Slowing Germany and Rising PIIGS Yield Make Perfect Economic Crisis Storm

Economics / Double Dip Recession Nov 18, 2011 - 07:07 AM GMTBy: Capital3X

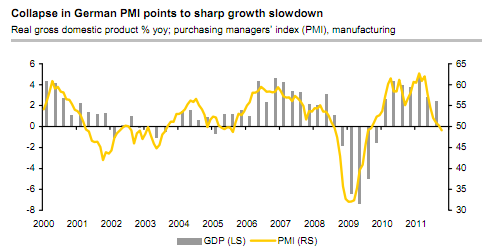

Germany registered an impressive quarter-on-quarter growth of 0.5% in the third quarter. However, the recent drop in the leading indicators suggests that the German economy will not expand much in Q4, if at all; it might even contract. The uncertainties triggered by the sovereign debt crisis are increasingly dampening activity. The growth rate for the second quarter was revised upwards, from 0.1% to 0.3%. This suggests that the German economy might expand by 3.0% in 2011 as a whole which is impressive but well baked into the price.

Germany registered an impressive quarter-on-quarter growth of 0.5% in the third quarter. However, the recent drop in the leading indicators suggests that the German economy will not expand much in Q4, if at all; it might even contract. The uncertainties triggered by the sovereign debt crisis are increasingly dampening activity. The growth rate for the second quarter was revised upwards, from 0.1% to 0.3%. This suggests that the German economy might expand by 3.0% in 2011 as a whole which is impressive but well baked into the price.

In complete contrast to what happened in the third quarter, the German economy is unlikely to expand much, if at all, in the fourth quarter; it might even contract. German carmakers worked weekends to produce more cars than before which allowed the GDP to register the extra kick (0.3 points) which will be absent in the next GDP. All leading indicators are now pointing to an extended period of slowdown and even contraction in the German economy.

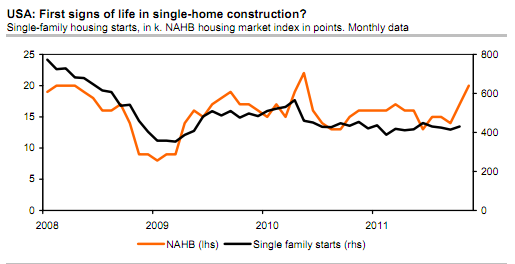

US Building Permit

US housing activity stabilized on a somewhat higher plateau in October. Housing starts declined only marginally to 628k while building permits rose more than 10% to 653k, the highest level since March 2010. While building is still on a depressed level, there are some signs of improvement recently.

The recently released National Association of Home Builders’ housing market index rose 3 points to 20 in November. This is the highest reading since May 2010, a number which was distorted by the housing tax credit. Ignoring this artificial boost, the index rose to a four years high. Taking into account that ‘50’ marks the dividing line between expansion and contraction, this is still an extremely low level. We believe that the next round of housing contraction is around the corner and will make the case for the next round of QE.

Bond Market Update

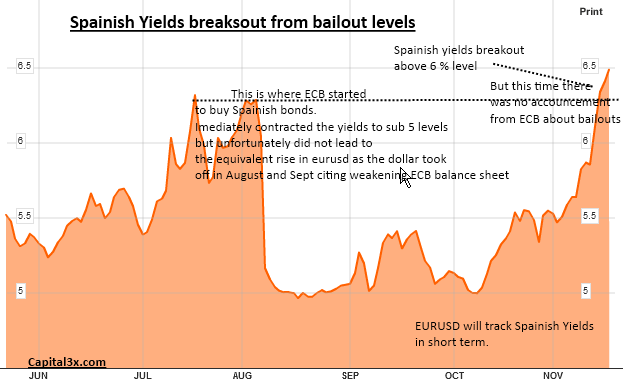

Spain: Yields breakout ominious

Spainish yields broke out in anticipation of weekend elections with neither party having a clear agenda to reduce national debt. The breakout of 6% is a clear indication that EURUSD has some tough days ahead.

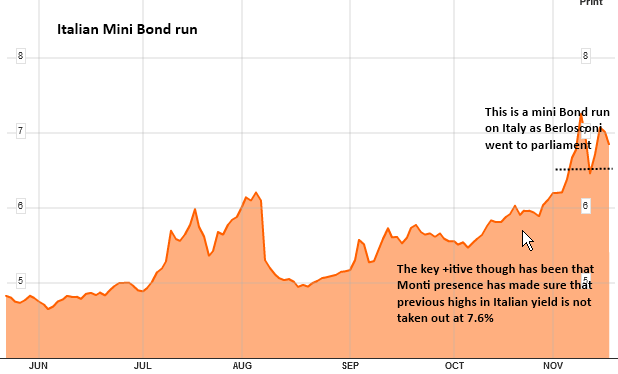

Italy fate with Bond run

Italy came wafer thin to complete bankruptcy as bonds made a run as Berlosconi made his way to the parliament and announced that he will stay. If you have not seen a bond run before, you need to take a look at the picture and stare.

Important that after Monti government, investors have respected those highs and have not tested them again. Confidence returning?

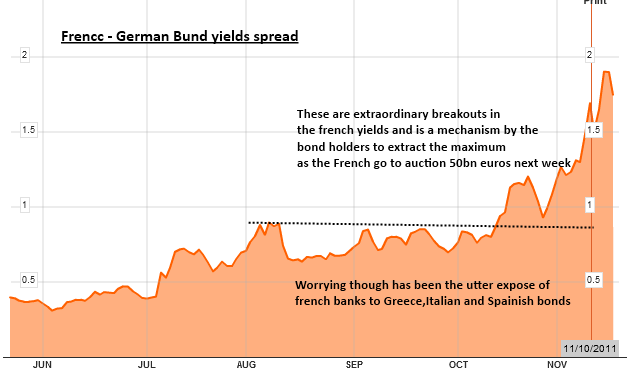

More worrying that Spainish and Italian debt has been the unstoppable rise in spreads between the french and the German 10Y yield spreads.

We look forward to doing further work on these extra ordinary moves in the bond markets over the next week as Dec 9 EU summit approaches which could hold surprises if word on the street is to be believed but again we do know from past experiences, these are all pre fabricated rumors before the summit.

As long as Italy and Spainish yields are outside the breakout range, we continue to see eur bearishness to persist.

Our feeds: RSS feed

Our Twitter: Follow Us

Kate

Capital3x.com

Kate, trading experience with PIMCO, now manage capital3x.com. Check performance before you subscribe.

© 2011 Copyright Capital3X - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.