Sovereign Wealth Fund Capital Injections Will Fail to Increase Commercial Bank Lending

Stock-Markets / Credit Crunch Dec 21, 2007 - 10:35 AM GMTBy: Paul_L_Kasriel

When economists discuss investment in real capital expenditures they make a distinction between gross and net. If investment expenditures just match the depreciation of capital equipment, then gross investment rises, but net investment is unchanged. Increases in net investment, not gross investment, are what matters with regard to the future productivity of the economy.

When economists discuss investment in real capital expenditures they make a distinction between gross and net. If investment expenditures just match the depreciation of capital equipment, then gross investment rises, but net investment is unchanged. Increases in net investment, not gross investment, are what matters with regard to the future productivity of the economy.

Financial institutions have been experiencing a good bit of "depreciation" of their financial capital of late due to losses on some of their investments. So-called sovereign funds have been advancing these financial institutions funds in order to shore up their diminished capital. But this is akin to the gross investment expenditures discussed above. These fund injections just replace some of the financial capital that has evaporated due to losses. These capital injections do not enable financial institutions that have experienced recent accelerated depreciation of their capital to increase their lending - just allow them to cut back less on their lending than otherwise. In the absence of this depreciation of financial capital, these sovereign funds could have been advancing funds that would have resulted in net new lending.

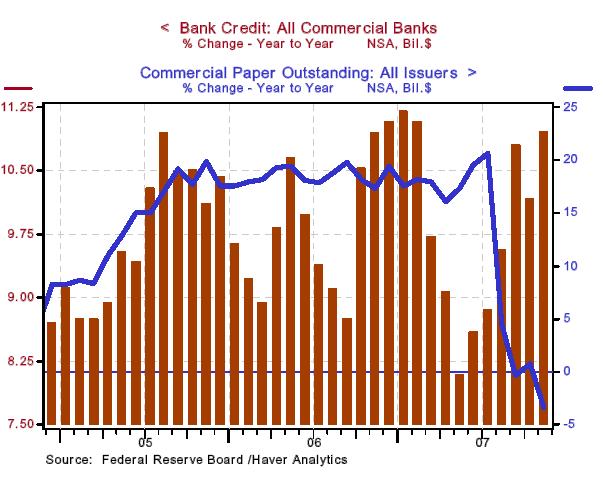

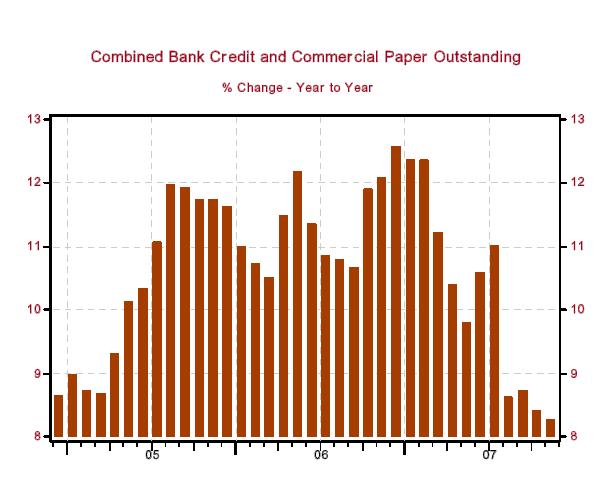

U.S. commercial banks have been adding to their loans and investments at a faster pace in the past four months as commercial paper issuance has contracted (see Chart 1). The reason for the contraction in commercial paper outstanding is the increased risk aversion to commercial paper directly or indirectly related to the residential mortgage market. With the difficulties in rolling over commercial paper, borrowers have tapped back-up lines of credit at commercial banks. In addition, some of the entities formerly funding themselves in the commercial paper market were "sponsored" by commercial banks. These sponsoring banks have taken onto their balance sheets the assets of these sponsored entities. When we examine the behavior of the combined aggregate of commercial bank credit and commercial paper, we see that there has been a sharp slowing in the growth of this aggregate in the past four months (see Chart 2). Again, this is akin to the distinction between gross and net investment. Although bank credit growth has picked up, it has been largely to refund old debt rather than to create net new debt.

Chart 1

Chart 2

The upshot of all this is that the U.S. economy is experiencing a sharp increase in the depreciation of its financial capital. It will need large increases in its gross financial investment just to keep its net financial investment from contracting.

By Paul L. Kasriel

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2007 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Paul L. Kasriel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.