Euro-zone Will Print or Perish

Interest-Rates / Quantitative Easing Nov 20, 2011 - 10:16 AM GMTBy: John_Mauldin

Europe is again at center stage. At conferences and meetings and in private conversations, it is the topic of the hour. I have thought a lot this week about Europe and its impact, so once again we delve into what is an evolving situation. This time, we look at possible impacts on the markets, as we ponder the questions, “Are we back to 2008?” and “Is there a Lehman in our future?” and I try once again to keep from making this a book-length letter. And I close with some brief thoughts I brought back from DC on the Super Committee and the deficit cuts.

Europe is again at center stage. At conferences and meetings and in private conversations, it is the topic of the hour. I have thought a lot this week about Europe and its impact, so once again we delve into what is an evolving situation. This time, we look at possible impacts on the markets, as we ponder the questions, “Are we back to 2008?” and “Is there a Lehman in our future?” and I try once again to keep from making this a book-length letter. And I close with some brief thoughts I brought back from DC on the Super Committee and the deficit cuts.

But first, and quickly, I want to say that I am very pleased that Amazon has made Endgame one of their Best Books of the Year for 2011 AND their editors’ pick of “Gift Ideas for a Geeks,” although I am not sure how they define geek (I never thought of myself as smart enough to be a geek). The book has had very good sales of late, which is probably due to the fact that it is out in front explaining the crisis that is being caused by the end of the debt supercycle. Plus, good reviews and favorable mentions from congressional leaders (like Paul Ryan in the New York Times a few weeks ago) have helped.

It makes a good gift for Christmas or for clients! You can get it from Amazon at http://www.amazon.com/Endgame. Now, let’s jump right in to Europe and its own particular Endgame.

Print or Perish

Last week I attempted to give a short summary of the problems that face Europe. I called it “Where is the ECB Printing Press,” though I could have titled it “Print or Perish.” If you missed it, you can read it at http://www.johnmauldin.com/frontlinethoughts/where-is-the-ecb-printing-press. (For foreign readers, “publish or perish” is a mantra of the US university system, where if you do not publish in certain journals, you do not get tenure.)

Now let me summarize that letter in one paragraph. Europe has too much sovereign debt, which is on the books of its banks, which have too much debt; and there is a huge trade imbalance between core and peripheral Europe. All three problems must be solved in order to prevent the Eurozone from imploding. And while the debt is the “sore thumb” today, the trade imbalance is the biggest problem. As I outlined in Endgame, it is impossible for a country to balance its government and business deficits while running a trade deficit. This is an accounting identity and is true for all countries at all times. Greece and others are in a monster predicament. No amount of austerity will work until their labor costs drop (for both private and government workers) and their trade deficits are brought into alignment.

I pointed out that the Eurozone must find at least €3 trillion (give or take) to pay for the sovereign debt “haircuts” and bank losses. Some argue it is only €2 trillion and others argue for €6 trillion. Whatever it is, it is such a large number that it cannot be found by borrowing or creating a special fund. The ONLY way to deal with it is to allow the ECB to print, essentially putting a floor underneath Eurozone bonds, especially those of Italy and Spain, both of which governments are too big to save by conventional means.

Now, with that in mind let’s look at what we learned this week. In the interest of space, I am going to leave out a lot of back-up data, and perhaps in future weeks we will go into greater depth. But I am again attempting an overview here. First, Sarkozy is essentially arguing that the ECB must be allowed to deal with the bank problems by supplying whatever funds are needed. This is of course his position, as French banks are so insolvent that it is not possible for France to bail them out and remain an AAA-rated country (more on that later). If France loses its AAA rating, the EFSF debt rating is essentially meaningless and the fund will be downgraded. End of game.

If the ECB does not backstop the banks and Italian and Spanish debt, the Eurozone will fall into a deflationary debt spiral. The large majority of European banks (even in core countries) are basically insolvent. They simply hold too much sovereign debt of all types, at leverages approaching 40 to 1. They have this debt on their books at face value. Even a write-down of 10% wipes out most of their capital. It would be an unmitigated disaster. Look at Dexia. Only a few weeks before it was nationalized by the French and Belgians, the regulators were telling us the bank was well-financed. And then Bang! In a matter of a few weeks, it had to be taken over by the governments.

Note please that these are the same regulators that said European banks only needed about €3 billion this summer, and recently that has been raised to €100 billion. They have no clue what mark to market means, but the market does. Bank financing dries up quickly and there is a default moment. Maybe the only real purpose of European bank regulators is to make US regulators look conservative and prudent.

