Euro Gold Outperforming Bunds and Euro Assets / Celente’s MF Global Gold Account ‘Looted’

Commodities / Gold and Silver 2011 Nov 16, 2011 - 02:54 PM GMTBy: GoldCore

Gold is trading at USD 1,775.20, EUR 1,318.30, GBP 1,125.30, CHF 1,630.20 , JPY 136,576 and CNY 11,263 per ounce.

Gold is trading at USD 1,775.20, EUR 1,318.30, GBP 1,125.30, CHF 1,630.20 , JPY 136,576 and CNY 11,263 per ounce.

Gold’s London AM fix this morning was USD 1,773.00, GBP 1,124.43, and EUR 1,311.49 per ounce.

Yesterday's AM fix was USD 1,765.00, GBP 1,113.99, and EUR 1,302.39 per ounce.

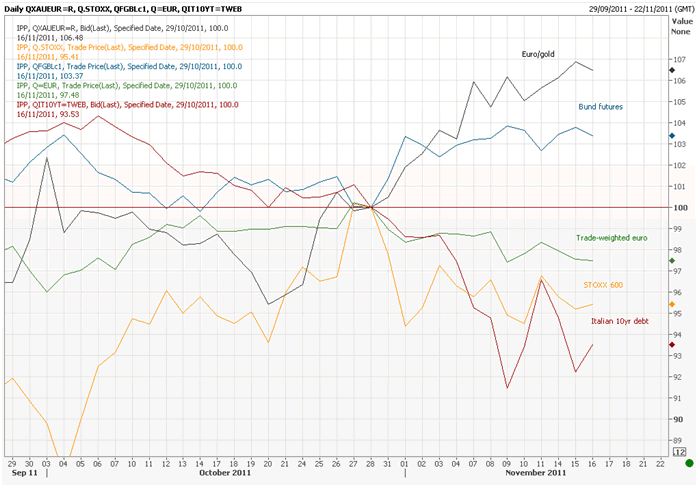

Euro/Gold Outperforms Stoxx 600, German Bunds and Euro Assets (Reuters Chart)

Gold is marginally lower today but is consolidating in all currencies after French, Belgian and Austrian bond yields gained sharply yesterday as contagion takes hold in the Eurozone. French financial markets experienced turmoil on Tuesday, reflecting fears that France is being sucked into the spiraling debt crisis.

UK unemployment soared to 2.62 million in Q3 and joblessness among young people climbed above 1 million for the first time since at least 1992. Sterling fell against all majors and gold due to the appalling jobs numbers and more indications that the BoE will embark on QE3 – further devaluing sterling.

Gold in British pounds has risen to £1,125/oz and is now only 5% below the record nominal high reached on the 5th of September of £1,179/oz.

COMEX gold options floor trader Jonathan Jossen told Reuters that there were lots of bullish plays on gold yesterday. Out-of-the money bull call spreads and outright out-of-money calls were seen with $1,800, 1,900, 2,000 and 2,100 being popular strike prices.

US regulator, Bart Chilton, the Democratic commissioner at the US Commodity Futures Trading Commission said he thinks “something nefarious” occurred at MF Global, deepening the criticism facing the fallen futures brokerage.

As customers worried about whether they will recoup the full value of their accounts, some filed court papers on Tuesday looking to form a committee to protect their interests.

Chilton told Reuters Insider that US regulators are closer to finding out what happened to roughly $600 million in missing customer money.

“The money is not where it should be. I think something nefarious has happened, potentially something illegal,” he said.

Reuters also reports how CFTC Commissioner Bart Chilton, who recently acknowledged silver market manipulation, said the regulator's budget should not be cut.

One of the more high profile victims of MF Global’s fraud is economist and trends forecaster Gerard Celente.

Celente became the latest victim of the MF Global bankruptcy when funds, in the six figures, in his gold futures account were taken (or ‘looted’ as Celente called it) by Chapter 11 trustees. Celente was hit with a margin call within days of the corporate shutdown despite his account being fully funded.

(YouTube) – Gerald Celente on His Gold Account Being ‘Looted’ by MF Global

Celente told Russia Today (RT), “I really got burned, I got a call last Monday, I have an account with Lind-Waldock, and I have been trading gold since 1978, and I have a very simple strategy. As you well know, I’ve been very bullish on gold for many years… So I was building up my account to take delivery on a contract, and I got a call on Monday, and they said I needed to have a margin call. And I said, what are you talking about, I’ve got a ton of money in my account. They responded, oh no you don’t, that money’s with a trustee now.”

He said that MF Global “have cleaned out and ruined a lot of people. So maybe the name MF, I’m thinking the first word of MF is ‘mother’ and we could put the other word in there if you use your imagination . . . because that is what they are doing to everybody.”

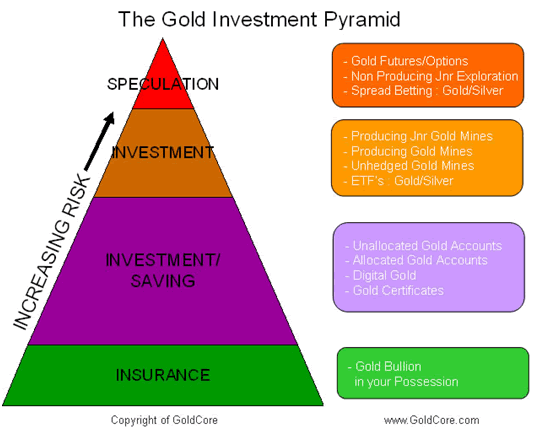

Celente is astute and is on record regarding the importance of owning physical gold bullion. The incident shows the increasingly fundamental importance of owning physical bullion (see table above) – either by taking delivery or by owning in personal allocated accounts.

For breaking news and commentary on financial markets and gold, follow us on Twitter.

SILVER

Silver is trading at $34.47/oz, €25.55/oz and £21.83/oz

PLATINUM

Platinum is trading at $1,629.20/oz, palladium at $655.50/oz and rhodium at $1,600/oz.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.