Paulson Sells Gold ETF, Buys Physical Bullion? Soros Not Gold Bearish

Commodities / Gold and Silver 2011 Nov 15, 2011 - 10:49 AM GMTBy: GoldCore

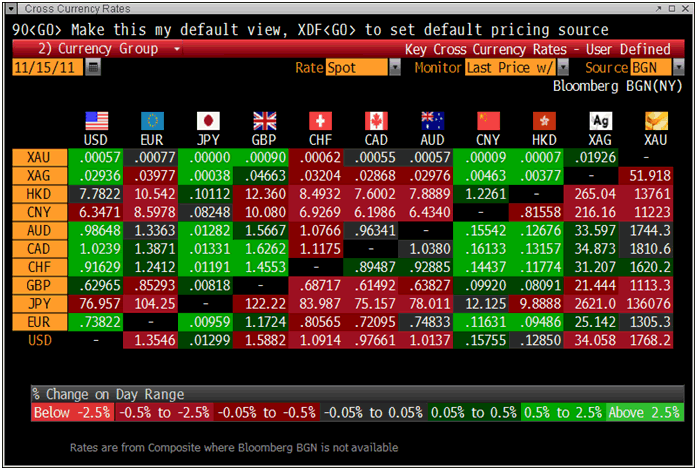

Gold is trading at USD 1,768.20, EUR 1,305.30, GBP 1,113.30, CHF 1,620.20 , JPY 136,076 and CNY 11,223 per ounce.

Gold is trading at USD 1,768.20, EUR 1,305.30, GBP 1,113.30, CHF 1,620.20 , JPY 136,076 and CNY 11,223 per ounce.

Gold’s London AM fix this morning was USD 1,765.00, GBP 1,113.99, and EUR 1,302.39 per ounce.

Yesterday's AM fix was USD 1,780.50, GBP 1,115.29, and EUR 1,299.06 per ounce.

Cross Currency Table

Gold has fallen 0.6% in US dollars to $1,768/oz but is flat in the beleaguered euro at €1,306/oz. Volatility and sell offs in equity and European bond markets appears to be contributing to gold’s failure to rise through the $1,800 level. Europe's ability to tackle its growing debt crisis is in serious doubt which is leading to renewed risk off sentiment and short term gold weakness.

Gold will be supported by its proven safe haven status, but is prone to short term weakness due to sell offs in the wider financial markets. Sentiment remains very fragile which will lead to continuing safe haven demand which shall support gold in the medium and long term. Especially as the official policy response is inflation and the currency debasement.

The gold ETF SEC filings were released overnight and make for interesting reading.

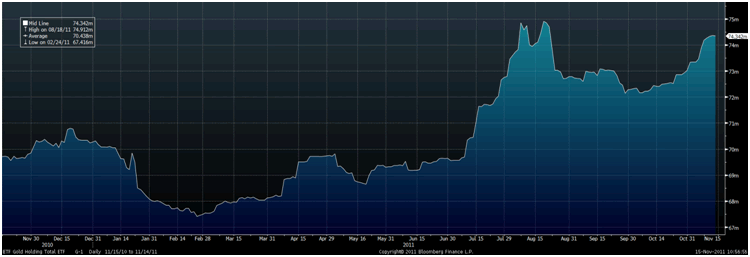

Known Gold Holdings by Exchange Traded Funds/ Trusts Worldwide

Paulson & Co., the hedge fund founded by billionaire John Paulson, cut its stake in the SPDR Gold Trust to 20.3 million shares in the third quarter from 31.5 million as of June 30. The firm remained the largest holder.

Paulson & Co. sold a third of their SPDR holding which is quite a large liquidation. However, Paulson remains bullish on gold as was seen in positive comments he made recently so it would seem likely that this sale may have been an effort to raise cash after his fund suffered sharp losses in the last quarter. Some hedge funds sold the ETF to cover losses during a rout that erased $7.8 trillion from the value of global equities since May.

Given Paulson’s expressed bullishness on gold, his fund may have opted for allocated accounts as was done by David Einhorn.

The SEC filings also show that billionaire investor George Soros increased his stake in the SPDR Gold Trust. Soros’ gold ETF sale was latched onto by gold bears and some advisers to warn that gold was a risky bubble.

Soros Fund Management LLC held 48,350 in the SPDR Gold Trust as of Sept. 30, compared with 42,800 shares at the end of the second quarter.

The increase in Soros gold holdings are meager at some $10 million worth but suggest that Soros is not as bearish on gold as the multitude of news headlines, regarding his comments regarding gold being “the ultimate asset bubble”, would suggest.

Soros added 145,000 call options and 120,000 puts in SPDR Gold in the third quarter. This confirms that Soros is not as bearish on gold as some would have us believe.

There is also the real possibility that Soros’ fund, like other hedge funds, may have opted to own allocated bullion rather than a gold trust. Some hedge funds have opted for allocated gold bullion due to it being more discreet with a lack of disclosure (no quarterly filings), due to the lower long term costs and due to allocated accounts having less counter party risk than a trust with many indemnifications.

Steven Cohen’s SAC Capital Advisors LP and New York- based Touradji Capital Management LP established gold positions in the third quarter. SAC Capital, which manages $14 billion and is based in Stamford, Connecticut, held 184,601 shares in the SPDR Gold Trust as of Sept. 30. Paul Touradji had 45,000 shares compared with none on June 30, the filings show.

Total holdings in exchange-traded products backed by gold reached a record 2,330 metric tons on Aug. 18 and stood at 2,312.3 tons yesterday.

Many hedge funds are likely increasing allocations to gold but are opting to do it through safer means, such as allocated accounts, rather than the gold trusts.

This has important implications for the gold market as it means that some of the allocations of the massively powerful hedge fund industry to gold may not be realized or accounted for.

The Paulson redemptions also show up the ridiculous notion that selling by any one individual or institution, no matter how large or wealthy, could bring an end to gold’s bull market today.

In other gold news, Venezuelan Central Bank President Nelson Merentes said his country will receive its first gold shipment within 15 days as part of President Hugo Chavez’s decision to repatriate its gold reserves held abroad.

“Tomorrow we sign the contract and we’ll have the first shipment of our gold in the country within 15 days,” Merentes said at an event with Chavez broadcast on state television.

SILVER

Silver is trading at $34.33/oz, €25.35/oz and £21.64/oz

PLATINUM GROUP METALS

Platinum is trading at $1,631.20/oz, palladium at $654/oz and rhodium at $1,525/oz

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.