Allowing banks and sovereign governments to default at the scale we are talking about means Europe would be plunged into a depression. And that of course means the value of the euro would plummet.

Just Say “Nein”

Angela Merkel has been adamant in simply saying “Nein.” To let the ECB print in the amount needed would indeed be inflationary. It would also mean the value of the euro drops, maybe by a lot.

“German Chancellor Angela Merkel rejected French calls to deploy the European Central Bank as a crisis backstop, defying global leaders and investors calling for more urgent action to halt the turmoil.

“As the crisis sent borrowing costs in core economies outside Germany to euro-era records, Merkel listed using the ECB as lender of last resort alongside joint euro-area bonds and a “snappy debt cut” as proposals that won’t work.

“ ‘I’m convinced that none of these approaches, if applied right now, would bring about a solution of this crisis,’ Merkel said in a speech in Berlin today. ‘If politicians believe the ECB can solve the problem of the euro’s weakness, then they’re trying to convince themselves of something that won’t happen.’

“Merkel’s comments underscore German reluctance to assume more liability for taming the debt crisis even as it moves on to France, the euro region’s second-largest economy, and threatens to trigger a global recession. While President Barack Obama renewed calls for Europe to act, Merkel said ‘political action’ to tighten budget rules is needed to stem the turmoil.”

( http://www.businessweek.com/news/2011-11-18/merkel-rejects-ecb-as-crisis-backstop-in-clash-with-france.html)

Hold that thought as we look at a rather sensationalized article in the London Telegraph, in which we learn that “Angela Merkel, the German chancellor, is today expected to tell David Cameron that Britain does not need a referendum on EU treaty changes, despite demands from senior Conservatives for more powers to be repatriated to Britain. The leaked memo, written by the German foreign office, discloses radical plans for an intrusive new European body that will be able to take over the economies of beleaguered eurozone countries.

“It discloses that the EU’s largest economy is also preparing for other European countries, which are too large to be bailed out, to default on their debts — effectively going bankrupt. It will prompt fears that German plans to deal with the eurozone crisis involve an erosion of national sovereignty that could pave the way for a European “super state” with its own tax and spending plans set in Brussels.” ( http://www.telegraph.co.uk/news/worldnews/europe/eu/8898044/Germanys-secret-plans-to-derail-a-British-referendum-on-the-EU.html)

The Telegraph published a six-page document, attributed to the German Foreign Ministry, suggesting that partial bankruptcy must be made possible for all euro members "unable to achieve debt sustainability. There must also be the option of an orderly default [of a struggling euro member] to reduce the burden on taxpayers" in other Eurozone countries that are paying for its bailout, the document said.

“There is nothing secret about it," the ministry said Friday, stressing that it contained ideas on which Foreign Minister Guido Westerwelle had already publicly commented.

Merkel and Germany are playing a very high-stakes game with France in particular and the rest of Europe in general. Let me first say that it would be absurd for Germany not to be thinking about all its options. One of those options most assuredly must be how they would go about allowing European banks and government to fail and what might be the consequences, whether or not they have any real intention of doing so. To not think about that would be irresponsible for a government. After thinking about it, they could decidedly reject it, but to not think about it? Somewhere in Germany I will bet you there is a memo on what it would take for Germany to leave the euro and who would go with them. Just saying…

(Likewise, someone in Greece must be thinking about what it would take to leave the euro, whether or not they have any intention of doing so. Someone, albeit very privately and behind closed doors, has to look at the options.)

Germany is in a game where the costs of leaving the euro, or a real euro break-up, are extremely high. But the costs of bailing out the profligate members of the Eurozone are also extremely high. Either way the cost is formidible. It is not a choice of whether they will bear a huge cost burden, but just what form that burden takes.

The Germans would like the rest of Europe to get their budgets and deficits under control BEFORE they have to accept those costs. Not getting those agreements means that there will be no end to the amount of money Germany will have to pay. It will all too soon be enough that it would put their own credit rating at risk. They can envision how that works out. Without real spending controls, what disciplines a nation to not spend as much as it can get away with?

What Germany wants is for some mechanism to insure (and assure their voters) that the rest of Europe will control their deficits. And that means some type of European-wide control on spending and for governments to give up their sovereignty in exchange for the backing of Germany and/or the ECB. Otherwise, go ahead and default and see how that works out for you.

That is a perfectly rational position. But it is a huge gamble, as allowing the crisis to go a “bridge too far” would mean an economic crisis of biblical proportions, from which the recovery would be long and brutal.

