Silver Trend Rethink on Mounting Deflation Threat

Commodities / Gold and Silver 2011 Nov 20, 2011 - 03:11 PM GMTBy: Clive_Maund

We have had a major rethink since the last update was posted, which was one reason why no update was posted last weekend. This rethink has been occasioned by the rapid tilt towards deflation of the past couple of weeks. In the last update you may recall that we assumed that politicians and world leaders would follow the easiest route of QE which would lead in the direction of hyperinflation, but we really should know by now that you can't assume anything in this business. For sure, most of them would like to follow this route, for it buys them the maximum time before they end up at the end of a rope, but unfortunately for them they are losing control and things are starting to fall apart at alarming rate.

We have had a major rethink since the last update was posted, which was one reason why no update was posted last weekend. This rethink has been occasioned by the rapid tilt towards deflation of the past couple of weeks. In the last update you may recall that we assumed that politicians and world leaders would follow the easiest route of QE which would lead in the direction of hyperinflation, but we really should know by now that you can't assume anything in this business. For sure, most of them would like to follow this route, for it buys them the maximum time before they end up at the end of a rope, but unfortunately for them they are losing control and things are starting to fall apart at alarming rate.

Details of the latest thinking re the deflation/hyperinflation arguments are set out in the parallel Gold Market update, to which you are referred, and it will suffice here to give as examples of the tilt towards deflation the moves in the US to rein in the deficits and of course the spiking bond interest rates in Europe - if we do not see dramatic large scale intervention by the European Central Bank (ECB) involving a massive blast of QE, Europe will be finished shortly as a united economic entity, and after a possible temporary party to celebrate the demise of Europe, the US Treasury market will collapse.

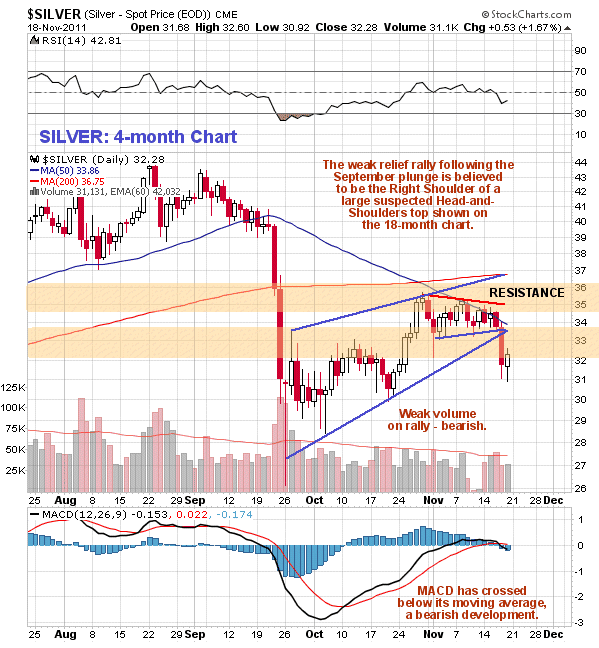

On the 4-month chart for silver we can examine recent action in detail. In the light of the latest thinking the rally from late September following the brutal plunge is now viewed as a weak relief rally, which failed on Thursday with a breakdown, which was anticipated on the site with a warning being given, and for a break lower by the broad stockmarket. Volume on this rally was weak, and after struggling beneath heavy resistance centered on $35 and its falling 50-day moving average for more than 2 weeks, silver broke down from the uptrend in force from late September. The MACD has dropped down through its moving average, which is a bearish development. We cannot hope to grasp the big picture of what is going on in silver on a 4-month chart, so now we will look at an 18-month chart.

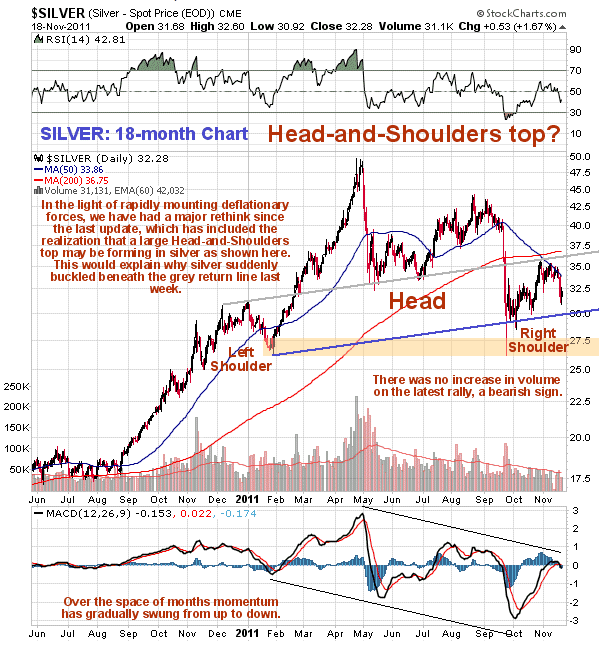

The 18-month chart for silver shows all of the action from the start of the big ramp that began in August of 2010. Earlier thinking was that as a 3-wave decline, involving 2 crashlets, had completed by the September low, a new 5-wave major uptrend would follow, and of course it would if politicians obliged with a globally coordinated QE campaign, but unfortunately it doesn't look like they are going to get that together and we are instead looking at the specter of a deflationary implosion triggered by the collapse of Europe. This realization has prompted a reexamination of the charts which has led to the discovery of a large Head-and-Shoulders top in silver completing above an upsloping neckline as shown. Other technical factors suggesting that an H&S top is indeed completing are the volume pattern - there was no increase in volume at all on the latest rise to mark out the Right Shoulder of the pattern and a particularly ominous development is the strongly downtrending MACD indicator which is showing that the major trend is swinging steadily from up to down - and we are already firmly in down territory.

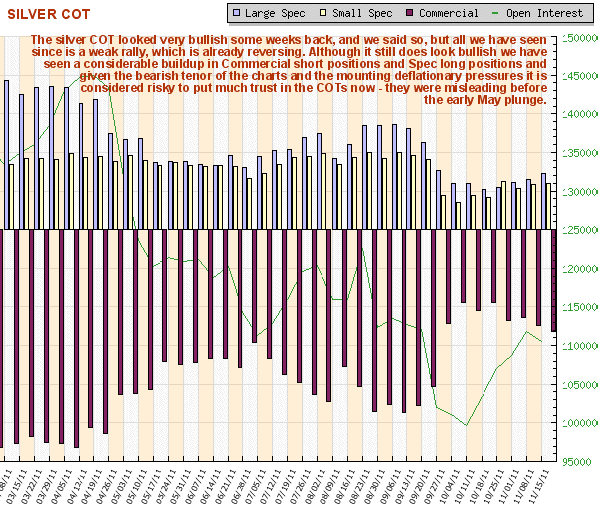

A reason for our bullishness in the recent past was the COT charts, which showed a very low Commercial short and Large Spec position. However, the COT has deteriorated in recent weeks with little to show for it in the way of a rally. Currently it still looks rather bullish, and it is difficult to reconcile this with the bearish picture we have just described which correlates with the potential for a brutal collapse in world stockmarkets associated with deflationary forces coming to the fore again.

By Clive Maund

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2011 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.