Is Economic Optimism Warranted Or Not?

Economics / US Economy Nov 20, 2011 - 06:19 AM GMTBy: Tony_Pallotta

"Things are not always what they seem; the first appearance deceives many; the intelligence of a few perceives what has been carefully hidden" - Author unknown

"Things are not always what they seem; the first appearance deceives many; the intelligence of a few perceives what has been carefully hidden" - Author unknown

Recent economic data has surprised to the upside and once again hope springs eternal. Like a school of bait fish many economists and market pundits seem to be reversing course scrambling to highlight the positives in the economy while ignoring the structural problems that still exist.

I caution against taking the easy road and simply accepting this renewed optimism at face value for two reasons.

The first reason is probably the most blatant argument one could make against the quality of the current economic recovery. The consumer price index (CPI) has averaged approximately 3.5% on a rolling 12 month basis in 2011. The price deflator though which is used to inflation adjust nominal GDP into real GDP has been 2.5%. In other words the BEA estimates inflation a full percentage point below CPI. Considering GDP through 2011 has averaged .8% there's your entire "economic recovery."

I will ignore that argument though because I am sure an academic can "explain" why the two measures of inflation are different yet correct. Talk about irony though as the Fed fears the effects of deflation the BEA finds it very useful. The second reason is far more compelling. We have been here before.

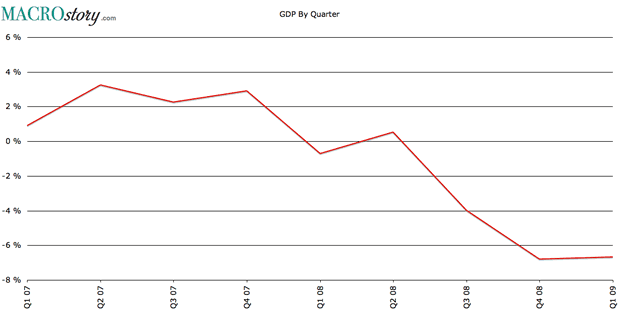

In the summer of 2008 market chatter was all about goldilocks and the Fed adjusting monetary policy just enough to manage a soft landing. Like a plane practicing touch and goes the US economy would skip right off the runaway and back into a normal flight path. The data was supporting this argument.

On July 31, 2008 the first estimate of Q2 GDP was 1.9% up from 0.9% in Q1 2008 while unemployment averaged 5.8% throughout the summer. Far from a recessionary outlook and certainly not what one would expect as a precursor to the "Great Recession." Then a shock event came, subprime MBS affected the quality of collateral in the repo market and overnight liquidity disappeared.

Three months later the first estimate of Q3 2008 GDP contracted (0.3%) later revised to contract at (3.99%) and (6.78%) in Q4. So much for goldilocks and monetary policy getting it just right.

Fast forward just three years and once again the economy is teetering on expansion or contraction. Goldilocks has been replaced with "transitory soft patch" and a new shock event has hit the global economy. Sovereign debt has replaced subprime MBS. For those who think this is a European problem explain why MF Global (how fitting global is in the name) is the first and so far only bankruptcy from a "European problem."

I won't go into the mechanics of how a freeze in liquidity can turn a global economy on a dime as it did in 2008. In 2008 the threat was a run on the banks. In 2011 the banks themselves are now causing their own "bank run." This time on sovereign debt.

Europe arguably has already entered recession. The US consumer has pushed their savings rate to 3.6% from 5.3% in just three months and at levels last seen in December 2007. The inventory build cycle which drove economic growth has come to an end and contracted in September. Most alarming though was the words of Eric Rosengren, Boston Fed President during a speech November 16 when he was quoted "Crisis might warrant coordinated action by Fed, ECB."

So whether it is the "deflated" price deflator or the liquidity crunch facing the global economy I believe history will once again show the current state of economic optimism to be completely misguided. Question what you are being told and don't be deceived by first appearances.

By Tony Pallotta

Bio: A Boston native, I now live in Denver, Colorado with my wife and two little girls. I trade for a living and primarily focus on options. I love selling theta and vega and taking the other side of a trade. I have a solid technical analysis background but much prefer the macro trade. Being able to combine both skills and an understanding of my "emotional capital" has helped me in my career.

© 2011 Copyright Tony Pallotta - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.