But what does Germany have to lose by pushing it? Simply giving in without some sort of real controls in place for national deficits is not a solution from the German taxpayer point of view. Allowing the ECB to print without real fiscal guarantees from the various beneficiary governments simply postpones the inevitable and means a great deal of cost in the meantime.

And Then There Is France

France has the weaker hand, but Sarkozy is playing it well. France cannot backstop its banks without losing its AAA rating. And if that happens before the elections next year, Sarkozy is toast. Further, if they really nationalized their losing banks, it would put them in a very precarious financial position. The French economy is already very dependent on government spending. Taxes are about 46% of GDP and government spending is 53%. The national debt is at 82% of GDP and rising, as the annual national deficit is 5.7%.

France is likely to grow at less than 1% for the year and is also likely to slip into recession along with the rest of Europe in 2012. If they do slip into recession, the deficit will rise as costs explode and revenues fall. Not a good thing when the markets are beginning to question your debt.

French interest rates on its ten-years bond rose to 3.72% this week. That is about 1.9% over German bonds. Just a few years ago that difference was less than 20 basis points (0.2%). That is the market clearly indicating concern about French debt.

The Guardian wrote last month: “The M&G analysts say: French spread widening poses a major problem because the tail tends to wag the dog when it comes to credit ratings. In other words, widening spreads tend to cause credit rating downgrades, which tend to cause further spread widening.

“That would not be good for France – or perhaps more crucially for the EFSF – which is why the markets are convinced that president Nicolas Sarkozy will do everything in his power to ensure that AAA rating is maintained – and not just for national vanity.”

Note they wrote that when the spread was less than 140 basis points, which they considered cause for concern. In less than a month it had risen to 189, as of Wednesday.

Both Italian and Spanish 10-year debt rose to over 7% this week before the ECB stepped in and bought €10 billion of the debt, bringing rates back into the mid-6 range. Without ECB buying, the interest rates would be soaring. Although that did not keep my CNBC friend Steve Liesman from recommending buying Italian bonds as an investment to get the yield. No chance of a default, I guess. Trusting the ECB and the Italian government to back that debt takes faith-based investing to a whole new level. But enough investors agreed with Steve that Italy sold its debt issuance, with a little help from the ECB.

The markets are beginning to wonder, what is the difference between Italian and Spanish debt and Greek and Portuguese debt? And that means France is in a very difficult position, because the markets are also beginning to wonder, what is the difference between French debt and Italian debt? Admittedly, French rates have not been historically high, looking back over the last decade, but the recent direction is not good news, given the current turmoil.

Rising interest rates make it even harder to get your deficit under control. (Is anyone paying attention in Washington?) France has an even larger future-liability problem than the US. And taxes are already at a level that any increase is just not really useful and could hurt more than it helps. And you think the Greeks don’t like austerity? Try cutting French farm subsidies or pensions or government salaries. The streets will erupt. I have long contended that France is on an unsustainable path. They too are coming to their own version of the Endgame.

That is why Sarkozy is pounding the table to get Europe to backstop the banks and limit the banking crisis. They are approaching the theoretical limits of their economic ability to absorb more debt, and the market senses it. And that is why he is opposing the German plan. It means a disaster for France in the not-too-distant future. The numbers, even in French, don’t lie.

How Will it Play Out?

No matter what Europe does, not matter what Germany and France do, Europe is in for a lot of pain. Recession most assuredly and likely a severe one, if not a depression. While I think that eventually Germany allows the ECB to print, that is not a foregone conclusion.

From a European perspective, printing money is a real problem, and for some countries an economic disaster. But (selfishly) what the US and the rest of the world needs is for Europe not to let its banking system implode. A recession will hurt exports, but Europe only accounts for a little over 10% of US exports. Losing even 20% of that is a problem, but not a disaster. What is a disaster is another 2008 banking crisis.

The US, while not robust, is in Muddle Through mode. 2-3% growth is still growth. While not generating enough jobs to really make a serious dent in unemployment, the economy is not making the situation worse. But that could change. As I have written for two years, my biggest concern is a European banking crisis coming to the US and the rest of the world. And recent data suggests that the markets are beginning to share that concern.

