Don't Sweat the Gold Price Correction

Commodities / Gold and Silver 2011 Nov 18, 2011 - 12:09 PM GMTBy: Jeff_Clark

Jeff Clark, BIG GOLD writes: I've told more than one concerned investor that when the gold price falls, they should "come back in three months" and see if they're still worried. The idea is that the daily and monthly gyrations are nothing to fret over, that the price will recover and, in time, fetch new highs.

Jeff Clark, BIG GOLD writes: I've told more than one concerned investor that when the gold price falls, they should "come back in three months" and see if they're still worried. The idea is that the daily and monthly gyrations are nothing to fret over, that the price will recover and, in time, fetch new highs.

That advice has worked every time gold underwent any significant correction (except in late 2008, when one had to take a longer view than three months). Here's proof.

I've traded emails regularly with Brent Johnson ever since meeting him at an investor event I spoke at a couple years ago. He's the managing director of Baker Avenue Asset Management, a wealth management firm with over $700 million in assets. He forwarded some charts he'd prepared for his clients that put gold's September decline into perspective; it's a good visualization of my standing advice to worriers.

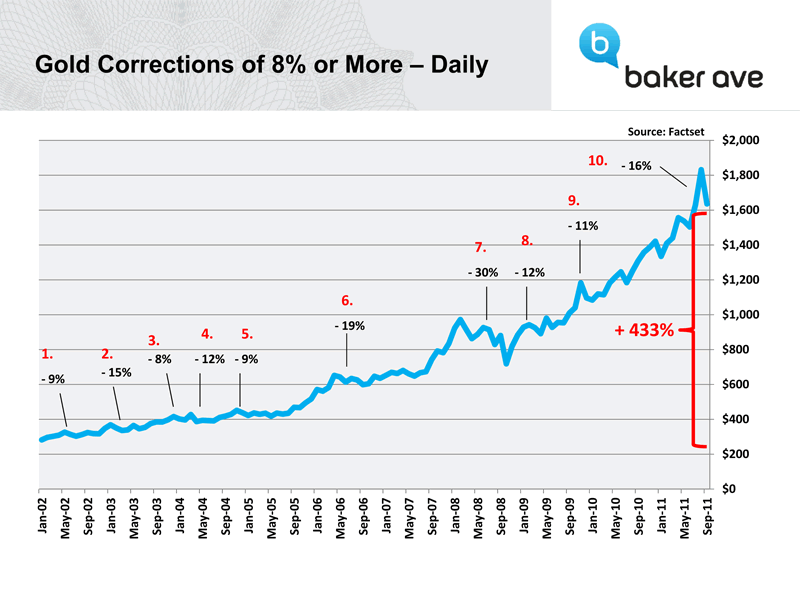

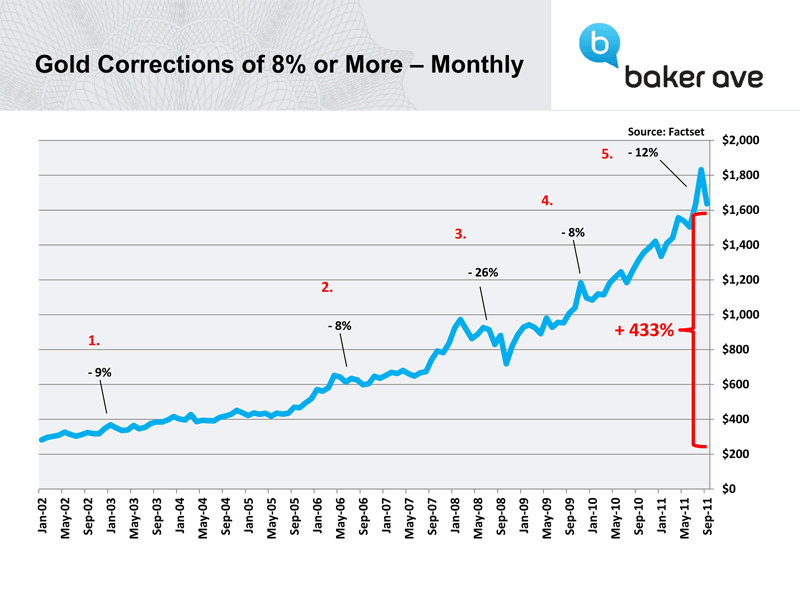

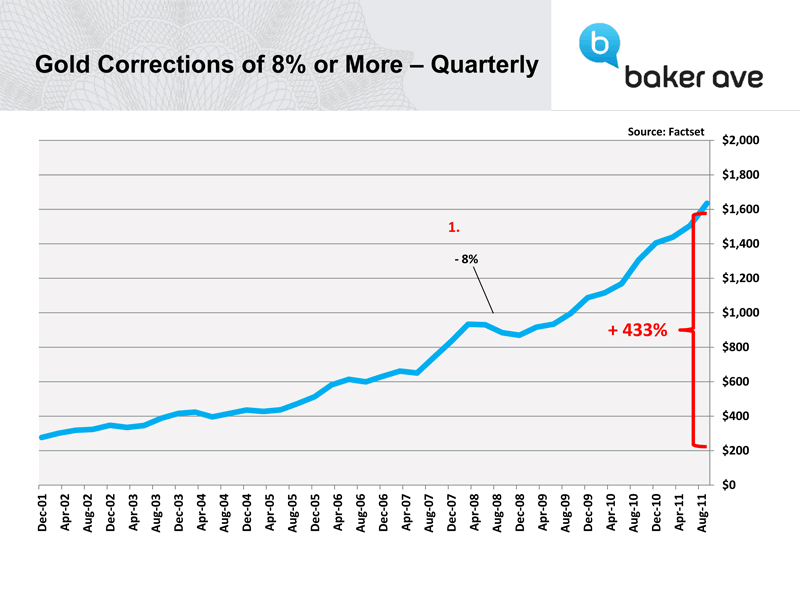

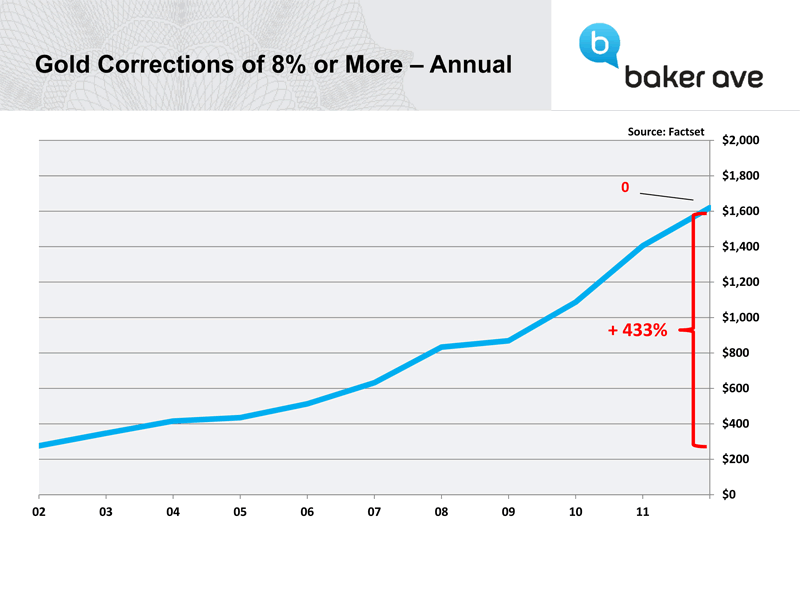

The following charts document corrections in the gold price of 8% or more – first measured with daily prices, then monthly, quarterly, and finally annually. See if this doesn't put things into perspective.

While the gold price has had plenty of big corrections since late 2001, they're not so concerning when viewed beyond a day-to-day basis. In fact, if one resists checking the gold price except once a quarter, one might wonder what all the fuss with price declines is about.

You'll also notice that the September decline, when measured monthly, was our second biggest in the current bull market (and third when calculated daily). This suggests to me that unless we have another 2008-style meltdown in all markets, the low for this correction is in.

That's not to say the price couldn't fall from current levels, of course, nor that the market couldn't get more volatile. It's simply a reminder that when viewed on any long-term basis, corrections are nothing but one step down before the next two steps up. It tells us to keep the big picture in mind.

It also implies that pullbacks represent buying opportunities. It demonstrates that one could buy any 8% drop with a high degree of confidence. Keep that in mind the next time gold pulls back.

Until the fundamental factors driving gold shift dramatically – something that would require most of them to completely reverse direction – I suggest deleting any worries about price fluctuations from your psyche.

And if you're still a tad uneasy about today's gold price, well, let's talk next February.

[The current issue of BIG GOLD lists the top stocks to buy in our portfolio, ones we're convinced are destined for much higher stock prices before this bull market is over. Get their names, along with our new Bullion Buyers Kit, with a risk-free trial here.]

© 2011 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.