Gold Falls 2.5% But Up 21% YTD, Technical’s Short Term Bearish; Long Term Bullish

Commodities / Gold and Silver 2011 Nov 18, 2011 - 08:16 AM GMTBy: GoldCore

Gold is trading at USD 1,727.10, EUR 1,278.60, GBP 1,090.30, CHF 1,579.20, JPY 132,590 and CNY 10,970 per ounce.

Gold is trading at USD 1,727.10, EUR 1,278.60, GBP 1,090.30, CHF 1,579.20, JPY 132,590 and CNY 10,970 per ounce.

Gold’s London AM fix this morning was USD 1,730.00, GBP 1,093.00, and EUR 1,279.87 per ounce.

Yesterday's AM fix was USD 1,756.00, GBP 1,115.70, and EUR 1,304.12 per ounce.

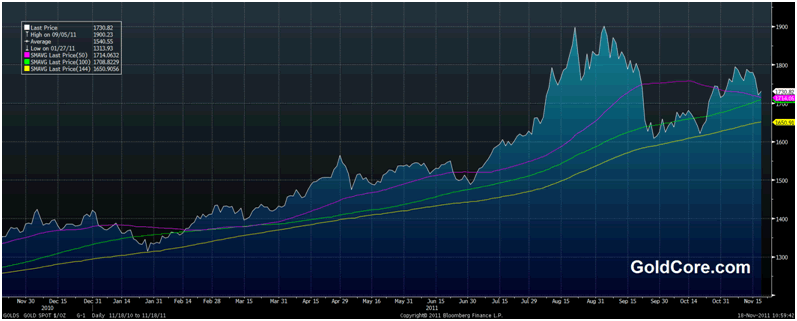

Gold in USD – 1 Year Daily and DMAs

Gold has bounced 0.5% today, after falling 2.5% yesterday. Gold is down 2.6% week to date and is headed for its first weekly loss in four weeks which would turn the short term technicals bearish.

Spot gold has rebounded above the 50-day moving average that it fell below yesterday. The 50-day MA is moving close to crossing below the 100-day MA, which can be seen as a bearish technical signal. However, the last time gold’s 50 dma fell below the 100 dma in February 2011 it was prelude to rising prices in the coming months (see chart above).

However, while the short term technicals may turn bearish, the long term technicals remain positive as does the all important fundamental picture as seen in the global gold supply and demand figures yesterday.

The data was extremely positive but there was an element of ‘buy on the rumour’ and ‘sell on the news’ as the positive demand backdrop may have been factored into prices.

Official intervention as ever cannot be ruled out and there is now a frequent pattern of somewhat odd sharp sell offs prior to options expiry – options expire next Tuesday.

Yesterday’s sell off was attributed to risk aversion due to concerns of contagion after Fitch warned that US banks face a “serious risk” from Europe’s debt crisis. This led to sharp sell offs in equity and many commodity markets which likely resulted in traders, hedge funds and other speculators closing gold positions and moving to cash.

Massive uncertainty, counter party and systemic risk is leading to some speculators and fund managers opting out of the paper or leveraged gold market and moving to cash. Some are also moving into the safety of physical bullion in the form of allocated accounts.

The Wall Street Journal mentioned how the continuing liquidation of holdings by former MF Global clients, as accounts become unfrozen by the trustee, helped pressure precious metal prices lower.

The trustee of the troubled brokerage, which filed for bankruptcy protection last month, has been transferring client holdings to other clearing firms with only partial margins, or collateral deposits, as around $600 million of client money was reported missing. Clients who are unable to post additional margins with the new client firms are being forced to sell their holdings, according to the Wall Street Journal.

The MF Global fraud looks set to lead to thousands of clients losing their investments and has claimed some brokerages as victims.

Counter party and systemic risk is on a scale never seen before in modern financial history (or indeed in all of history due to the globalised and massively integrated nature of financial markets today) and this will lead to more investors avoiding brokerages who offer leveraged paper gold vehicles via the official exchanges and opting to buy physical bullion over the counter.

It may also lead to further questioning of some of the gold ETFs due to their many custodians and sub custodians and the high level of indemnification in their prospectuses.

The Shanghai Gold Exchange lifted silver margin requirements to a very high 18% of a contract’s value, up from 15% previously.

Some believe this may have exacerbated the sharp selloff in silver yesterday. It’s not clear when the new margin requirements come into effect, but a report by Reuters said it would likely be from Monday.

Arbitrary and incomprehensible margin increases will likely lead to traders in the spot and futures markets opting for physical bullion as they realize that the leverage offered by paper gold products is a double edged sword.

‘Return of capital’ rather than ‘return on capital’ will become a dominant theme in the coming weeks and months as contagion leads to the domino effect of innumerable bankruptcies globally.

Gold and particularly silver are ‘on sale’ at these levels (silver fell 6% yesterday) and buyers of bullion with a long term outlook will again be wise to buy this dip. Gold is just above the 100 day moving average at $1,708/oz and the 100 day moving average has proven to be a good entry point for buyers in recent months and years.

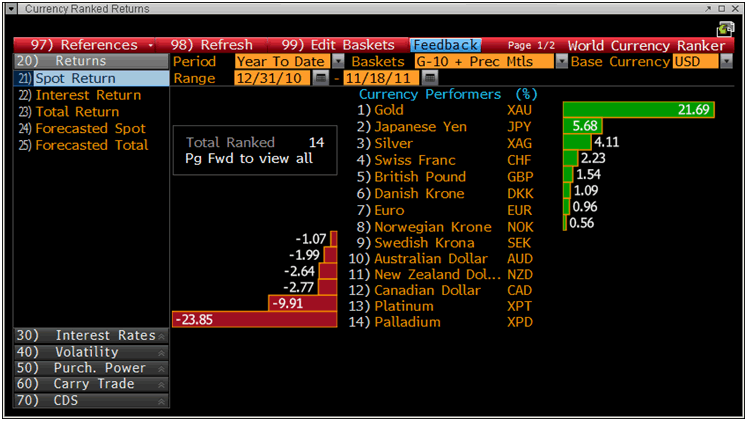

While gold fell 2.6% yesterday, it is important to focus on the long term and gold remains up 1% MTD, 4% QTD & 21% YTD.

Silver’s sharp fall yesterday mean that its monthly and quarterly performance are negative but year to date silver is up 4%. This is quite a performance after last year’s 80% gain and suggests that silver is consolidating prior to further price gains in the coming months.

Thus, the precious metals are again outperforming equity indices in 2011 showing their importance as a diversification for investor portfolios.

For breaking news and commentary on financial markets and gold, follow us on Twitter.

SILVER

Silver is trading at $32.34/oz, €23.80/oz and £20.38/oz

PLATINUM GROUP METALS

Platinum is trading at $1,592.70/oz, palladium at $609.50/oz and rhodium at $1,575/oz.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.