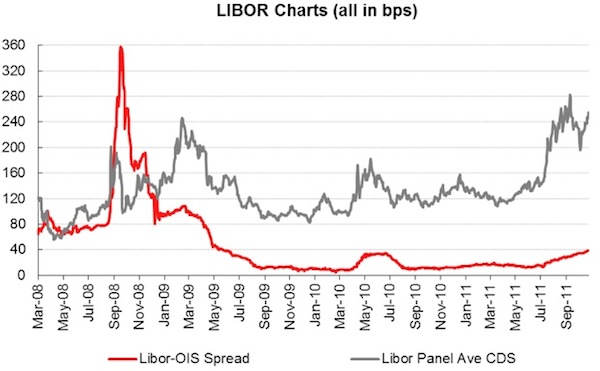

Credit spreads are rising, as is the cost of interbank funding. My co-author Jonathan Tepper of Variant Perception sent me this note today:

“One of the main reasons for the disparity is that Libor panel CDSs, i.e. the credit default swaps on the banks that participate in the interbank lending market, have shot up to levels beyond what was seen during the Lehman crisis. The CDSs are telling you that people have grave doubts about the solvency of the interbank lending market.”

And we are seeing spreads begin to widen in the US. They are not at levels that suggest a crisis is imminent, but they are worrisome. And this is the type of thing that you see before a crisis becomes evident. Credit market turmoil has a very nasty way of leaking into all market prices.

The game that Merkel and Sarkozy are playing is a very serious one. The markets are right to be focused on Europe, because the Europeans could bring the whole thing down on our collective heads. We must hope they get it right and that someone really decides what to do, instead of bluffing.

For what it’s worth, I really am at the point where I do not think the euro will survive with the current mix of countries, nor do I think that Germany thinks so either. Greece is likely to go, as is Portugal. Can Spain really get its deficit under control in time? Do we see a “two-euro” world, one in the northern states and one in the southern? And to which one does France go? Looking at the politics, one might think the answer is obvious, but if you just look at the numbers, it is clearly not. France is in many respects a Mediterranean country. So many choices and none of them good.

Again, all we really need is for Europe to not let their banks implode. Is that asking too much?

Some Thoughts on the Super Committee

I met privately on Tuesday with Senator Rob Portman of Ohio, who is on the “Super Committee.” I really do like his thoughtful approach and am impressed with his knowledge of spending and the deficit. Then again, he was head of the Office of Management and Budget, so he spent years involved in the issues and numbers.

I must confess that what I saw was not encouraging. There just is not a lot of progress. Portman gets that we need to cut about $1.2 trillion annually from the deficit, not just over ten years. And while I recognize that some of that will have to be done with taxes, to make tax increases 50% of the total will simply stall the economy in ways we won’t like. We will enshrine European levels of unemployment. The problem is not tha taxes are too low but that spending is too high. And that spending problem was created on a bipartisan basis, so I am not pointing fingers here.

The most important thing is that the deficit is brought under control and put on a path to sustainability, which requires a deficit below the growth rate of the country. Otherwise we risk a situation like Europe is facing now. Unless there is a real breakthrough, I think it is just better to take the cuts that are currently on the table, even if they are painful to both parties, and then go to the polls next year and decide.

Interesting election cycle, is it not?

New York, Hong Kong, and Singapore

I am really looking forward to next week. Thanksgiving is my favorite holiday, and I will be cooking for a large group again. Prime rib, turkey, and all the fixings, plus my special mushrooms and butternut squash soup. The clan is gathering.

I fly to Cleveland for one day tomorrow to be with my great friend Mike Roizen at the Cleveland Clinic, where my one issue (a funky right arm) is now an excuse for him to arrange for a complete physical at the Cleveland Clinic Wellness Center. Since I am there anyway… And it has been over two years, so he is right.

Then the next weekend it’s NYC on Sunday to meet with Bill Dunkelberg (the NFIB chief economist) to work on our new book on creating jobs, plus have some other meetings and then head back to Texas Tuesday morning. Then I am home for a while.

The next “real” trip is to Hong Kong in mid-January to be with the team at the Hong Kong Economic Journal and speak at their conference. I will let you know more about that conference as the time gets nearer. The HKEJ has started publishing my writing, and I am excited to meet them in person. I am going to take the opportunity to then go to Singapore to visit and learn. I have never been to either country, so this will be a real learning experience for me. I am sure I will get to meet a lot of new friends.

And all that international traveling (South Africa is again on my future agenda) brings to mind that International Living magazine on my desk. I think that needs to go into my Saturday reading pile. You can get your own copy at http://www1.internationalliving.com/outside/november11/invinse/ .

It is late and time to hit the send button. Because the HKEJ is now translating my letter for their Monday edition, I need to finish the letter earlier than I have been recently, so I am going to have to figure out how to get done earlier on Friday nights. Have a great week.

Your really nervous about Europe analyst,

By John F. Mauldin

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.JohnMauldin.com.

Please write to johnmauldin@2000wave.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.JohnMauldin.com.

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2011 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.