EU Gold Investment Demand Surges 135%, World Demand Up 6% in Q3 2011

Commodities / Gold and Silver 2011 Nov 17, 2011 - 11:26 AM GMTBy: GoldCore

Gold is trading at USD 1,759.10, EUR 1,305.60, GBP 1,116.30, CHF 1,618.20, JPY 135,390 and CNY 11,190 per ounce.

Gold is trading at USD 1,759.10, EUR 1,305.60, GBP 1,116.30, CHF 1,618.20, JPY 135,390 and CNY 11,190 per ounce.

Gold’s London AM fix this morning was USD 1,756.00, GBP 1,115.70, and EUR 1,304.12 per ounce.

Yesterday's AM fix was USD 1,773.00, GBP 1,124.43, and EUR 1,311.49 per ounce.

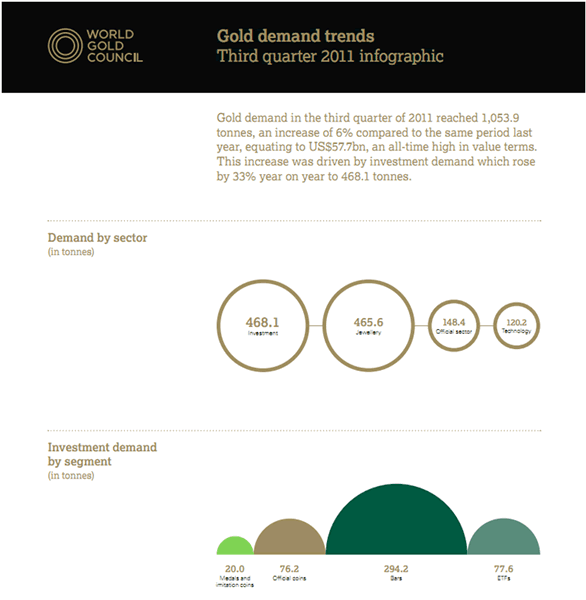

Gold Demand Trends (Q3 2011) released today by the World Gold Council (GoldCore Research Section) shows that investment and central bank demand for gold were key drivers of total gold demand last quarter. Third quarter gold demand increased 6% year on year to 1,053.9 tonnes with investment demand rising a significant 33% y/y to 468.1T.

Virtually all markets saw strong double-digit growth in demand for gold bars and coins. Investment demand in Europe surged 135% due to the deepening sovereign debt crisis.

Significantly, 390.5 tonnes of the 468.1 tonnes of investment demand went into physical bullion in the form of bars and coins.

ETF demand was 77 tonnes and nearly 50% of that was from European investors and institutions.

The increase in overall investment demand was quiet impressive considering the higher average price in the quarter and the price correction in September but not surprising given the scale of the global economic crisis.

A huge and paradigm shift change in the gold market is central bank buying which rose 556% to 148.4T from 22.6T in Q3 last year. For the past 15 years there has been net selling of around 400 tonnes per annum from central banks.

Importantly, the World Gold Council can only identify about 40 to 50 tonnes of the 148.4 tonnes bought by central banks.

The WGC note that "additional purchases were made by a number of countries' central banks, which cannot currently be identified due to confidentiality restrictions". Central banks do not have to reveal immediately who purchasers are.

The World Gold Council’s Marcus Grubb told Bloomberg that “we can’t say who it is … we do not exactly know who the central banks are” but that they are likely “surplus countries” or creditor nations in “Latin America, Central Asia and the Far East.”

The fact that there is 100 tonnes of new central bank buying that is unaccounted for is not surprising to GoldCore and analysts who have long been saying that the People’s Bank of China and other central banks are likely continuing to quietly and gradually accumulate large quantities of bullion.

They are not declaring their purchases due to concerns that this may further devalue their currency reserves which are mostly in US dollars and also in euros and would result in them having to pay higher gold prices for their new gold reserves.

Central bank gold demand and unaccounted for central bank gold demand is very bullish for the gold market and has barely been reported on in the non-specialist financial media.

Also of note was the fact that Chinese jewellery demand surpassed India – which has only happened in 4 quarters since January 2003. Chinese gold demand in the first 3 quarters is now already ahead of last year entire demand for 2010.

It is important to note that while the total gold demand figure of 1,053.9 tonnes in Q3, 2011 sounds like a lot, it is actually very small in investment, foreign exchange and financial terms as it is worth just $57.7 billion.

Total global investment assets are estimated to be over $200 trillion. Average daily turnover in global foreign exchange markets is estimated at over $4 trillion. Russia’s Sberbank, a bank many will not have heard of, has a market cap of $60 billion.

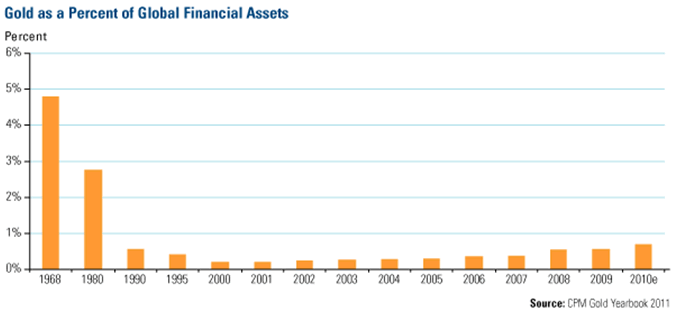

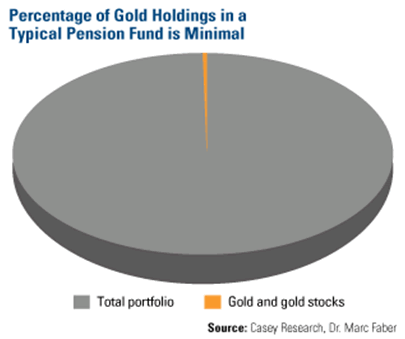

Gold remains a negligible part of the world’s investment and financial universe and remains under owned by savers, investors, institutions and central banks internationally.

This latest report which can be read here shows that this is changing but the increase in demand continues to be from a very low base.

Given gold’s proven risk mitigation, hedging and safe haven properties, it is likely that savers and investors will continue to seek protection from economic uncertainty.

This uncertainty shows no signs of abating and indeed appears to be set to deepen in the coming weeks and into 2012.

Scaring investors from diversifying into gold by comparing the gold market today to the 1970s boom and bubble burst continues to be unfortunate and imprudent. It is a simplistic theory propagated by the biased and by those who have not bothered to inform themselves about the gold market.

SILVER

Silver is trading at $33.04/oz, €24.54/oz and £21.00/oz

PLATINUM GROUP METALS

Platinum is trading at $1,602.20/oz, palladium at $630.00/oz and rhodium at $1,600/oz.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.