% or more of the banking market, it will inevitably lead to the disappearance of one or another of these very large players ... whatever their leaders, stress tests or rating agencies say (36). If you are a shareholder (37) or customer of a bank that may collapse in the first half of 2012 there are, of course, precautions to take. We offer a number in the recommendations in this issue. If one is an officer or employee of such an institution, things are more complicated because we now think it’s too late to avoid serial bankruptcies; and the banking job market is saturated because of massive layoffs. However, here is a piece of advice from our team if you are an employee in any of these institutions, if you are made an interesting offer of voluntary redundancy, take it as the next few months, the redundancies won’t be voluntary and will be under much less favorable conditions.

Notes here.

GEAB is an affordable and regular decision and analysis support instrument intended for all those whose work involves some understanding of ongoing and future global trends seen from a European point of view: advisors, consultants, researchers, experts, heads of public institutions, research centres, international companies, financial institutions and major NGOs. Available in: Français, English, Deutsch, Español Frequency: Monthly - 10 issues a year published on the 16th of each month (interruption in July/August) Contributors: Every issue is coordinated by Franck Biancheri and mobilises the totality of our research teams © 2011 Copyright LEAP - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.